[ad_1]

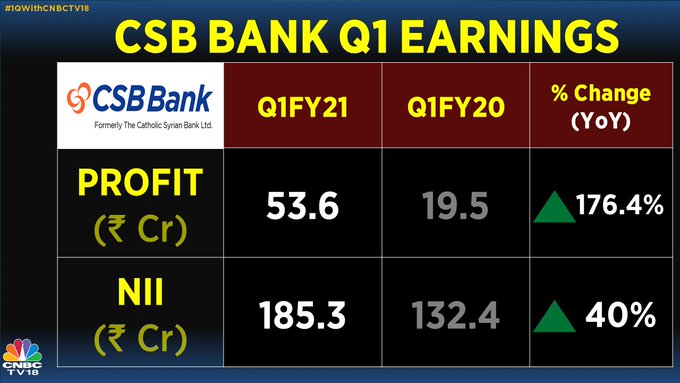

CSB Bank reports Q1 earnings. Profit rises more than 176% on a yearly basis & NII up 40%. Gross NPA unchanged at 3.5%, net NPA at 1.7% Vs 1.9% (QoQ). The stock is trading 12 percent higher to Rs 222.50/share.

Just In: Bombay High Court dismisses Yes Bank’s petition against Zee Promoters. Zee has contended that it given a letter of comfort for loans which is not a personal guarantee. Yes Bank wanted take possession of pledged Zee promoter shares, invoke personal guarantee clause. Yes Bank had approached Bombay HC seeking to prevent the promoters of Zee from selling pledged shares.

European markets slightly lower after record highs on Wall Street; Maersk up 5.6%

European stocks retreated slightly on Wednesday morning, pausing after a strong session stateside that saw the S&P 500 hit a fresh record high.

The pan-European Stoxx 600 edged 0.2% lower, with basic resources shedding 0.8% to lead losses while food and beverages inched 0.3% higher. DAX and FTSE100 traded 0.19 percent and 0.12 percent higher respectively, while CAC and FTSE MIB rose 0.25 percent each.

Market participants in Europe broke from the positive sentiment on Wall Street, where the S&P 500 and Nasdaq Composite set records. The S&P 500 rose to an all-time high Tuesday, wiping out all its losses from the market sell-off caused by the coronavirus pandemic. It confirms the start of a new bull market.

New strategic divestment PSE policy likely in cabinet in a few weeks

A new strategic divestment policy for public sector enterprises (PSEs) is likely to make its way before cabinet in a few weeks, sources informed CNBC TV-18.

Currently, the government is reconciling views of ministries/departments on the new PSE policy, sources said.

The call on privatisation/strategic sale of public sector banks (PSBs)/insurance companies will be taken after cabinet’s nod on this PSE policy.

No call has yet been taken if IDBI bank stake sale will be done in tranches or strategically. The government may call for bids soon to appoint advisors for IDBI bank stake sale.

Sharp upmove seen in Future Group stocks.

Don’t miss the ‘mine’ of wealth! Pharma sector remains biggest buyer of this niche space

Post COVID-19, one niche space that is moving almost parallely with pharmaceuticals and FMCG is chemical amines. Both the front-runners from this sector- Alkyl Amines and Balaji Amines are running with the same pace as the pharma stocks.

Despite the small size of the amines industry ($4.1 billion), Alkyl Amines surged 167 percent while Balaji Amines jumped 112 percent, so far this year respectively.

Amines are organic compounds and majorly used in sectors like pharmaceutical, agrochemicals and paints. Given the current rally in all the three sectors, it is quite self-explanatory over amines companies splendid run in the market.

The highest amount of revenue in amines is contributed by the pharma space, about 51 percent followed by agrochem (26 percent), paints (4 percent) and oil & gas (3 percent). Given the pharma’s highest revenue contribution to amines, it is quite likely that both these sectors will move hand-in-hand. Continue reading

Gold rate today: Yellow metal falls; Support seen at Rs 52,600 per 10 grams

Gold prices in India fell on the Multi Commodity Exchange (MCX) Wednesday tracking weakness in international spot prices on a steady dollar and ahead of US Federal Reserve meeting minutes, analysts said. Silver prices also declined by over 2 percent.

At 11:45 am, gold futures for October delivery fell 0.83 percent to Rs 53,124 per 10 grams as against the previous close of Rs 53,571 and opening price of Rs 53,450 on the MCX. Silver futures traded 2.22 percent or by Rs 1,545 lower at Rs 67,960 per kg. The prices opened at Rs 68,783 as compared to the previous close of Rs 69,505 per kg.

