[ad_1]

Key Insights

-

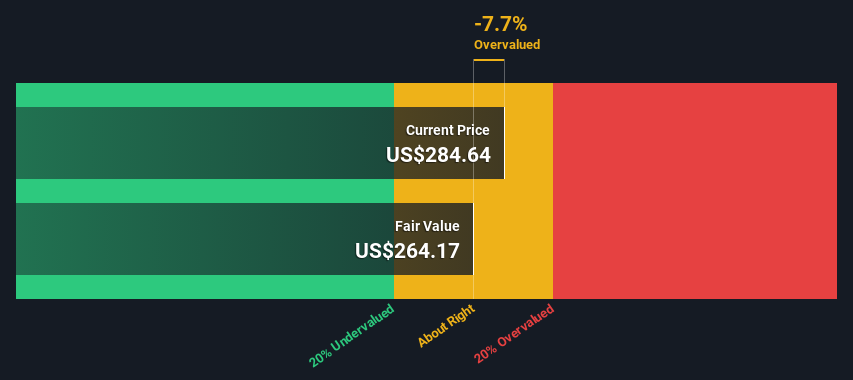

The projected honest worth for Align Technology is US$264 primarily based on 2 Stage Free Cash Flow to Equity

-

Current share worth of US$285 suggests Align Technology is doubtlessly buying and selling near its honest worth

-

Analyst price target for ALGN is US$391, which is 48% above our honest worth estimate

Does the October share worth for Align Technology, Inc. (NASDAQ:ALGN) replicate what it is actually value? Today, we are going to estimate the inventory’s intrinsic worth by taking the forecast future money flows of the corporate and discounting them again to right now’s worth. Our evaluation will make use of the Discounted Cash Flow (DCF) mannequin. There’s actually not all that a lot to it, although it’d seem fairly complicated.

We would warning that there are various methods of valuing an organization and, just like the DCF, every approach has benefits and downsides in sure situations. If you continue to have some burning questions on such a valuation, check out the Simply Wall St analysis model.

See our latest analysis for Align Technology

The Model

We use what is called a 2-stage mannequin, which merely means now we have two completely different durations of development charges for the corporate’s money flows. Generally the primary stage is greater development, and the second stage is a decrease development part. To begin off with, we have to estimate the subsequent ten years of money flows. Where doable we use analyst estimates, however when these aren’t obtainable we extrapolate the earlier free money circulation (FCF) from the final estimate or reported worth. We assume firms with shrinking free money circulation will sluggish their fee of shrinkage, and that firms with rising free money circulation will see their development fee sluggish, over this era. We do that to replicate that development tends to sluggish extra within the early years than it does in later years.

Generally we assume {that a} greenback right now is extra useful than a greenback sooner or later, and so the sum of those future money flows is then discounted to right now’s worth:

10-year free money circulation (FCF) forecast

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

|

|

Levered FCF ($, Millions) |

US$673.8m |

US$769.7m |

US$774.1m |

US$877.1m |

US$931.6m |

US$978.1m |

US$1.02b |

US$1.05b |

US$1.09b |

US$1.12b |

|

Growth Rate Estimate Source |

Analyst x3 |

Analyst x3 |

Analyst x1 |

Analyst x1 |

Est @ 6.21% |

Est @ 4.99% |

Est @ 4.14% |

Est @ 3.54% |

Est @ 3.12% |

Est @ 2.83% |

|

Present Value ($, Millions) Discounted @ 6.6% |

US$632 |

US$678 |

US$640 |

US$680 |

US$678 |

US$668 |

US$653 |

US$635 |

US$614 |

US$593 |

(“Est” = FCF development fee estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$6.5b

After calculating the current worth of future money flows within the preliminary 10-year interval, we have to calculate the Terminal Value, which accounts for all future money flows past the primary stage. The Gordon Growth method is used to calculate Terminal Value at a future annual development fee equal to the 5-year common of the 10-year authorities bond yield of two.2%. We low cost the terminal money flows to right now’s worth at a price of fairness of 6.6%.

Terminal Value (TV)= FCF2033 × (1 + g) ÷ (r – g) = US$1.1b× (1 + 2.2%) ÷ (6.6%– 2.2%) = US$26b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$26b÷ ( 1 + 6.6%)10= US$14b

The whole worth, or fairness worth, is then the sum of the current worth of the longer term money flows, which on this case is US$20b. The final step is to then divide the fairness worth by the variety of shares excellent. Relative to the present share worth of US$285, the corporate seems round honest worth on the time of writing. The assumptions in any calculation have a huge impact on the valuation, so it’s higher to view this as a tough estimate, not exact right down to the final cent.

The Assumptions

The calculation above may be very depending on two assumptions. The first is the low cost fee and the opposite is the money flows. Part of investing is arising with your individual analysis of an organization’s future efficiency, so strive the calculation your self and examine your individual assumptions. The DCF additionally doesn’t take into account the doable cyclicality of an trade, or an organization’s future capital necessities, so it doesn’t give a full image of an organization’s potential efficiency. Given that we’re taking a look at Align Technology as potential shareholders, the price of fairness is used because the low cost fee, quite than the price of capital (or weighted common price of capital, WACC) which accounts for debt. In this calculation we have used 6.6%, which relies on a levered beta of 0.881. Beta is a measure of a inventory’s volatility, in comparison with the market as an entire. We get our beta from the trade common beta of worldwide comparable firms, with an imposed restrict between 0.8 and a couple of.0, which is an inexpensive vary for a steady enterprise.

SWOT Analysis for Align Technology

Strength

Weakness

Opportunity

Threat

Moving On:

Valuation is just one aspect of the coin when it comes to constructing your funding thesis, and it ideally will not be the only real piece of study you scrutinize for a corporation. DCF fashions will not be the be-all and end-all of funding valuation. Instead one of the best use for a DCF mannequin is to check sure assumptions and theories to see if they might result in the corporate being undervalued or overvalued. For occasion, if the terminal worth development fee is adjusted barely, it might probably dramatically alter the general outcome. For Align Technology, we have put collectively three elementary features you need to additional analysis:

-

Risks: As an instance, we have discovered 1 warning sign for Align Technology that that you must take into account earlier than investing right here.

-

Future Earnings: How does ALGN’s development fee examine to its friends and the broader market? Dig deeper into the analyst consensus quantity for the upcoming years by interacting with our free analyst growth expectation chart.

-

Other Solid Businesses: Low debt, excessive returns on fairness and good previous efficiency are elementary to a robust enterprise. Why not discover our interactive list of stocks with solid business fundamentals to see if there are different firms you could not have thought of!

PS. Simply Wall St updates its DCF calculation for each American inventory daily, so if you wish to discover the intrinsic worth of another inventory simply search here.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We intention to deliver you long-term centered evaluation pushed by elementary information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link