[ad_1]

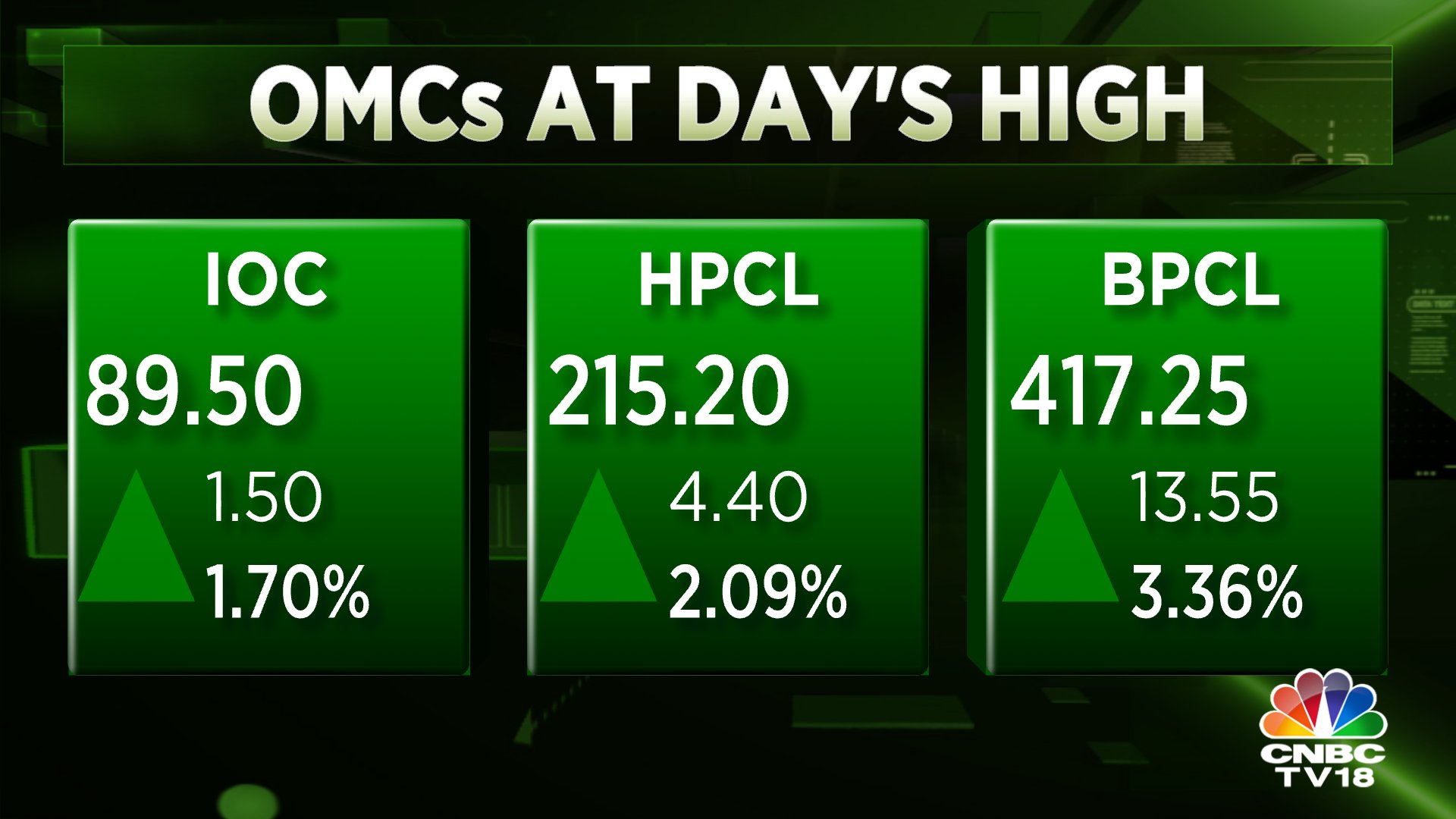

Market Update| Oil marketing companies surge to day’s high; IOC & HPCL recover more than 3% from day’s low

