/https://specials-images.forbesimg.com/imageserve/43956451/0x0.jpg)

[ad_1]

A jewelry box sits on Indian rupee banknotes inside the Zaveri Kapoorchand Lalchand jewelry store … [+]

Gold prices touching record highs through the month of July has got many wondering how they can make use of their physical gold.

India is the world’s second largest consumer of gold, as citizens attach significant cultural value to gold coins, bars and jewellery held and gifted. In fact, in an interview with Indian financial daily The Financial Express last November, the managing director of World Gold Council had revealed that Indian households have accumulated up to 25,000 tonnes of gold.

Many consumers who hold gold in reserve are considering gold loans as an option to meet their credit requirements, and Indian financial entities have a host of options on offer. Gold loan companies and banks have reported a surge in demand for gold loans in the last three months since the coronavirus pandemic hit.

Learn how consumers can get gold loans in India and how a gold loan fares compared to a personal loan.

How To Get a Gold Loan in India

To avail a gold loan, customers have three options:

1) Visit a Bank Branch to Get Your Gold Evaluated

Customers can visit the nearest gold loan branch with their jewellery as well as gold bars or coins that they wish to pledge, along with basic Know Your Customer (KYC) documents to attest their identity and residential address. The bank then measures your jewellery’s worth and proposes a price for the gold loan, typically at an interest rate ranging from 7.50% to up to 12%.

2) Request for Door-step Evaluation of Your Gold

Customers can request for door-step gold loan facilities offered by banks and some non-banking financial companies (NBFCs). When customers opt for this service, the financial entity sends a company executive to visit their home to evaluate their gold jewellery on the spot and decide and agree upon a credit amount, which is then transferred to the customer’s account.

To ensure security, always verify the credentials of the company executives who are scheduled for visit in advance.

3) Apply for a Gold Loan Digitally

Customers can also apply for a gold loan via the digital route, where the bank or the NBFC helps them choose loan offers from their website or app-based digital service. Customers compare interest rates and choose the best available option for them. The financial institution then verifies the customer by the help of their Aadhaar card details and by conducting a video-based KYC process.

When the customer decides to part with the decided gold jewellery or bars by pledging it against the gold loan disbursal decided by the financial entity, they receive a receipt, also called a pawn ticket, which lists out the full details about the pledged ornaments (including weight, karatage, pictures among others details).

From this point onward, the financial entity ensures secure storage of the gold handed over until the gold is not taken back by the customer upon repayment of the loan. If the customer fails to repay the loan capital, the lender holds the right to keep the loan with themselves and auction it to retrieve the investment. To avoid such a situation, customers are requested to repay timely and in adverse conditions, renegotiate the loan repayment clause.

How Does a Gold Loan Work?

The lender evaluates the pledged jewellery in terms of purity and weight and verifies the jewellery ownership and identity documents submitted before offering a loan amount, also known as the LTV (loan to value).

A credit limit, similar to a bank overdraft account, is sanctioned up to a limit of 75% of the market value of the pledged gold ornaments. This LTV is capped by the Indian banking regulator Reserve Bank of India. This amount can be withdrawn by the customer whenever required. On repayment of the loan, the customer has the option to repledge the same gold for future loans.

Customers do not need to repay the loan via a monthly installment amount. They enjoy the choice of instead making bullet repayments, which refer to a lump sum payment made for the entirety of an outstanding loan amount, usually at maturity.

On maturity, the customer has the option to repay the outstanding and close the account or extend the tenure by repledging the jewellery at the current LTV.

There exists no limit on how many times a customer can repledge their gold, which means the loan can be rolled over for as long as needed.

Some banks and NBFCs also allow partial payments and early repayments without any penalties. In this way, a gold loan functions like an overdraft facility for the retail customers.

Pros of Taking a Gold Loan

Existing Asset Can Be Used

When taking a gold loan, borrowers can pledge the jewellery and gold bars or coins that they already own. This means the customer enjoys the benefit of possessing the jewellery and taking a loan on it whenever they want. This jewellery is returned to the customer securely once the loan repayment is complete, or it can be reused.

Repledging

There is no limit on the number of times the same piece of jewellery or gold coins or bars can be pledged. This helps customers take loans repeatedly on the same asset. This feature is unique to gold loans, as compared to personal loans, where loans are disbursed based on the customer’s capacity to repay the loan. Also with personal loans, a repeat loan from the same banking entity completely depends on the customer’s ability to repay at that point.

Bullet Payments

The biggest advantage of a gold loan is the flexibility to repay the loan principal and interest as a lump sum amount instead of the popular way to repay other forms of loans—equated monthly installments, or EMIs.

This feature encourages small-business owners and traders, who face temporary cash crunch situations, to take gold loans as opposed to other loan options where monthly EMIs could burden borrowers from the very next month of the loan approval.

Cons of Taking a Gold Loan

Lower LTV

When taking a gold loan, the banking entity decides the amount of loan to be disbursed based on the current market value of the gold pledged. This loan to value, or LTV, amount is different for different financiers, and the full value of the gold may not be realised. Customers, hence, may end up receiving lower LTV on gold pledged.

Priced Gold Asset Could Be Lost

If a customer fails to repay the dues, lenders have the right to liquidate the jewellery or the gold asset pledged for the loan. When a customer is unable to meet the loan obligation, they can approach the lender to extend the tenure of the payment to defer a possible auction of the gold pledged. This extension may attract a penalty, which the customers are expected to honour.

