[ad_1]

Outgoing MD of HDFC Bank Aditya Puri says ‘best is yet to come’ in letter to employees

Outgoing Managing Director of HDFC Bank Aditya Puri in an emotionally charged letter to employees reiterated his 26-year journey with the bank and said that “the best is yet to come”. Puri expressed how satisfied he was to pass on his responsibilities to Sashidhar Jagdishan to lead the bank. HDFC Bank, recently announced that Jagdishan would take over as managing director from October 27. Click here for the complete letter he wrote to all employees

Strong anti-China sentiment possible game changer for domestic industry, says L&T’s AM Naik

Amidst geopolitical tensions between China and India, several stalwarts of India Inc have supported the Narendra Modi government restricting business with Chinese companies. AM Naik, the chairman of Larsen and Toubro (L&T) is no exception to this. Addressing shareholders at L&T’s 75th AGM, Naik said anti-China sentiment poses an opportunity for India Inc, “The strong anti-China sentiment within India and around the world is a possible game changer for domestic industry. To leverage these trends and harness them for productive purposes, we need to move beyond knee-jerk responses and draw up a long-term strategy with a time-bound plan for implementation.” More here

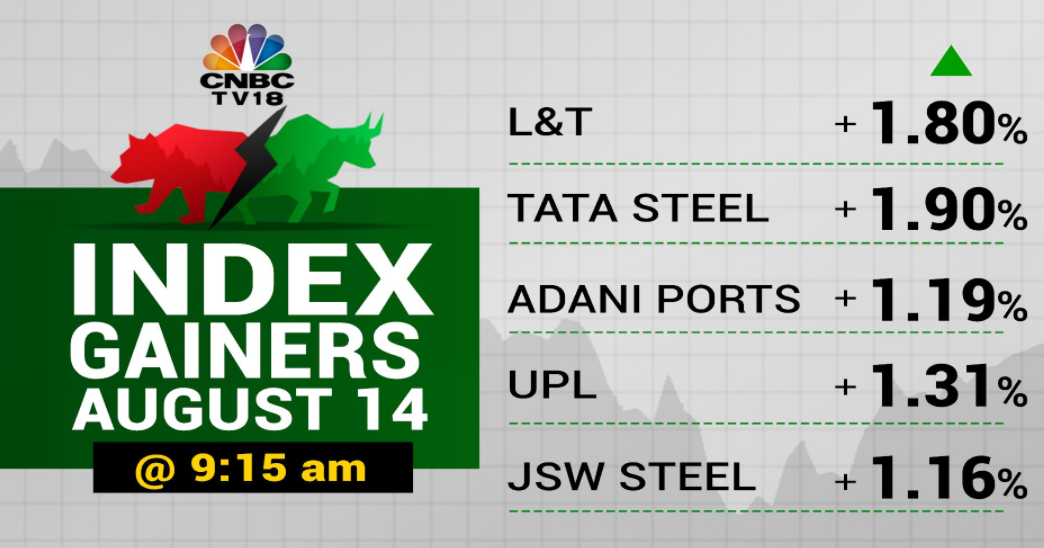

A look at the index gainers this morning; Tata Steel shrugs off weak Q1 earnings, leading the Nifty

Opening Bell: Sensex, Nifty open higher; all indices in the green

Indian shares opened higher on Friday led by gains in all key indices. However, the sentiment was capped as Asian shares fell on Friday after lacklustre Chinese economic data. At 9:18 am, the Sensex was trading 128 points higher at 38,438 while the Nifty rose 35 points to 11,335. Broader markets were also positive with the midcap and smallcap indices up around half a percent each. All sectors were in the green at opening with metal and pharma indices rising 0.5 percent each and bank, IT, and FMCG indices up around 0.3 percent.

