[ad_1]

With short clips of 15 to 60 seconds length, TikTok became particularly popular in the tier-2 and tier-3 cities in India, where millions of users are accessing the internet for the first time on smartphones.

With short clips of 15 to 60 seconds length, TikTok became particularly popular in the tier-2 and tier-3 cities in India, where millions of users are accessing the internet for the first time on smartphones.

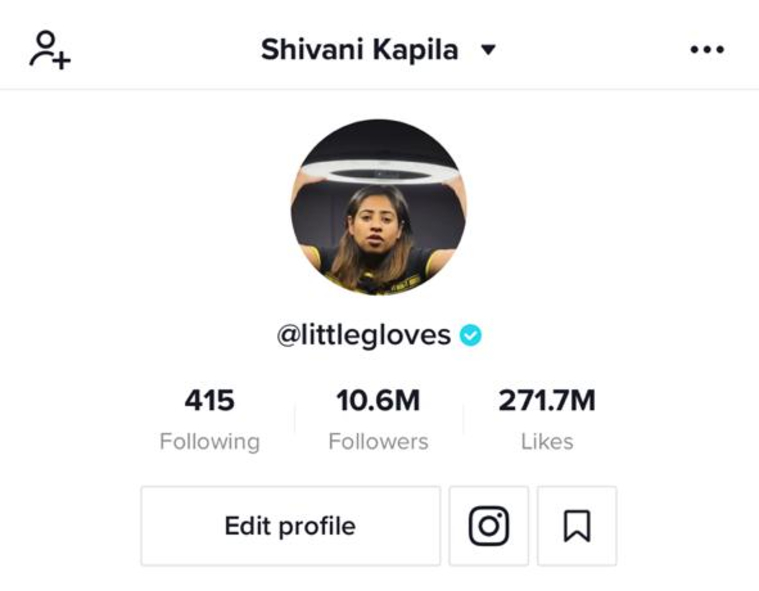

“Two years of my life is gone.” Shivani Kapila, a Surat-based TikTok creator with over 10.6 million followers, is yet to come to terms with a ban on the popular short-form video platform. Kapila spent two years trying to master the platform, leaving behind her job as an HR executive.

Sangeeta Jain, popularly known as Geet on TikTok with over 10 million followers, used to be a practising lawyer in the United States before becoming a full-time content creator. The wheelchair-bound Jain created a mass following with three channels on the video platform, where she puts up motivational and self-help videos and English lessons for followers in rural India.

With TikTok no longer operational in India, people like Kapila and Jain have not only lost the video platform, but also access to millions of loyal fans and thus a livelihood. The 1.2 million TikTok content creators in India have no option but to shift to rival apps or legacy content creation platforms like YouTube.

“The ban on TikTok has left many influencers out of work and in shock,” says Irfan Khan, partner at Yaap, a multi-specialized digital content marketing and design company. “However, the real impact will be based on how long the ban will last. If the ban lasts for anything more than 3 to 4 months, then it will have a big impact in this space.”

Kapila spent two years trying to master the platform, leaving behind her job as an HR executive. (Image credit: Shivani Kapila)

Kapila spent two years trying to master the platform, leaving behind her job as an HR executive. (Image credit: Shivani Kapila)

Khan agrees the ban on TikTok is going to have a much bigger impact on content creators and influencers than on brands. Content creators like Kapila, he says, need to find a substitute of TikTok in order to keep going. Even if they do find one, there is the challenge of setting up a follower base and then monetising like before. They must be ready to take a considerable hit, as high as 80 per cent in their income during this period, he warns.

Fan base gone, TikTok stars hit but ready for options: ‘App is banned, not talent’

Before the ban was announced on June 29, India was TikTok’s biggest market outside China with 200 million monthly active users. With short clips of 15 to 60 seconds length, TikTok became particularly popular in the tier-2 and tier-3 cities in India, where millions of users are accessing the internet for the first time on smartphones.

“People didn’t use TikTok just because TikTok was also there,” said Aman Kumar, co-founder and CEO of market intelligence platform Kalagato. “They used it because of what TikTok offered them. If you see the subset of users that used the platform, it is quite dissimilar to Instagram. That tells you that people chose TikTok because as an ecosystem it may have felt more familiar to them.”

