[ad_1]

Summary

- Amid tough COVID-19 pandemic challenges and market downtrends, there have been stocks such as EML Payments and WiseTech that have defined resilience and have continued to write success stories.

- Owing to COVID-19, accelerated shift in the digital payments’ issuance and acceptance, EML Payments with its robust financial performance during FY20 and Project Accelerator (commenced in July 2020) is well-positioned to capitalise on this burgeoning shift and experience growth.

- WiseTech through its recently released FY20 results, echoed that its highly cash generative business, bolstered balance sheet and solid cash flows have empowered it make strategic and operational initiatives, with the elevated global demand amongst large logistics service providers for the Company’s technological and digital solutions.

Technology sector has been on the radar amidst COVID-19 pandemic induced physical distancing and shutdown measures. Technology sector has been experiencing strong demand for e-learning, digital payments, cloud computing, cybersecurity, and virtual business meeting applications.

Numerous businesses in the technological space have been resilient, and have been leveraging a swathe of opportunities to stay afloat and maintain their position in the competitive market.

Notably, On 19 August 2020, the S&P/ASX 200 Information Technology Index (ASX: AXIJ) ended the day’s session in green. AXIJ closed the day’s session at 1786.50, up by 2.56% as compared to previous day’s close. Keeping the momentum going, the same index was trading at 1,810.4, up by 1.34% (at AEST 11:51 AM), on 20 August.

However the benchmark S&P/ASX200 index was trading at 6114.2, decreasing by 0.87% (at AEST 11:55 AM), on 20 August 2020.

Did you read; ASX indices Showing Interesting Developments- Benchmark ASX200, IT, and Financial Index

Furthermore, several technology-based growth stocks have been functioning uninterruptedly and are moving up the ladder to witness growth and capitalise on the increasing demand of the technology-based solutions such as digital payments, cloud computing and many more.

Did you read; How Technology has Transformed the Australian Payment System?

On that note, let us quickly discuss two ASX 200 resilient stocks, EML and WTC.

EML Payments Limited (ASX:EML)

A global payments technology company, EML Payments unveiled its robust business performance with soared group revenue of 25% to AU$121.6 million for the financial year ended 30 June 2020 as compared to FY19.

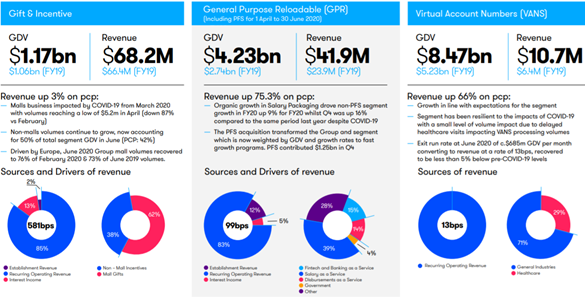

The swelled revenue reflected an enlarged growth in each of its segments:

- Increase of 3% (y-o-y) to AU$68.2 million in the Gift & Incentive segment;

- Upsurge of 75% to AU$41.9 million in the General Purpose Reloadable segment; and

- Increment of 66% to AU$10.7 million in Virtual Account Numbers segment.

Source: Company’s Presentation, dated 19 August 2020

Other highlights of the accelerated financial performance of EML for FY20 are as follows:

- The Group achieved a gross profit margin of 73.0%, noting a decline of 2.1% pcp.

- The Company witnessed an upsurge of 10% (y-o-y) in the underlying Group EBITDA and stood at AU$32.5 million.

- Furthermore, the Group net profit after tax and amortisation (NPATA) experienced a boosted y-o-y growth of 17% to stand at AU$24 million.

- The Company noted a substantial increment of 63% (y-o-y) in the underlying operating cashflow and was recorded at AU$35.8 million.

- Cash balance was recorded of AU$118.4 million, as on 30 June 2020.

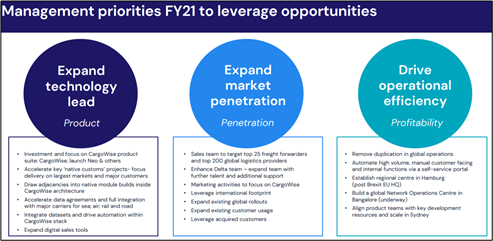

Notably, EML reviewed its Group Strategy after the acquisition of PFS in April 2020 and introduced Project Accelerator in July 2020 to enhance its platform and technology to capitalise on the accelerated technology trend of digital payments issuance along with acceptance and experience growth over the next three years.

On 20 August 2020, EML Payments was trading at A$3.055, down by 3.931% (at AEST 12:34 PM).

Did you read; How are ASX listed FXL, TYR, PPS, EML, APT and WAAX stocks faring amid Covid-19?

WiseTech Global Limited (ASX:WTC)

A leading developer and global provider of software solutions to the logistics industry, WiseTech share price rose up by 0.179%, trading at AU$27.92, on 20 August 2020 (at AEST 12:50 PM).

The increase in the share price was buoyed by the unveiling of WiseTech bolstered business performance, on 19 August, with soared revenue despite COVID-19 headwinds for the year ended 30 June 2020.

The Company noted a y-o-y increase of 23% in the total revenue to AU$429.4 million, demonstrating growth from its CargoWise platform (20% up from pcp) and strategic acquisitions (29% increase from pcp).

Notably, organic revenue growth from CargoWise platform stood at AU$263.0 million after noting a substantial growth of 20% on pcp, primarily due to robust gains in new customer base (contract wins from numerous new clients such as Hellmann Worldwide Logistics, Seafrigo Group and Aramex ) and swelled usage by existing customers, partly offset by lower transaction volume owing to the impact of the pandemic on the global logistics space.

Did you read; WiseTech founder dumps $45.8m of shares, Is the charm around WiseTech Share Price fading away?

Interestingly, By July end, the number of CargoWise users stood near pre-COVID-19 pandemic levels.

Additionally, WiseTech’s EBITDA witnessed an increase of 17% to AU$126.7 million, and statutory net profit after tax (NPAT) experienced a bolstered y-o-y growth of 197% to stand at AU$ 160.8 million. However, WTC’s underlying NPAT was noted to be flat at AU$52.6 million.

Did you read; WiseTech Global Renegotiates Earnout Arrangements for Acquisitions

Furthermore, WiseTech possessed a boosted balance sheet with cash of AU$223.7, operating cash flow of AU$146.3 million at the end of 30 June 2020, demonstrating the fact that WTC is well-positioned to administer both strategic, as well as operational initiatives, going forth.

Dividend

The Company unveiled a fully franked final dividend of 1.60 cents per share (cps), combined with 1H20 interim dividend declared of 1.70 cps, the total dividend was noted at 3.30 cps.

Notably, the final dividend of 1.60 cents per share would be paid on 2 October 2020. The dividend would go ex on 4 September 2020, and has a record date of 7, 2020.

On the earnings guidance front, for FY21, WTC projects the following-

- Total revenue in the range of AU$470 – AU$510 million (indicating rise between 9% – 19%); and

- EBITDA, between AU$155 – AU$180 million (increase bewteen 22% to 42%)

Source: Company’s Presentation, dated 19 August 2020

Did you read; Shedding light on 7 ASX Tech Titans that have rebooted Growth Investment Style

[ad_2]

Source link