Global Markets: Asian stocks falter after China data disappointment

Asian shares fell on Friday after lacklustre Chinese economic data and worries about a delay in U.S. fiscal stimulus discouraged some investors from taking on risk. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.24 percent, although shares in Japan rose 0.07 percent. South Korean stocks fell 1.27 percent after authorities reported the largest number of new coronavirus cases since March. Chinese shares erased early gains and fell 0.1 percent as a slower-than-expected rise in industrial production and a surprise fall in retail sales weighed on investor sentiment.

List of earnings you need to watch out for today

Top stock recos by Ashwani Gujral for today

– Buy Titan with a stop loss of Rs 1,085, target at Rs 1,140

– Buy Hindalco with a stop loss of Rs 178, target at Rs 192

– Buy Tata Motors with a stop loss of Rs 126, target at Rs 140

– Buy Bharti Infratel with a stop loss of Rs 195, target at Rs 212

– Buy Adani Ports with a stop loss of Rs 340, target at Rs 365

Click here for buy/sell calls by Prakash Gaba and Mitessh Thakkar

Dollar drifts higher as coronavirus, China data sap confidence

The dollar drifted higher on Friday, helped by strong U.S. jobs data as well as firmer global demand for safe-havens amid concerns about the coronavirus recovery, setting the currency up to potentially snap a seven-week losing streak. Soft Chinese retail and production figures cast a pall over the mood in Asia, dragging on the risk-sensitive Australian and New Zealand dollars. China’s industrial output rose more slowly than expected in July and retail sales fell for a seventh straight month, suggesting some bumps in even the world’s most promising rebound. Troubling signs also emerged on the health front in Asia, with a dozen new cases in New Zealand – which is considering whether to ease or extend its lockdown of Auckland – and the biggest daily jump in new cases in South Korea since March.

Here are some global cues from this morning & overnight

Retail inflation climbs to 6.93% in July due to high food prices

India’s retail inflation as measured by the Consumer Price Index (CPI) recorded 6.93 percent in the month of July as food prices continued to soar due to disrupted supply chains, showed data released by the National Statistics Office (NSO) on Thursday. The retail inflation based on Consumer Prince Index was 6.09 percent in June 2020 and 3.15 percent in the year-ago period. The food inflation, according to the Consumer Price Index (CPI) data, increased to 9.62 percent in July. The retail inflation in June was 6.23 percent, while the food inflation stood at 8.72 percent.

Earnings: Tata Steel slips into red, posts Rs 4,648 crore net loss in Q1

Domestic steel major Tata Steel on Thursday reported a consolidated net loss of Rs 4,648.13 crore for the quarter ended June, mainly on account of reduced income. The company had posted a consolidated net profit of Rs 714.03 crore during the same period a year ago, Tata Steel said in a BSE filing. Total income dropped to Rs 24,481.09 crore during the quarter under review, from Rs 36,198.21 crore earlier. The company”s expenses also reduced to Rs 27,892.09 crore from Rs 34,447.42 crore in the April-June period of the preceding fiscal.

JUST IN: China July industrial output up 4.8% YoY Vs expectation of 5% rise; up 0.98% MoM.

First up, here is quick catchup of what happened in the markets on Thursday

Indian indices ended lower on Thursday after paring all morning gains led by banking and pharma names. However, auto stocks continued to gain, with Tata Motors leading the pack (4.55%). Broader markets continued to outperform the benchmarks, with Nifty Midcap100 and Nifty Smallcap100 indexes ending 1.66 percent and 0.77 percent higher. Auto, Metal and Media indices ended over a percent higher. Tata Motors was the Nifty50 top gainer of the day while Sun Pharma remained the index top loser.

Welcome to CNBC-TV18’s Market Live Blog

Good morning, readers! I am Pranati Deva the market’s desk of CNBC-TV18. Welcome to our market blog, where we provide rolling live news coverage of the latest events in the stock market, business and economy. We will also get you instant reactions and guests from our stellar lineup of TV guests and in-house editors, researchers, and reporters. If you are an investor, here is wishing you a great trading day. Good luck!

[ad_2]

Source link