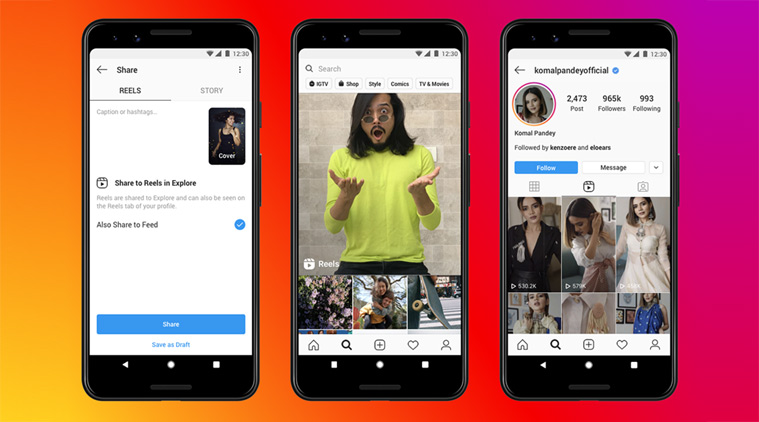

Like TikTok, Instagram Reels will let users record and edit 15-second video clips set to music. (Image credit: Instagram)

Like TikTok, Instagram Reels will let users record and edit 15-second video clips set to music. (Image credit: Instagram)

As TikTok penetrated deeper into India’s Hindi heartland and smaller towns, it also helped broaden the concept of influencer culture at a macro level. Big brands took advantage of the rising popularity of TikTok, as the platform gave them easy access to the customers at the grassroots level. A recent study from influencer analytics company HypeAuditor reveals that around 12 per cent Indian TikTok influencers had over 100K followers, which gives them an opportunity to collaborate with brands and get paid for advertising. The study also shows that the average engagement of Indian influencers is 6 per cent higher than the worldwide rate.

With the ban already into its third week, creators like Kapila have already started looking for other options. “The show must go on,” she says. “I haven’t joined anything yet. I am a content creator by nature and I love creating conceptual videos. So I and my team are currently focusing on YouTube and Instagram.”

While Kapila says there are similar options where she can now put out the content, she also knows that it’s not going to be an easy ride. “Within 15 days, we were able to get 30,000 followers on YouTube, but 30K is a small number for somebody with 10 million. We still have to work really hard from the scratch…it’s a nightmare.”

Kapila believes it was TikTok’s ease of use that made it popular with content creators like her — all she needed was a phone and her thoughts. While she could edit the entire video on TikTok itself, for other platforms she needs a proper editor and graphic designer. But most importantly, according to her, TikTok gave everybody a chance to make content that transcended language and region.

Ropso video app now has 75 million downloads. The app has been benefited by the ban on TikTok in India. (Image credit: Roposo)

Ropso video app now has 75 million downloads. The app has been benefited by the ban on TikTok in India. (Image credit: Roposo)

“We are already using a lot of the other platforms,” says Jain who started with Facebook. “But none of these platforms have the organic reach that TikTok had. Sure we can move to these platforms, but my followers don’t follow me on these platforms because they don’t use these main platforms,” she explained.

There are also those who would rather sit out the ban and not jump ship. “I will never join any other platform,” says Naveen Ricky, who was popular for his relationship videos on TikTok. Naveen has amassed more than 400K followers on the platform.

While the ban has given TikTok rivals a boost and pushed their downloads to new highs, locally developed apps like Roposo, Chingari, Mitron, and ShareChat still have to retain the users and offer originality on their platforms.

Sangeeta Jain, known as Geet on TikTok, gives English lessons to millions of users on the popular platform. (Image credit: Sangeeta Jain)

Sangeeta Jain, known as Geet on TikTok, gives English lessons to millions of users on the popular platform. (Image credit: Sangeeta Jain)

There is also Instagram Reels in the fray now. “It is tough to predict the uptake of Instagram Reels in India, but it is likely to receive an initial surge due to the ready base of influencers on Instagram,” said a spokesperson of Zefmo, an influencer marketing platform. Yaap’s Khan feels if Instagram wants Reels to be successful in India, it needs to look at a separate app to compete with TikTok in India. “One key challenge that Instagram Reels will face is that it is integrated as just another feature in Instagram app as opposed to building a separate app to address this vacuum,” he said. Issues related to customised feed could drop in due to the “mixed content base and bringing in of brand-led features like TikTok’s popular hashtag challenge.”

A lot of established influencers are also seriously considering YouTube, given its reach and monetisation avenues. “Influencers earn more on YouTube and Instagram for a similar amount of followers and audience vs what they earn on Tiktok for paid content/collaboration. But they will need to rev up their creativity to stand out,” Khan says.

“TikTok can, of course, challenge the ban in court, claiming the grounds for the ban under Section 69A of the IT ACT have not been met with,” explains Prasanth Sugathan, Legal Director, SFLC. But Bytedance, which owns TikTok, has not pursued legal options and is working with the government to address the concerns. Earlier this week, the Information Technology Ministry asked ByteDance to answer 77 questions about its apps including whether they censored content, worked on behalf of foreign governments, or lobbied influencers. The Ministry has given ByteDance three weeks to respond.

For all the latest Technology News, download Indian Express App.

© IE Online Media Services Pvt Ltd

[ad_2]

Source link