“Gold prices declined on a steady US dollar. Profit booking after a rise in the previous session also pressurized the yellow metal prices. Both precious metals are expected to remain volatile. While gold may trade with a downside bias,” said Amit Sajeja, AVP Research – Commodities & Currencies at Motilal Oswal. Read more

Here are a few top buzzing midcap stocks at this hour

Japan’s exports tumble as US demand collapses, order books shrink

Japan’s exports extended their double-digit slump into a fifth month in July as the coronavirus pandemic took a heavy toll on auto shipments to the United States, dashing hopes for a trade-led recovery from the deep recession. Meanwhile, core machinery orders, a leading indicator of business spending, unexpectedly fell to a seven-year low in June, dashing hopes domestic demand would make up for some of the slack from sluggish global growth. The grim data suggests the depressed conditions seen in the world’s third-largest economy in the second quarter showed no signs of rapid improvement in the current quarter, compounding challenges for policymakers as they look to prop up activity. Total exports fell 19.2 percent in July from a year earlier, roughly in line with market expectations for a 21.0 percent decrease, government data showed on Wednesday. It was, however, smaller than a 26.2 percent drop in June, which some analysts saw as a sign external demand may have bottomed out.

Market Watch: Ruchit Jain of Angel Broking

“First is the buy call in Grasim Industries, yesterday the stock has seen a good breakout from its recent high as well as its 200 day moving average, the breakout was also a complete by very good volume. Today there is a minor retracement, but this retracement should be viewed as a good buying opportunity keep a stop below Rs 640 one can go long on Grasim for target of Rs 710.”

“From the momentum perspective one of the midcap name INOX Leisure is doing quite well today. There is a breakout along with good volumes in INOX Leisure, keep a stop below Rs 265 for target of Rs 292, Rs 292 would be the first target and above that the stock has potential to test levels around Rs 300-305 as well.”

Expect revenue to grow in H2 as festive season kicks in, says Zee Ent

Zee Entertainment is expecting the ad revenues to grow in the second half of the year on the back of the festive season, said Rohit Gupta, Chief Financial Officer of the company. Gupta added that there was already some improvement seen in the ad revenue due to the lockdown relaxations. Gupta’s comments came after the company reported its first-quarter earnings which saw a 94 percent fall in the net profit. The revenues came in-line with estimates, but the operating performance was lower than estimates. “Like every other business around the world, Zee was also impacted by the pandemic during the first quarter and the impact has been both from the operational and financial perspective,” said Gupta. More here

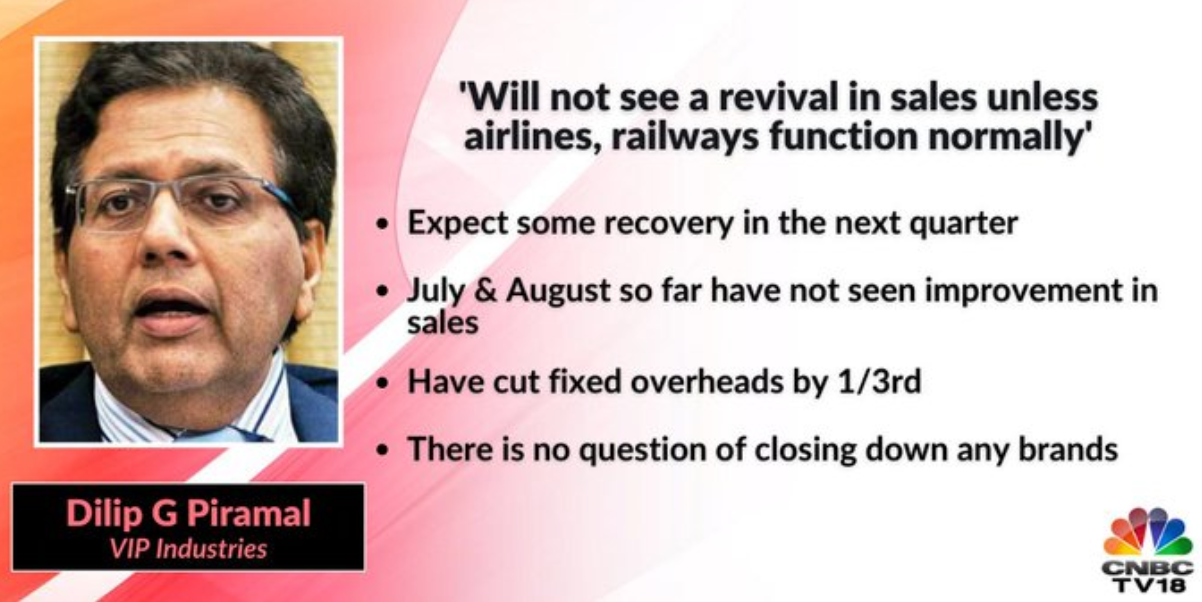

Dilip Piramal of VIP Ind says co will not see a revival in sales unless airlines & railways function normally.

