[ad_1]

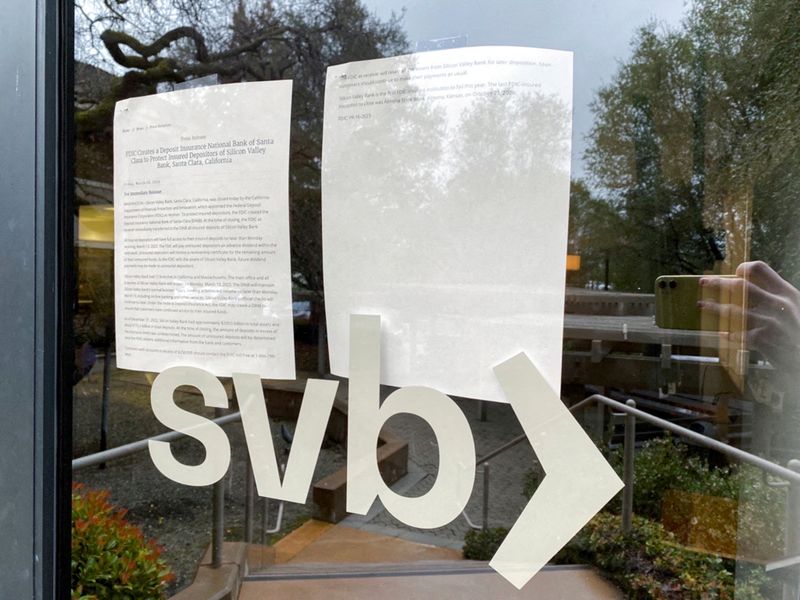

© Reuters. FILE PHOTO: A locked door to a Silicon Valley Bank (SVB) location on Sand Hill Road is seen in Menlo Park, California, U.S. March 10, 2023. REUTERS/Jeffrey Dastin/File Photo

By Echo Wang

(Reuters) – In the center of final week, Moody’s (NYSE:) Investors Service Inc delivered alarming information to SVB Financial Group, the mum or dad of Silicon Valley Bank: the scores agency was making ready to downgrade the financial institution’s credit score.That telephone name, described by two individuals acquainted with the state of affairs, started the method towards Friday’s spectacular collapse of the startup-focused lender, the most important financial institution failure because the 2008 monetary disaster.

Friday’s collapse despatched jitters by way of world markets and walloped banking shares. Investors fear that the Federal Reserve’s aggressive rate of interest will increase to struggle inflation are exposing vulnerabilities within the monetary system.

Details of SVB’s failed response to the prospect of the downgrade, reported by Reuters for the primary time, present how shortly confidence in monetary establishments can erode. The failure additionally despatched shockwaves by way of California’s startup economic system, with many corporations not sure how a lot of their deposits they’ll get better and worrying about how you can make payroll.

The Moody’s name got here after the worth of the bonds the place SVB had parked its cash fell because of the increased rates of interest.

Worried the downgrade might undermine the arrogance of traders and shoppers within the financial institution’s monetary well being, SVB Chief Executive Greg Becker’s staff known as Goldman Sachs Group Inc (NYSE:) bankers for recommendation and flew to New York for conferences with Moody’s and different scores companies, the sources stated.

The sources requested to not be recognized as a result of they’re certain by confidentiality agreements.

SVB then labored on a plan over the weekend to spice up the worth of its holdings. It would promote greater than $20 billion value of low-yielding bonds and reinvest the proceeds in property that ship increased returns.

The transaction would generate a loss, but when SVB might fill that funding gap by promoting shares, it will keep away from a multi-notch downgrade, the sources stated.

The plan backfired.

News of the share sale spooked shoppers, primarily know-how startups, that rushed to withdraw their deposits, upending the capital elevating. Regulators stepped in on Friday, shutting down the financial institution and placing it in receivership.

SVB, Goldman Sachs and Moody’s representatives didn’t instantly reply to requests for remark.

THE UNRAVELING

As SVB executives debated when to proceed with the fundraising, they heard from Moody’s that the downgrade was coming this week, the sources stated.

SVB sprang into motion within the hopes of softening the blow.

The financial institution lined up non-public fairness agency General Atlantic, which agreed to purchase $500 million of the $2.25 billion inventory sale, whereas one other investor stated it couldn’t attain a deal on SVB’s timeline, the sources stated.

By Wednesday, SVB had offered the bond portfolio for a $1.8 billion loss.

Moody’s downgraded the financial institution, however solely by a notch due to SVB’s bond portfolio sale and plan to boost capital.

Ideally, the inventory sale would have been accomplished by earlier than the market opened on Thursday, to keep away from the sale being jeopardized by any declines in SVB’s shares as soon as information of the sale received out. But the sources stated that was not an choice given the tight schedule.

SVB had not completed the preparatory work wanted to signal confidentiality agreements with traders who would decide to a deal of such a dimension. Its attorneys suggested the financial institution that traders would want not less than 24 hours to digest new downbeat monetary projections and full the sale, the sources stated.

Reuters couldn’t decide why SVB didn’t begin these preparations earlier.

SVB’s inventory plunged on information of the share sale, ending Thursday down 60% at $106.04. Goldman Sachs bankers nonetheless hoped they may shut the sale at $95, the sources stated.

Then information got here of enterprise capital companies advising startups that they had invested in to tug cash out of Silicon Valley Bank for concern of an imminent financial institution run.

This shortly turned a self-fulfilling prophecy: General Atlantic and different traders walked away and the inventory sale collapsed.

General Atlantic didn’t reply to a request for remark.

California banking regulators closed the financial institution on Friday and appointed the Federal Deposit Insurance Corporation (FDIC) receiver. The FDIC will eliminate its property.

In the previous, the regulator has struck offers shortly, generally over only a weekend, one thing that some specialists stated might occur with SVB.

[adinserter block=”4″]

[ad_2]

Source link