[ad_1]

If I had to summarize my view of the Efficient Market Hypothesis, it would be this:

Markets tend to be more inefficient in the short term and more efficient in the long term.

One way of thinking about this is that the information we obtain in the short term tends to be incomplete. So, investors have to make informed guesses about market prices. This makes the short-term prices “wrong” at all times.

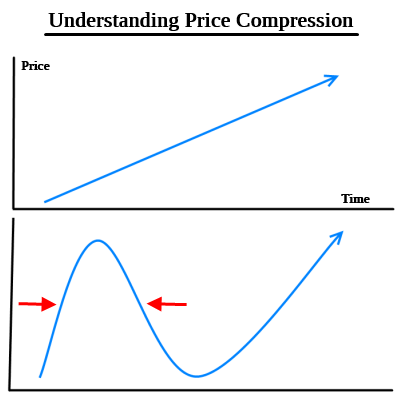

In my book, I talked about one of my favorite ways to think about the inefficiency of markets – price compression. The basic gist of the concept is that most markets (such as stocks and bonds) are comprised of inherently long-term instruments. That is, they accrue their cash flows over long periods of time and so sustainable gains can only be realized in the long term. The instruments literally cannot pay out their cash flows sustainably in the short term. Of course, stocks don’t only change in value because of realized cash flows (like dividends). Their prices can change purely based on how valuable someone expects those future cash flows to be. So, you can get wild changes in valuations across time that result in huge booms and busts.

Now, price compression is helpful in that it shows what happens to markets at times when they become irrational. For instance, the Nasdaq bubble was a classic price compression.¹ In the long term, there was nothing unsustainable about the cash flows and valuations that would accrue to tech firms. The internet really was the world changing invention that investors believed it to be in 1999. But the instruments couldn’t sustainably pay out their cash flows in the period in which investors expected. So, there was an asset and liability mismatch between the short-term cash flow expectations of the market’s prices and the firms that had to pay out those cash flows. And when the first hint of a recession became apparent in 2000 that cash flow mismatch became realized.

Getting to today – I would argue that COVID has created a price compression in technology. That is, many of the long-term trends that we’re seeing (work from home, video calls, etc.) are examples of things that will become more and more widely adopted. But COVID forced us all to adopt these things in a highly compressed period. And the market has fully reflected that adoption. This has resulted in some crazy things happening. For instance:

- Tech stocks are now worth more than the entire European stock market.

- The market cap of Apple (NASDAQ:AAPL) is greater than the entire Russell 2000.

- The 25% concentration of the top 5 tech stocks is the highest in the history of the S&P 500.

What the market has potentially missed is that this adoption period is going to be longer than some people seem to think. And so there is a risk of a decompression in technology as COVID dissipates and life returns to some semblance of normalcy in 2021 and 2022. In other words, what appears to be a permanent adoption of Peloton (NASDAQ:PTON) rides at home, Zoom (NASDAQ:ZM) meetings and higher than normal internet usage, will likely revert to the mean as COVID dissipates. In the long term, however, these trends are likely real.

To be clear, this is different from the tech bubble in that most of the firms seeing the price appreciation are earning real profits. In fact, the rally is concentrated mostly in the biggest and most profitable tech firms. So, there isn’t the same sort of downside risk because the firms are inherently safer than they were in 1999. But from my perch I wouldn’t be shocked by a prolonged 20-30% downturn in tech as the upside price compression of COVID turns into a decompression as COVID dissipates.

¹ – I’ve never liked the term “bubble” as it implies that the trend dies, or pops. Price compression is a better way to communicate the concept of an unsustainable trend because it doesn’t necessarily imply that the trend will die or that the market is wrong in the long term.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link