Reliance Industries jump 1.5% on acquisition of pharmacy delivery startup Netmeds

Shares of Reliance Industries (RIL) jumped 1.5 percent on Wednesday after the company announced the acquisition of a majority equity stake in online pharmacy delivery startup Netmeds. RIL subsidiary Reliance Retail Ventures has acquired a majority equity stake in Vitalic Health and its subsidiaries Netmeds for a cash consideration of approximately Rs 620 crore. The acquisition comes on the back of rival Amazon launching online drug sales in Bengaluru – Amazon Pharmacy, which will offer both over-the-counter and prescription-based drugs. Also, two other prominent e-pharma companies Medlife and PharmEasy are now looking for a potential merger. As per the CCI filing, PharmEasy looks to acquire 100 percent equity shares of Medlife. Medlife and its promoters will get 19.59 percent of the equity share capital of PharmEasy’s parent company API Holdings

Buzzing | Dilip Buildcon shares jump 4% on receiving LoA from Rail Vikas Nigam

Dilip Buildcon stock price rallied over 4 percent after the company received a letter of acceptance (LOA) from Rail Vikas Nigam. The company has received the letter of acceptance (LOA) through its joint venture HCC-DBL (JV) on August 18, 2020 for the new project worth 1,334.95 crore in Uttarakhand from Rail Vikas Nigam Limited. The project includes the construction of tunnels, bridges, yard and formation works under package-9 in connection with new BG Line between Rishikesh and Karanprayag (125km) in Uttarakhand.

Technical View | The Nifty has opened in splendid form going past the 11,450 levels. We should be targeting 11,500 – 11,700 levels and this could be achieved during the course of this month’s expiry itself. The support has been upgraded to 11,350. A buy on dips strategy can be implemented, says Manish Hathiramani, Index Trader and Technical Analyst, Deen Dayal Investments.

Rupee Opens | Indian rupee opened higher at 74.69 per US dollar as against previous close of 74.76.

Gold dips below $2,000/ounce as dollar slide briefly halts

Gold fell below USD 2,000 an ounce on Wednesday after rising sharply in the previous session as the dollar steadied, while investors awaited minutes from the US Federal Reserve’s last policy meeting. Spot gold was down 0.4 percent at USD 1,993.68 per ounce by 0253 GMT, after hitting a one-week high of USD 2,014.97 on Tuesday. US gold futures fell 0.5 percent to USD 2,002.50. “Gold is down as the US dollar strengthened slightly this morning. In the short term, a rebound in the USD might inhibit the rally in gold,” said DailyFx strategist Margaret Yang. More here

Pharma sector contributes 50% gains to this niche space

Post COVID-19, one niche space that is moving almost parallely with pharmaceuticals and FMCG is chemical amines. Both the front-runners from this sector- Alkyl Amines and Balaji Amines are running with the same pace as the pharma stocks. Despite the small size of this industry ($4.1 billion), Alkyl Amines surged 167 percent while Balaji Amines jumped 112 percent, this year respectively. Amines are organic compounds and majorly used in sectors like pharmaceutical, agrochemicals and paints. Given the current rally in all the three sectors, it is quite self-explanatory over amines’ splendid run in the market. The highest amount of revenue in amines is contributed by the pharma space, about 51 percent followed by agrochem (26 percent), paints (4 percent) and oil & gas (3 percent). Given the pharma’s highest revenue contribution to amines, it is quite likely that both these sectors will move hand-in-hand. More here

IRB Infra up more than 10%; Here are a few other buzzing midcap stocks

Opening Bell: Sensex, Nifty open higher led by banks, RIL

Indian indices opened higher on Wednesday, tracking gains Asian peers after they climbed to a seven-month peak as S&P 500 scaled all-time highs in overnight trade. At 9:18 am, the Sensex was trading 217 points higher at 38,745 while the Nifty rose 60 points to 11,445. Gains in domestic indices were led by banks and index heavyweight Reliance Industries. The banking index surged 0.7 percent while the pharma and auto sectors were up around half a percent each. L&T, Adani Ports, ICICI Bank Reliance Idnustries, and ITC were the top gainers on the Nifty50 index at opening while HCL Tech, Nestle, Tata Steel, JSW Steel, and BPCL led the losses.

