[ad_1]

Technology One’s (ASX:TNE) top off by 6.1% over the previous three months. Since the market normally pay for a corporation’s long-term monetary well being, we determined to review the corporate’s fundamentals to see in the event that they may very well be influencing the market. Specifically, we determined to review Technology One’s ROE on this article.

Return on fairness or ROE is a key measure used to evaluate how effectively an organization’s administration is using the corporate’s capital. In brief, ROE exhibits the revenue every greenback generates with respect to its shareholder investments.

View our latest analysis for Technology One

How Do You Calculate Return On Equity?

Return on fairness will be calculated through the use of the method:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, primarily based on the above method, the ROE for Technology One is:

34% = AU$103m ÷ AU$306m (Based on the trailing twelve months to September 2023).

The ‘return’ is the quantity earned after tax over the past twelve months. Another manner to consider that’s that for each A$1 value of fairness, the corporate was capable of earn A$0.34 in revenue.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an environment friendly profit-generating gauge for a corporation’s future earnings. We now want to judge how a lot revenue the corporate reinvests or “retains” for future progress which then offers us an thought in regards to the progress potential of the corporate. Assuming every thing else stays unchanged, the upper the ROE and revenue retention, the upper the expansion charge of an organization in comparison with firms that do not essentially bear these traits.

A Side By Side comparability of Technology One’s Earnings Growth And 34% ROE

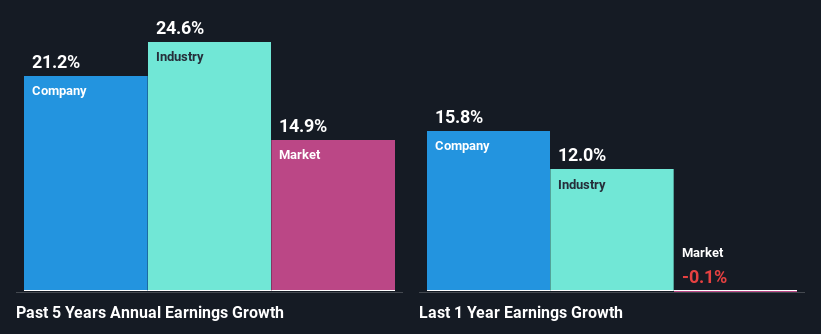

Firstly, we acknowledge that Technology One has a considerably excessive ROE. Secondly, even when in comparison with the trade common of 9.5% the corporate’s ROE is kind of spectacular. As a consequence, Technology One’s distinctive 21% internet revenue progress seen over the previous 5 years, does not come as a shock.

Next, on evaluating Technology One’s internet revenue progress with the trade, we discovered that the corporate’s reported progress is just like the trade common progress charge of 25% over the previous couple of years.

Earnings progress is a large consider inventory valuation. What buyers want to find out subsequent is that if the anticipated earnings progress, or the shortage of it, is already constructed into the share value. Doing so will assist them set up if the inventory’s future seems promising or ominous. If you are questioning about Technology One’s’s valuation, take a look at this gauge of its price-to-earnings ratio, as in comparison with its trade.

Is Technology One Using Its Retained Earnings Effectively?

The excessive three-year median payout ratio of 59% (implying that it retains solely 41% of earnings) for Technology One means that the corporate’s progress wasn’t actually hampered regardless of it returning a lot of the earnings to its shareholders.

Moreover, Technology One is decided to maintain sharing its earnings with shareholders which we infer from its lengthy historical past of paying a dividend for no less than ten years. Our newest analyst knowledge exhibits that the long run payout ratio of the corporate over the following three years is predicted to be roughly 56%. Therefore, the corporate’s future ROE can also be not anticipated to alter by a lot with analysts predicting an ROE of 33%.

Summary

In whole, we’re fairly pleased with Technology One’s efficiency. Especially the excessive ROE, Which has contributed to the spectacular progress seen in earnings. Despite the corporate reinvesting solely a small portion of its earnings, it nonetheless has managed to develop its earnings so that’s considerable. With that mentioned, the most recent trade analyst forecasts reveal that the corporate’s earnings progress is predicted to decelerate. Are these analysts expectations primarily based on the broad expectations for the trade, or on the corporate’s fundamentals? Click here to be taken to our analyst’s forecasts page for the company.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to convey you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link