[ad_1]

Key Insights

-

Significant insider management over PMB Technology Berhad implies vested pursuits in firm development

-

The high 3 shareholders personal 55% of the corporate

-

Ownership analysis, mixed with past performance data can assist present a great understanding of alternatives in a inventory

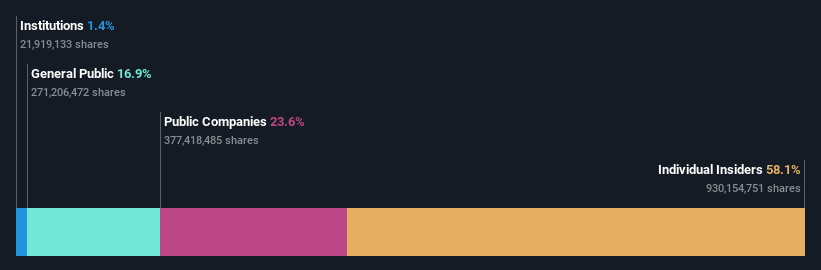

Every investor in PMB Technology Berhad (KLSE:PMBTECH) ought to concentrate on probably the most highly effective shareholder teams. We can see that particular person insiders personal the lion’s share within the firm with 58% possession. In different phrases, the group stands to achieve probably the most (or lose probably the most) from their funding into the corporate.

With such a notable stake within the firm, insiders could be extremely incentivised to make worth accretive choices.

Let’s delve deeper into every sort of proprietor of PMB Technology Berhad, starting with the chart beneath.

Check out our latest analysis for PMB Technology Berhad

What Does The Institutional Ownership Tell Us About PMB Technology Berhad?

Institutions sometimes measure themselves in opposition to a benchmark when reporting to their very own traders, so that they usually change into extra enthusiastic a few inventory as soon as it is included in a significant index. We would anticipate most corporations to have some establishments on the register, particularly if they’re rising.

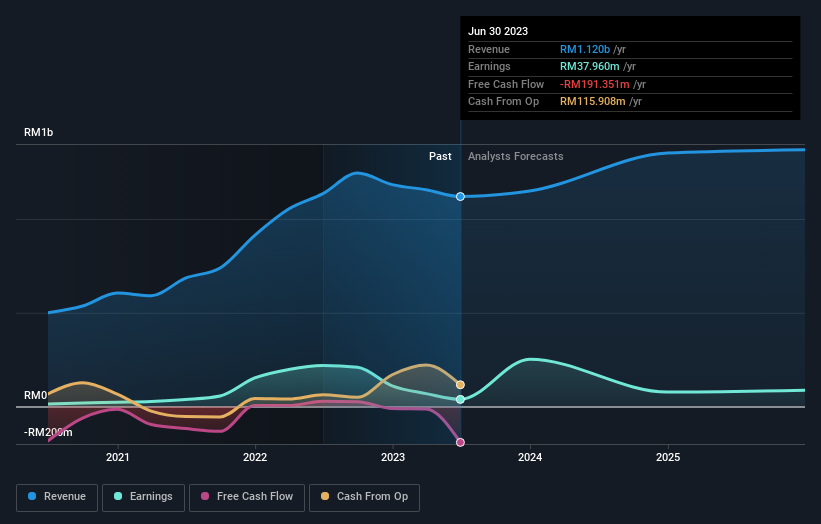

Institutions have a really small stake in PMB Technology Berhad. That signifies that the corporate is on the radar of some funds, nevertheless it is not notably in style with skilled traders in the mean time. If the enterprise will get stronger from right here, we might see a scenario the place extra establishments are eager to purchase. It just isn’t unusual to see an enormous share value rise if a number of institutional traders are attempting to purchase right into a inventory on the identical time. So take a look at the historic earnings trajectory, beneath, however be mindful it is the longer term that counts most.

We notice that hedge funds do not have a significant funding in PMB Technology Berhad. The firm’s largest shareholder is Press Metal Aluminium Holdings Berhad, with possession of 24%. Meanwhile, the second and third largest shareholders, maintain 21% and 11%, of the shares excellent, respectively. Two of the highest three shareholders occur to be Chief Executive Officer and Member of the Board of Directors, respectively. That is, insiders characteristic greater up within the heirarchy of the corporate’s high shareholders.

A extra detailed examine of the shareholder registry confirmed us that 3 of the highest shareholders have a substantial quantity of possession within the firm, by way of their 55% stake.

While it is smart to check institutional possession knowledge for an organization, it additionally is smart to check analyst sentiments to know which means the wind is blowing. While there may be some analyst protection, the corporate might be not broadly lined. So it might acquire extra consideration, down the monitor.

Insider Ownership Of PMB Technology Berhad

The definition of an insider can differ barely between completely different international locations, however members of the board of administrators all the time depend. Management in the end solutions to the board. However, it’s not unusual for managers to be government board members, particularly if they’re a founder or the CEO.

Most take into account insider possession a constructive as a result of it will possibly point out the board is nicely aligned with different shareholders. However, on some events an excessive amount of energy is concentrated inside this group.

Our most up-to-date knowledge signifies that insiders personal the vast majority of PMB Technology Berhad. This means they will collectively make choices for the corporate. Insiders personal RM2.8b value of shares within the RM4.8b firm. That’s extraordinary! Most could be happy to see the board is investing alongside them. You might want to discover if they have been buying or selling.

General Public Ownership

With a 17% possession, most of the people, largely comprising of particular person traders, have a point of sway over PMB Technology Berhad. While this group cannot essentially name the pictures, it will possibly definitely have an actual affect on how the corporate is run.

Public Company Ownership

We can see that public corporations maintain 24% of the PMB Technology Berhad shares on subject. We cannot be sure however it’s fairly attainable this can be a strategic stake. The companies could also be related, or work collectively.

Next Steps:

It’s all the time value fascinated about the completely different teams who personal shares in an organization. But to know PMB Technology Berhad higher, we have to take into account many different components. Be conscious that PMB Technology Berhad is showing 4 warning signs in our investment analysis , and a couple of of these are doubtlessly critical…

But in the end it’s the future, not the previous, that may decide how nicely the homeowners of this enterprise will do. Therefore we predict it advisable to check out this free report showing whether analysts are predicting a brighter future.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which consult with the 12-month interval ending on the final date of the month the monetary assertion is dated. This will not be according to full yr annual report figures.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to deliver you long-term targeted evaluation pushed by basic knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link