[ad_1]

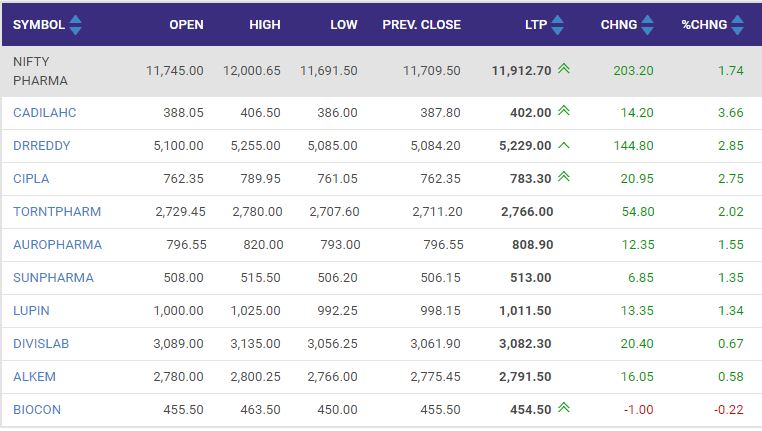

Nifty Pharma Index was trading 1 percent higher led by gains in Cadila Healthcare, Dr Reddy’s Laboratories and Cipla

Buzzing | Va Tech Wabag shares rallied over 6 percent after the announcement that Rekha Rakesh Jhunjhunwala, wife of ace investor Rakesh Jhunjhunwala, will invest Rs 80 crore in the company. The company has decided to raise Rs 120 crore via preferential issue, and on September 29, finalised the allotment of equity shares on a preferential basis.

Technical View | The Nifty is still below the 11,350 level which means it is still within the bearish zone. It will turn bullish only when it is successful in closing above the 11,350 levels. Until then traders could consider a favourable risk-reward ratio trade and look for opportunities to short the index at these levels for a target of 10,800 and a stop loss above 11,350, says Manish Hathiramani, Proprietary Index Trader and Technical Analyst, Deen Dayal Investments.

Robust returns: This pharma stock turned Rs 1 lakh to Rs 1.85 crore in 10 years

Caplin Points Labs has been a strong long-term performer giving robust return and steadily rising in the last 10 years. The pharma stock which traded around Rs 3 in 2010 has surged over 18,400 percent to quote at Rs 556 currently. To put it into perspective, an investment of Rs 1 lakh in the stock in 2010 would now be valued over Rs 1.85 crore currently.

In the last one year as well, the stock has risen 35 percent and 95 percent in 2020 amid a general rise in the pharma stocks due to the coronavirus pandemic. In comparison, benchmark Nifty fell 2.5 percent during the last one year and has declined 8 percent since the beginning of this year. Read more

Market opens lower, Nifty around 11,200; banks slip, IndusInd Bank top loser

Indian equity benchmark indices opened flat on Wednesday as gains in pharma and FMCG stocks were countered by selling in financial stocks amid mixed global cues.

At 9:15 am, the Sensex opened 0.25 percent, or 95.67 points, higher at 38,068.89, while the Nifty50 index opened at 11,244.45, up 22.05 points, or 0.20 percent.

Broader markets gained with Nifty Smallcap100 and Nifty Midcap100 trading 0.2 and 0.3 percent higher, respectively.

Among sectoral indices, the Nifty PSU Bank, Nifty Financial Services, Nifty Metal ad Nifty Private Bank declined while Nifty FMCG, Nifty Pharma, Nifty Auto and Nifty Media were trading in the green.

Before the opening bell, it’s important to know 10 things that could affect the Indian market today. Click here to read!

US Market: Stock futures turn negative amid virus treatment news, US presidential election

U.S. stock futures traded flat on Tuesday night as traders digested positive data regarding a potential coronavirus treatment from Regeneron Pharmaceuticals as well as the first U.S. presidential debate.

Dow Jones Industrial Average futures were down 7 points, or 0.03 percent, after jumping more than 150 points earlier. S&P 500 and Nasdaq 100 futures were also little changed.

Futures rose slightly during the debate, but quickly gave up most of that ground once the debate was over. It wasn’t clear whether the gyrations were related to the contentious comments being traded back and forth by the candidates. Traders are hoping that the start of the debate process will lead to a clear winner on Election Day and not a drawn-out electoral process that could hit the market. (Source: CNBC International)

General Atlantic to invest Rs 3,675 crore in Reliance Retail

US-based private equity firm General Atlantic will invest Rs 3675 crore in Reliance Retail Ventures for a 0.84 percent stake, the third strategic investment in the retail unit of Reliance Industries Ltd (RIL), within a month.

Reliance Retail Venture’s subsidiary Reliance Retail operates India’s largest retail business serving close to 640 million footfalls across its 12,000-odd

stores nationwide in 7000 cities.

The investment values Reliance Retail at a pre-money equity value of Rs 4.28 lakh crore, slightly higher than the previous two deals done at a valuation of Rs 4.21 lakh crore. Read more

Likhitha Infrastructure IPO: Issue fully subscribed on Day 1

The initial public offer of Likhitha Infrastructure has fully subscribed on the first day of the bidding process, September 29.

The IPO of Likhitha Infrastructure, the Hyderabad-headquartered oil and gas pipeline infrastructure service provider, has received bids for 51.35 lakh equity shares against offer size of 51 lakh equity shares, according to the data available on the exchanges.

The portion set aside for retail investors has been subscribed 2.5 times while the portion reserved for qualified institutional buyers has subscribed 1.8 percent. The non-institutional investors’ portion received 84.95 percent subscription so far.

The price band of the issue, which will close on October 1, has been fixed at Rs 117-120 per share. Here’s more

Here’s what you can expect from Vodafone-Idea AGM today!

Debt-ridden telecom operator Vodafone Idea Ltd’s (VIL) stock was under pressure in trade on Tuesday ahead of the annual general meeting (AGM) scheduled to be held on September 30.

The company had said it will seek shareholders’ approval to raise the borrowing limit to Rs 1 lakh crore, at the AGM. Shareholders of the company, which was earlier listed as Idea Cellular, had approved a borrowing limit of Rs 25,000 crore at AGM in September 2014.

In a regulatory filing, VIL said as the resolution passed by the company in September 2014 did not specify the securities premium, a necessary amendment is required to include securities premium in the borrowing powers. Watch Reema Tendulkar speak on the AGM

Welcome to our market blog!

I am Mousumi Paul and I will be bringing all the updates from the stock market, corporate world and the economy. To begin with, let’s see how the markets fared yesterday.

The Indian indices ended flat on Tuesday as gain in IT, auto and metal indices were capped by losses in banks and FMCG stocks. Meanwhile, fall in global peers also weighed on the sentiment as investors awaited the first U.S. presidential debate and eyed progress of a fiscal stimulus package in Washington. The Sensex ended 8 points lower at 37,973 while the Nifty fell 5 points to settle at 11,222. Broader markets also turned negative with Nifty Midcap and Nifty Smallcap indices down around 0.1 percent and 0.3 percent, respectively.

[ad_2]

Source link