[ad_1]

Zee Entertainment saw its stock price fell 3% in today’s trade on a letter fromInvesco demanding an extraordinary general meeting (EGM) before finalising its merger with Sony’s India unit.- Earlier this month, Invesco and Oppenheimer Funds had also asked for the removal of

Punit Goenka , the chief executive and managing director of Zee Entertainment, from the company’s board. - Invesco and OFI Global China Fund LLC, which together hold about 17.9% stake in the network, said the deal was struck in “erratic manner,” Bloomberg reported.

Zee Entertainment Enterprises Ltd. saw its shares fall 3% to ₹309 apiece on Monday morning as its largest shareholder, US-based Invesco Fund, has reportedly insisted that the board hold its extraordinary general meeting (EGM) before finalising its merger with Sony’s India unit.

The development, reported by

Bloomberg on Monday, said that Invesco and Oppenheimer Funds, in a September 23 letter, renewed their demand to convene an EGM to replace the board at Zee. A similar demand was made by Invesco on September 11.

“A newly constituted board supported with the strength of independence will be best suited to evaluate and oversee the potential for strategic transactions,” according to the Sept. 23 letter from Aroon Balani, vice president of Invesco, as cited by Bloomberg.

Earlier this month, the funds had also asked for the removal of Punit Goenka, the chief executive and managing director of Zee Entertainment, from the company’s board, citing issues with corporate governance at the firm. The letter also demanded removal of independent directors, Ashok Kurien and Manish Chokhani, who later resigned from the board.

Despite Invesco’s letter, Zee went ahead and announced the company’s merger with Sony Pictures Networks India on September 22. Based on disclosures filed with exchanges, Sony will hold a majority stake of 52.93% in the merged entity and infuse growth capital of about $1.6 billion once the deal closes. Zee shareholders, post the deal, will hold the balance 47.07% in the merged entity.

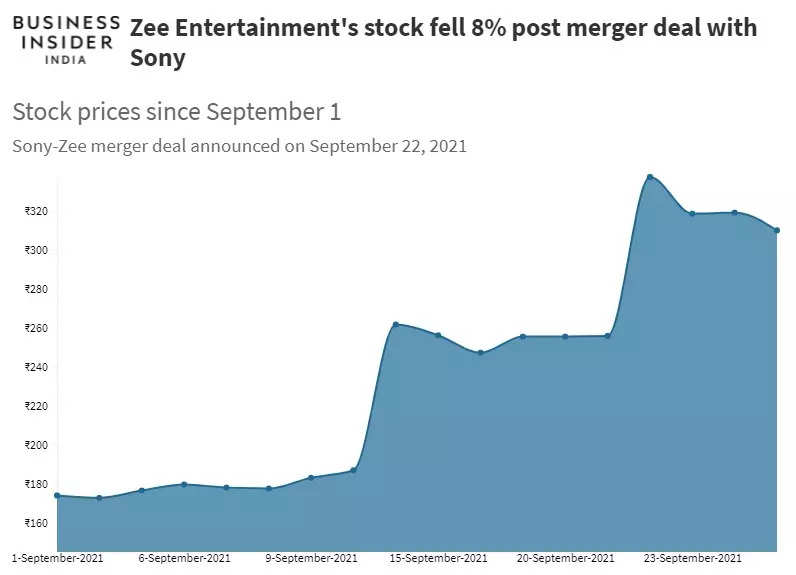

Since the deal announcement on September 22, the stock has fallen as much as 8% to ₹309 on Monday.

As part of the transaction, Goenka will continue to be the managing Director and chief executive of the company, it said.

Invesco and OFI Global China Fund LLC, which together hold about 17.9% stake in the network, said the deal was struck in “erratic manner,” Bloomberg reported.

SEE ALSO:

OfBusiness was the only woman led startup that entered the unicorn club this year

Tesla’s ‘Full Self Driving’ Beta programme request button goes live

Those who have held these stocks for a decade have only lost money

[ad_2]

Source link