Global Markets: Asian stocks at 7-month highs after Wall Street cracks more records

Asian shares climbed to a seven-month peak on Wednesday tracking the S&P 500, which scaled all-time highs driven by ever expanding policy stimulus aimed at cushioning the blow to economies from the coronavirus pandemic. MSCI’s broadest index of Asia-Pacific shares outside of Japan rose 0.3 percent, up for a third straight day to 570.80 points, a level not seen since late January. The gains were driven by Australian shares, up 0.8 percent and South Korea, which added 0.6 percent. Japan’s Nikkei nudged up too though Chinese shares started weaker with the blue-chip CSI300 index off 0.7 percent. Overnight, both the S&P 500 and Nasdaq Composite set records soon after the opening bell following strong sales growth reported by major US retailers including Walmart, Kohl’s and Home Depot.

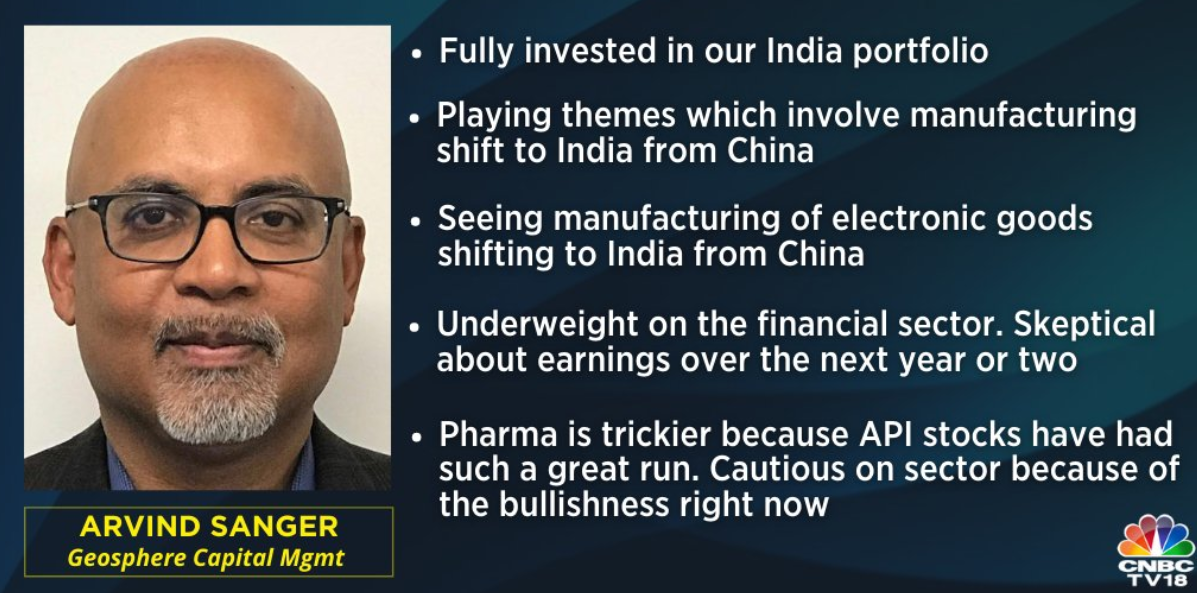

Arvind Sanger of Geosphere Capital Management is underweight on the financial sector.

