[ad_1]

Cloudpoint Technology Berhad (KLSE:CLOUDPT) inventory is about to commerce ex-dividend in three days. The ex-dividend date is one enterprise day earlier than the report date, which is the closing date for shareholders to be current on the corporate’s books to be eligible for a dividend cost. It is necessary to pay attention to the ex-dividend date as a result of any commerce on the inventory must have been settled on or earlier than the report date. Therefore, if you buy Cloudpoint Technology Berhad’s shares on or after the seventh of March, you will not be eligible to obtain the dividend, when it’s paid on the 2nd of April.

The firm’s subsequent dividend cost can be RM00.01 per share. Dividends are a serious contributor to funding returns for long run holders, however provided that the dividend continues to be paid. We have to see whether or not the dividend is roofed by earnings and if it is rising.

View our latest analysis for Cloudpoint Technology Berhad

If an organization pays out extra in dividends than it earned, then the dividend would possibly turn out to be unsustainable – hardly a super scenario. Cloudpoint Technology Berhad paid out 65% of its earnings to buyers final 12 months, a traditional payout degree for many companies.

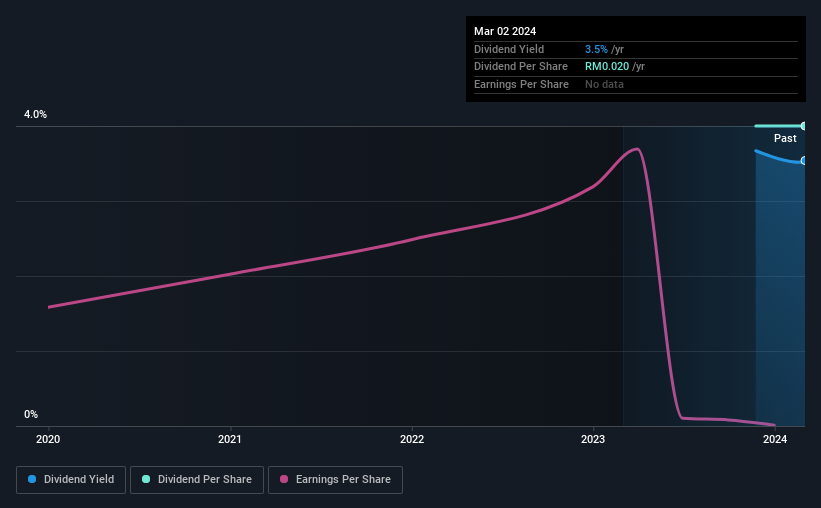

Click here to see how much of its profit Cloudpoint Technology Berhad paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are difficult from a dividend perspective. If earnings fall far sufficient, the corporate might be pressured to chop its dividend. Cloudpoint Technology Berhad’s earnings have collapsed sooner than Wile E Coyote’s schemes to entice the Road Runner; down an incredible 63% a 12 months over the previous 5 years.

Cloudpoint Technology Berhad additionally issued greater than 5% of its market cap in new inventory throughout the previous 12 months, which we really feel is more likely to damage its dividend prospects in the long term. It’s onerous to develop dividends per share when an organization retains creating new shares.

This is Cloudpoint Technology Berhad’s first 12 months of paying a dividend, so it would not have a lot of a historical past but to check to.

Final Takeaway

Is Cloudpoint Technology Berhad value shopping for for its dividend? We’re not overly enthused to see Cloudpoint Technology Berhad’s earnings in retreat concurrently the corporate is paying out greater than half of its earnings as dividends to shareholders. In sum this can be a middling mixture, and we discover it onerous to get excited concerning the firm from a dividend perspective.

However in the event you’re nonetheless interested by Cloudpoint Technology Berhad as a possible funding, you must undoubtedly take into account a number of the dangers concerned with Cloudpoint Technology Berhad. We’ve identified 3 warning signs with Cloudpoint Technology Berhad (at least 1 which is significant), and understanding them must be a part of your funding course of.

A typical investing mistake is shopping for the primary attention-grabbing inventory you see. Here you’ll find a full list of high-yield dividend stocks.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to carry you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link