AGR case latest updates: SC bench begins hearing; decision likely on staggered payment timeline for telcos

The Supreme Court on Thursday resumed the hearing on the issue of adjusted gross revenue (AGR) dues from telecom companies at 2 pm. The main highlights of Wednesday’s hearing were the arguments from Harish Salve, the counsel for both Reliance Jio as well as the Committee of Creditors (CoC) led by the SBI, pertaining to the sale of the spectrum by the insolvent companies RCom and Aircel. Follow live updates here.

Just In | Gateway Distriparks’ board approves rights issue price at Rs 72 per share.

J Kumar Infra Q1FY21 | The company reported a net loss of Rs 20.8 crore as against profit of Rs 40.9 crore YoY. Revenue declined 57.3 percent to Rs 285.3 crore from Rs 667.7 crore YoY. EBITDA was down 74.6 percent at Rs 28.3 crore against Rs 111.3 crore while EBITDA margin stood at 9.9 percent against 16.7 percent, YoY.

Here’s all you need to know about SEBI’s new proposals on minimum public shareholding for companies under CIRP

Markets regulator SEBI on Wednesday floated a consultation paper and invited suggestions for the proposals on minimum public shareholding norms for bankrupt companies that undergo corporate insolvency resolution process (CIRP) and seek to relist following the process.

Sebi also proposed enhanced disclosures for such companies. It said that post-resolution, the public shareholding in such companies could fall sharply. Read more

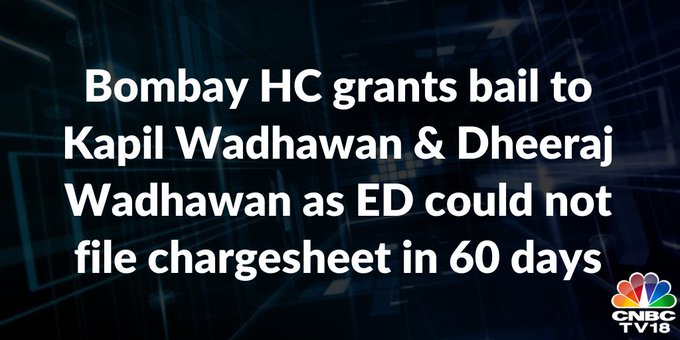

Yes Bank Case | Bombay HC has granted bail to Kapil Wadhawan & Dheeraj Wadhawan as the Enforcement Directorate could not file a chargesheet in 60 days. They have been granted given bail on condition of Rs 1 lakh cash bail and depositing their passports. Sources say ED filed chargesheet against Kapil & Dheeraj Wadhawan on the 61st day. Both will continue to remain in jail as they have been booked by CBI in Yes Bank case. Do note that they were arrested by the ED on May 14.

Just In: US & China to hold trade talks in the coming days, says Chinese Commerce Ministry. Washington and Beijing will be back around the negotiating table in the coming days, according to China’s commerce ministry, after scheduled talks last weekend were postponed.

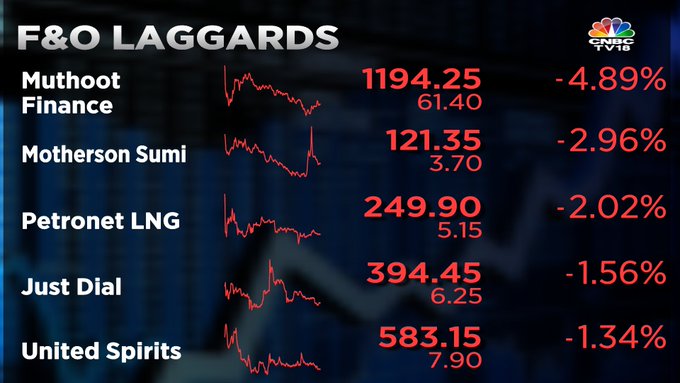

Why brokerages are cautious on Muthoot Finance despite a 52% jump in profit

The share price of Muthoot Finance fell over 5 percent on Thursday despite robust June quarter results as the brokerages remained cautious on the stock due to high valuation.