Top stock tips by Ashwani Gujral for today

– Buy Kotak Bank with a stop loss of Rs 1,350, target at Rs 1,410

– Buy ICICI Bank with a stop loss of Rs 360, target at Rs 385

– Buy HDFC Bank with a stop loss of Rs 1,040, target at Rs 1,085

– Buy Asian Paints with a stop loss of Rs 1,860, target at Rs 1,910

– Buy UltraTech Cement with a stop loss of Rs 4,100, target at Rs 4,280

Click here for more buy/sell calls by Sudarshan Sukhani, Mitessh Thakkar

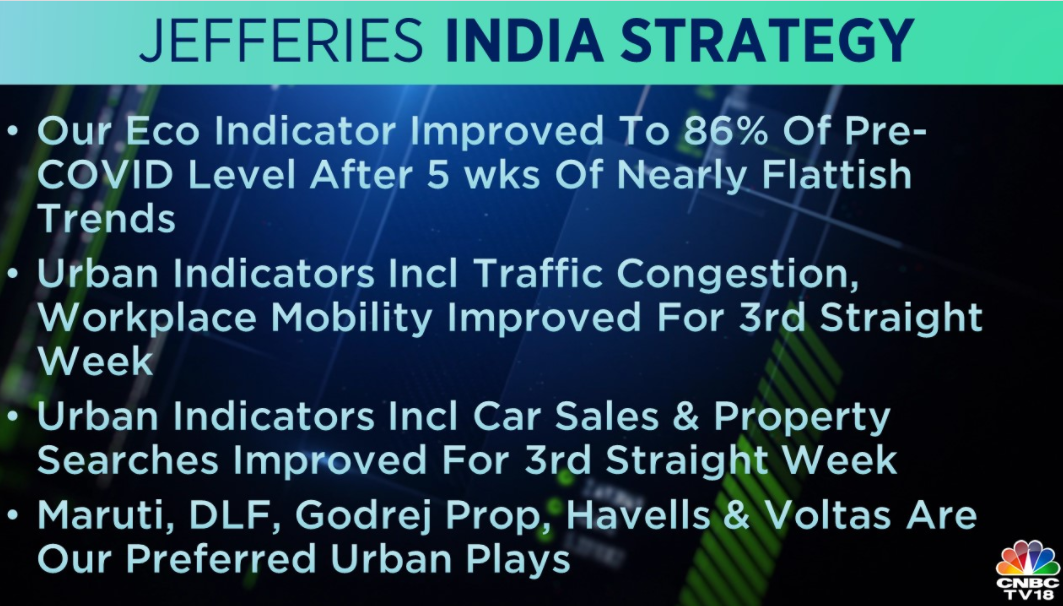

Jefferies says its eco proprietary eco indicator improved to 86% of pre-COVID level after 5 weeks of nearly flattish trends

Here are a few global cues ahead of today’s trade

Reliance Retail acquires majority stake in Netmeds

Reliance Industries (RIL) announced that its subsidiary Reliance Retail Ventures Limited (RRVL) has acquired a majority equity stake in Vitalic Health and its subsidiaries Netmeds for a cash consideration of approximately Rs 620 crore. The investment represents around 60 percent holding in the equity share capital of Vitalic and 100 percent direct equity ownership of its subsidiaries — Tresara Health, Netmeds Market Place and Dadha Pharma Distribution. Vitalic and its subsidiaries are in the pharma distribution, sales, and business support services. Its subsidiary run Netmeds that connects customers to pharmacists and enable door step delivery of medicines, nutritional health and wellness products. More here

Here are CNBC-TV18’s top stocks to watch out for on August 19

Zee Entertainment Enterprises | The company’s Q1FY21 net profit fell 94.3 percent to Rs 30.4 crore from Rs 530.6 crore while revenue declined 34.7 percent to Rs 1,312 crore from Rs 2,008 crore, YoY. The company has appointed Subhash Chandra as Chairman Emeritus and R Gopalan as Chairman of the board.

Yes Bank | The bank has repaid the Reserve Bank of India (RBI) Rs 35,000 crore out of the Rs 50,000 crore of Special Liquidity Facility (SLF) that was extended to the bank to make up for any shortfall in deposits during the crisis in March this year.

Indiabulls Real Estate | The company has signed definitive merger documentation with Embassy Group. IBREL existing shares to be valued at Rs 92.50 per share. NAM shareholders will get 6.619 shares of IBREL for every 10 shares of NAM.

First up, here is quick catchup of what happened in the markets on Tuesday

Indian indices ended nearly at day’s high on Tuesday as banking and cement stocks contributed most gains. Broader markets outperformed the benchmarks for the second day, ending over a percent higher. Nifty Midcap100 index ended 1.24 percent higher while Nifty Smallcap100 index rose 1.52 percent. Barring pharma index, all sectors ended in the green, Nifty Realty jumped the most, over 4 percent followed by Nifty Media (2.16 percent) and Nifty Financials (1.97 percent).

Welcome to CNBC-TV18’s Market Live Blog

Good morning, readers! I am Pranati Deva the market’s desk of CNBC-TV18. Welcome to our market blog, where we provide rolling live news coverage of the latest events in the stock market, business and economy. We will also get you instant reactions and guests from our stellar lineup of TV guests and in-house editors, researchers, and reporters. If you are an investor, here is wishing you a great trading day. Good luck!

[ad_2]

Source link