[ad_1]

If you are undecided the place to begin when on the lookout for the subsequent multi-bagger, there are a couple of key tendencies you need to maintain a watch out for. Typically, we’ll need to discover a development of rising return on capital employed (ROCE) and alongside that, an increasing base of capital employed. If you see this, it usually means it is an organization with a terrific enterprise mannequin and loads of worthwhile reinvestment alternatives. Speaking of which, we observed some nice adjustments in MACOM Technology Solutions Holdings’ (NASDAQ:MTSI) returns on capital, so let’s take a look.

What Is Return On Capital Employed (ROCE)?

For those that do not know, ROCE is a measure of an organization’s yearly pre-tax revenue (its return), relative to the capital employed within the enterprise. To calculate this metric for MACOM Technology Solutions Holdings, that is the formulation:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

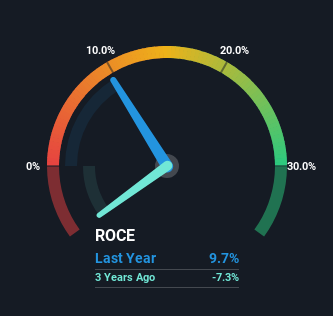

0.097 = US$148m ÷ (US$1.6b – US$91m) (Based on the trailing twelve months to March 2023).

So, MACOM Technology Solutions Holdings has an ROCE of 9.7%. In absolute phrases, that is a low return and it additionally under-performs the Semiconductor trade common of 13%.

Check out our latest analysis for MACOM Technology Solutions Holdings

In the above chart we now have measured MACOM Technology Solutions Holdings’ prior ROCE in opposition to its prior efficiency, however the future is arguably extra necessary. If you are , you’ll be able to view the analysts predictions in our free report on analyst forecasts for the company.

What Can We Tell From MACOM Technology Solutions Holdings’ ROCE Trend?

Shareholders might be relieved that MACOM Technology Solutions Holdings has damaged into profitability. While the enterprise was unprofitable up to now, it is now turned issues round and is incomes 9.7% on its capital. Interestingly, the capital employed by the enterprise has remained comparatively flat, so these increased returns are both from prior investments paying off or elevated efficiencies. So whereas we’re comfortable that the enterprise is extra environment friendly, simply remember the fact that may imply that going ahead the enterprise is missing areas to speculate internally for development. Because in the long run, a enterprise can solely get so environment friendly.

The Key Takeaway

In abstract, we’re delighted to see that MACOM Technology Solutions Holdings has been capable of improve efficiencies and earn increased charges of return on the identical quantity of capital. Since the inventory has returned a staggering 174% to shareholders during the last 5 years, it seems like traders are recognizing these adjustments. In gentle of that, we expect it is price wanting additional into this inventory as a result of if MACOM Technology Solutions Holdings can maintain these tendencies up, it may have a vibrant future forward.

One other thing to notice, we have recognized 2 warning signs with MACOM Technology Solutions Holdings and understanding these must be a part of your funding course of.

While MACOM Technology Solutions Holdings could not presently earn the very best returns, we have compiled an inventory of firms that presently earn greater than 25% return on fairness. Check out this free list here.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to deliver you long-term centered evaluation pushed by basic knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link