The stock fell as much as 5.6 percent to Rs 1,185.40 per share on the BSE in intra-day deals.

The company reported a 52 percent jump in its consolidated net profit at Rs 858 crore in Q1 as compared to a net profit of Rs 530 crore in the year-ago period. Total revenue from operations also rose 28 percent to Rs 2,385 in Q1 from Rs 1,857 last year.

However, brokerages are not very bullish on the stock despite the strong earnings. Here’s why

Experts’ View: Jay Thakkar of Marwadi Shares & Financials shares two recommendations

“I have two buy recommendations, first is Pidilite Industries. The stock has clearly broken out from falling trend line and the momentum indicators are well into the buy mode, so one can buy Pidilite targeting Rs 1,510 to 1,540 with a stop loss of Rs 1,410,” said Thakkar. His second recommendation is on Coal India. He said, “It seems to have formed a nice base reversal pattern with a clear buy crossover in its momentum indicators.Keep a target of Rs 143 with a stop loss of Rs 132.50.”

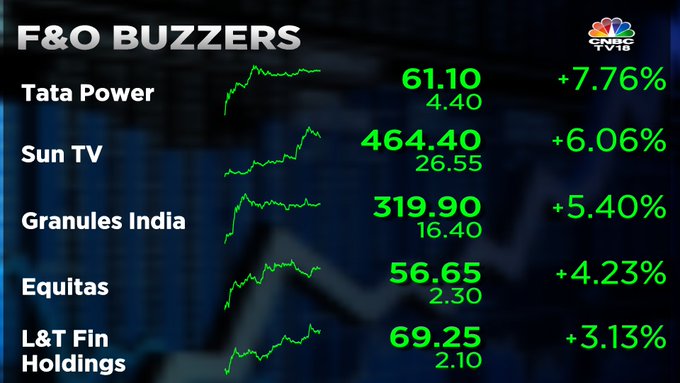

Tata Power up nearly 8% followed by Sun TV and Granules India.

Muthoot Finance continues to trade under pressure, down nearly 5%

Airbnb files for IPO as short-term rental market rebounds

Short-term home rental company Airbnb Inc said on Wednesday it filed confidentially for an initial public offering with US regulators, setting the stage for one of 2020’s marquee US stock market debuts. The move underscores a rebound in parts of the travel industry, which was battered this year by restrictions and shutdowns due to the COVID-19 pandemic.

San Francisco-based Airbnb said in July that customers had booked more than 1 million nights in a single day for the first time since March 3, in part as US travelers shy away from hotels and prefer to drive to local vacation rentals.

Shares of US online travel agency Booking Holdings Inc have rebounded around 14 percent in the past three months but are still down for the year. Click here to read more

Titan keeps promise to Jhunjhunwala; clarifies on gold hedging policy

After Dalal Street heavyweight Rakesh Jhunjhunwala sought clarification on Titan’s gold hedging policy at its earnings call last week, the company has put out a detailed note explaining it.

In the note shared with stock exchanges, Titan explained that it was protected against the fluctuation in gold prices in two ways. First, is the gold-on-lease method wherein the company borrows gold from banks on an unfixed basis on day 1 and it gets priced whenever the gold gets sold to customers, which could be 5-6 months from the date of purchase. Thus, the pricing of gold is matched with the sale price from customers and hence acts as a natural hedge and there is no impact on the profit & loss (P&L) statement of Titan.

The second way in which Titan hedges gold is by purchasing the precious metal in the spot market and immediately entering into a counter position in the gold futures market at the same price. While, this results in recognition of a loss or profit in the short term, over the long term, this hedge unwinds and there is, hence, no impact on Titan’s P&L. Read more here.