This is the biggest disadvantage of a gold loan in cases where the gold jewellery pledged has more than just the value of the asset but also sentimental value. Jewellery passed on from one generation to another may also possess antique value, which could price the asset higher than the value of the loan disbursed.

Credit Score Can Get Dented Upon Default

A customer does not need to worry about their credit score when taking a gold loan, but in the case of not being able to honour the loan repayment obligation, your credit score could be affected—as a default would result in a downgrade. Gold loan companies are particular about alerting credit score companies on their defaulters, and this downgrade could diminish a customer’s chance of getting other forms of loans.

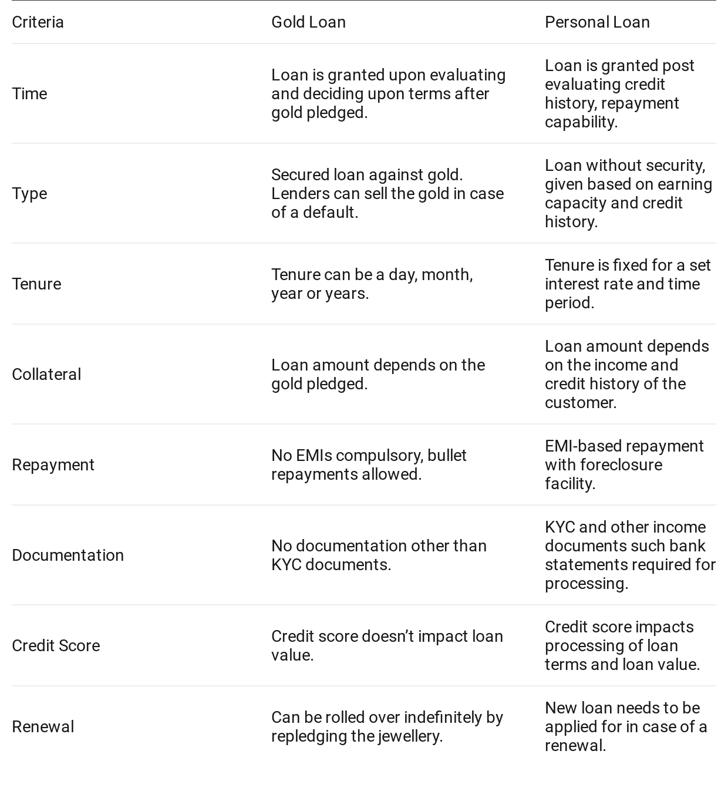

Gold Loans vs. Personal Loans

Besides unlocking the value of gold kept at home, a gold loan may have other features that attract customers over personal loans. Let’s find out how the two fare against the other.

Gold Loans vs. Personal Loans

Why Are Indians Exploring Options to Take Gold Loans

A gold loan is a quick way to raise money to meet urgent needs and is also considered an attractive option due to its inherently lower risk compared to other forms of loans.

Traditionally when the economy comes to a halt, and when the working capital cycle in the unorganised sector is disrupted, demand for gold loans also dries up. But the coronavirus outbreak has pushed this demand higher owing to most banks and NBFCs becoming risk averse, explains VP Nandakumar, the Managing Director & CEO of Manappuram Finance Ltd.

“With borrowers being denied access to their regular channels of credit, gold loans have become the default option, especially for meeting essential personal needs,” says Nandakumar.

Muthoot Finance, a gold loan company with 98% of their assets under management as gold loans, has been receiving gold loan requests from traders, shopkeepers and small business owners to restart their businesses after lockdowns, considering formal credit from banks may take time.

George Alexander Muthoot, the Managing Director of Muthoot Finance, has seen small-business owners using gold loans as short-term working capital – “Gold loans act as bridge financing, since small companies have not received payments during the lockdown and fresh credit sanction from banks will take time.”

Gold loans have also become the option for borrowers denied access to personal loans from regular channels for meeting their financial commitments in the wake of job losses or wage cuts due to the coronavirus pandemic, explains Muthoot.

Future of Gold Loans in India

The organised gold loan industry is estimated at about INR 3.5 trillion, or about 7% of the total size of the personal loan industry—estimated at over INR 25 trillion.

All big banks in India including the state-owned State Bank of India, plus India’s largest private banks HDFC Bank, ICICI Bank and Axis Bank, among others, are competing to offer lower interest rates and processing fees to lure customers.

Among popular gold loan NBFCs are Manappuram Finance, Muthoot Finance and IIFL among other that are offering gold loans.

In the short-term, Manappuram Finance has seen growth in gold loans from customers who are taking advantage of the higher LTV propelled by the sharp rise in gold price to borrow more against their existing pledges.

“We expect that once people get the sense that high prices of gold are here to stay for some more time, the impetus to sell their gold will ebb,” says Nandakumar. He envisages a 10 to 15 percent growth in the company’s gold loans portfolio in the coming months.

Muthoot Finance is banking upon traders, shopkeepers and small-business owners to take up gold loans actively to meet working capital requirements to kick-start their businesses, as many do not have sufficient collateral to provide against bank loans.

If you’re hoping to put your idle gold to good use, gold loans could be a financial product to research. In the case of gold loans, borrowers need to thoroughly understand the conditions of their loan terms to ensure all that is glittering is indeed gold.

[ad_2]

Source link