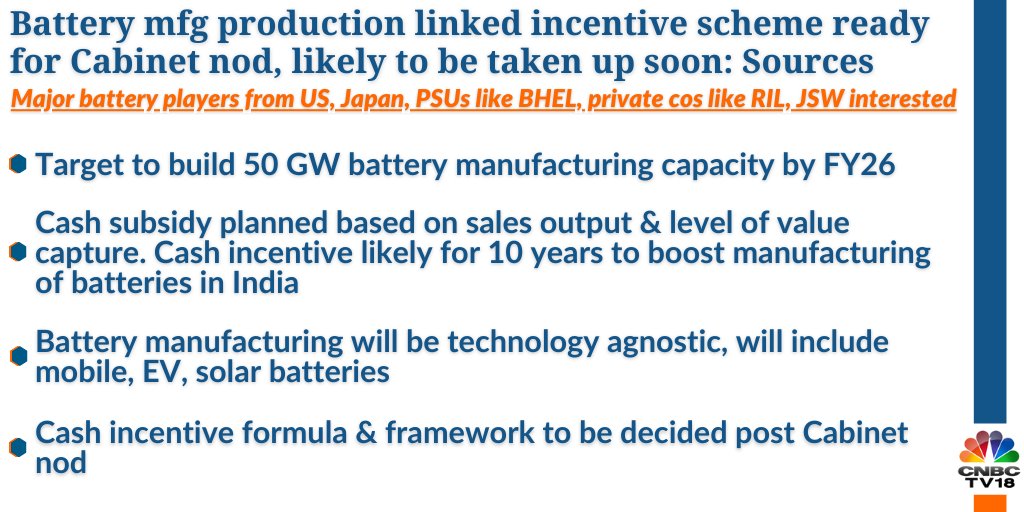

CNBC-TV18 Exclusive | Sources say battery manufacturing production linked incentive scheme ready for Cabinet nod, likely to be taken up soon. Major battery players from US, Japan, PSUs like BHEL, private companies like RIL, JSW interested.

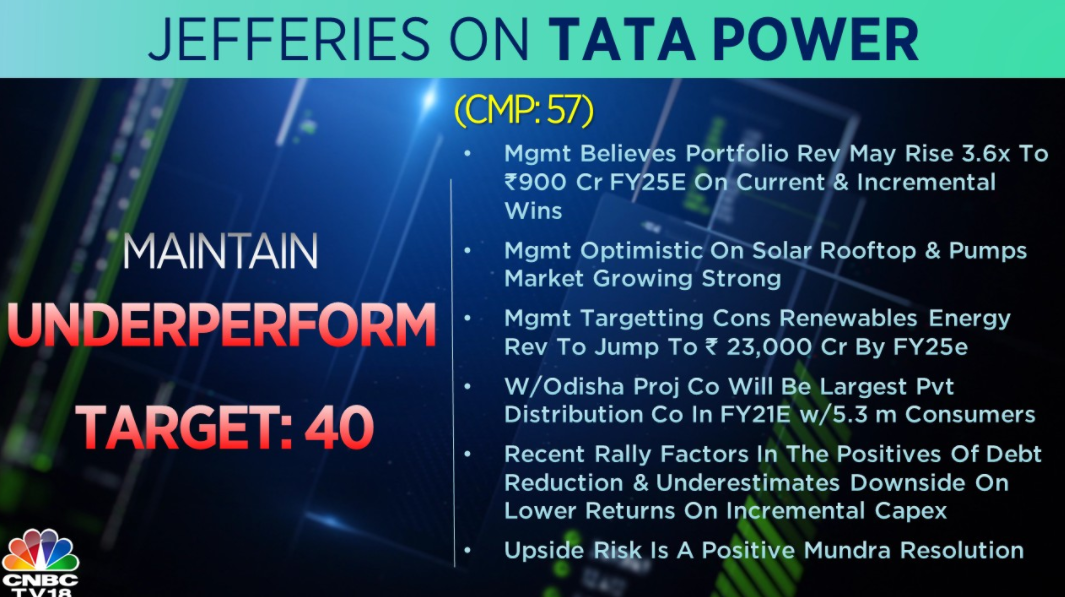

Buzzing | Tata Power shares rallied over 8 percent after the company exhibited its current business structure along with plans to achieve the aim of becoming one of the top 2 energy companies in India in the future.

Technical View | We are trading below the support of 11,350 but if we are able to recoup and close above this level, we should be back on track to achieve the 11,500 levels. Traders can use this fall to enter into call options and use a favorable risk is to reward ratio where the stop loss can be placed at a Nifty level of 11,200 and a target of 11,500, says Manish Hathiramani, Index Trader and Technical Analyst, Deen Dayal Investments.

Airbnb files for IPO as short-term rental market rebounds

Short-term home rental company Airbnb Inc said on Wednesday it filed confidentially for an initial public offering with US regulators, setting the stage for one of 2020’s marquee US stock market debuts. The move underscores a rebound in parts of the travel industry, which was battered this year by restrictions and shutdowns due to the COVID-19 pandemic. San Francisco-based Airbnb said in July that customers had booked more than 1 million nights in a single day for the first time since March 3, in part as US travelers shy away from hotels and prefer to drive to local vacation rentals. Shares of US online travel agency Booking Holdings Inc have rebounded around 14 percent in the past three months but are still down for the year. More here

Market Watch: Shrikant Chouhan, Kotak Securities

“Tech Mahindra looks good, it is a very interesting formation on daily as well as on weekly basis. After validating the double-bottom formation on weekly basis, Tech Mahindra is moving upward on day-to-day basis. So I am of the view that it is trading for at least Rs 750-755 in next one-two days of time. It is a buy at current price with a stop loss of Rs 715.

The other stock which we like is SAIL, which is currently trading at some Rs 40.80-41 levels and here also if you see the trade then overall momentum is there in the space and Rs 39.50 should be the final stop loss for creating any long position on SAIL because there we are expecting Rs 45-46 on the higher side.”

Activity across urban market best in last 7 weeks as economy shows signs of recovery

Just like the equity market is picking up, so is the economic recovery. In a recent report by Jefferies, it’s economic indicators showed that workplace mobility, car sales and property searches have improved for the third straight week, led by encouraging COVID trends in large cities. Activity this week was better across almost all economic segments. To gauge this conclusion, Jefferies studied it’s index that uses a combination of agriculture/rural (25 percent), broader economy (35 percent) and predominantly urban (40 percent) indicators. Based on this index, the global brokerage house saw that receding COVID concerns in top cities led to the third successive weak of improvement in urban trends. With keeping in the view the steady re-opening and the urban market improvement, Jefferies listed out its preferred plays i.e. Maruti Suzuki, DLF, Godrej Properties, Havells and Voltas. More here

Data story: ‘Robinhoods’ drive share trading boom in India during lockdown

India’s top brokerages, led by Zerodha, saw a surge in account sign-ups in the wake of stay-home orders that drove a greater number of people to dabble in stocks. Data put out by NSE shows strong growth in unique client codes (UCC) that brokers assign to their clients. Between February and July, the total number of UCCs on NSE jumped from 9.4 million to 12 million. This growth was most sharply led by Zerodha, which saw a nearly 70 percent increase in clients. Another discount broker, Upxstox (RKSV Securities), was also able to make the most of the share trading boom, with its client base rising 65 percent. Full service brokers such as ICICI Securities, Angel Broking, HDFC Securities, Kotak Securities and Sharekhan also clocked growth but at a smaller pace. Together, the top seven brokers account for a larger share (58 percent vs 53 percent) of all the accounts in the system. More here

Gautam Trivedi of Nepean Capital likes contract manufacturers like Dixon Tech, Amber Enterprises.

August GST Council meet: Hike in cess on sin goods like cigarettes on the agenda

The much-awaited Goods and Services Tax (GST) Council meeting is likely to be held on August 27 and another meeting will be scheduled on September 19, said senior government sources. As decided earlier by the council itself earlier, the August 27 GST Council meet, which will be the 41st Council, will be to discuss a single point agenda that is to iron out measures to meet the compensation requirements to continue to pay off states. According to people in the know, the council in 41st Council is likely to discuss various proposals to raise funds in the compensation cess kitty. The suggestions here are to either go in for an overall rate rationalization exercise or expand the cess kitty by levying cess on more items or to hike the cess quantum on sin goods, such as cigarettes, pan masala and aerated drinks. More here

Apple is 1st US company to be valued at $2 trillion

Apple is the first US company to boast a market value of USD 2 trillion, just two years after it became the first to reach USD 1 trillion. Apple shares have gained nearly 60 per cent this year as the company overcame the shutdown of factories in China that produce the iPhone and the closure of its retail sales amid the coronavirus pandemic. The company’s hugely loyal customer base trusts its products so much that they continued to buy iPhones and other devices online while stuck at home. Apple recently reported blowout earnings for the April-June quarter, An upcoming four-for-one stock split that will make Apple’s shares more affordable to more investors also sparked a rally after it was announced three weeks ago. More here

Reliance’s strategy to use M&A as a growth vehicle will continue

Mergers and acquisitions has been an important strategic tool used by Reliance Industries to diversify into consumer facing digital businesses from the earlier old economy focused segments. The company has spent over $3 billion in the last 3 years on acquiring businesses, which help it expand in areas it sees growth. Having raised more than $20 billion, Reliance’s shopping bag has just got bigger. If one looks at the company’s fund deployment, the intent is clear: tech-media-telecom so far has got the lion’s share of investment at 80 percent. The energy has got a miniscule 6 percent. In terms of funds, $1.7 billion has been allocated to TMT. Next comes retail (with a smattering of digital). More here

Muthoot Finance leads the list of losing F&O stocks, down more than 4.5%

These F&O stocks are trading in the green

Opening Bell: Sensex, Nifty open lower dragged by banks, metals

Indian indices opened lower on Thursday, snapping three sessions of gains on weak global cues after the overnight release of July meeting minutes from the US Federal Reserve’s policymaking body. The domestic indices were mainly dragged by financials and metal stocks at the opening. At 9:18 am, the Sensex fell 351 points at 38,262 while the Nifty lost 109 points to 11,299. On the Nifty50 index, Cipla and Dr Reddy’s were the only 2 stocks in the green while L&T, ICICI Bank, JSW Steel, Hindalco, and Axis Bank led the losses. All sectors were in the red at opening. the bank and metal indices fell around 1.3 percent each while Nifty Auto was down 0.9 percent.

Top stock tips by Ashwani Gujral for today

– Buy GAIL with a stop loss of Rs 97, target at Rs 112

– Buy Maruti with a stop loss of Rs 6,950, target at Rs 7,100

– Sell Bajaj Auto with a stop loss of Rs 3,100, target at Rs 2,950

– Sell ONGC with a stop loss of Rs 85, target at Rs 72

– Sell HUL with a stop loss of Rs 2,230, target at Rs 2,100

Click here for buy/sell calls by Sudarshan Sukhani, Mitessh Thakkar

Jefferies maintains UNDERPERFORM call on Tata Power

CNBC-TV18’s top stocks to watch out for on August 20

PNB Housing Finance | The company’s board has approved raising up to Rs 1,800 crore equity capital.

Titan Company | The company said that it is fully hedged with gold on lease and gold bought from stock markets. The ineffective hedge loss due to mismatch in sales quantity will be reversed subsequently with a corresponding reversal of stock gain accrued in the Q1FY21, it added.

Yes Bank | The bank has sold the entire stake of 6.34 crore equity shares (10.12% stake) in CG Power & Industrial Solutions in various tranches.

[ad_2]

Source link