[ad_1]

Finally, we are getting some downside movement in the S&P 500, which means we may have a potential intermediate top here at hand. Remember, the S&P has been in bull mode since the 23rd of March, which means we are well over 5 months into this present intermediate cycle. Whether we get another daily cycle in this intermediate cycle remains unclear at present. What we do believe, however, is that the lows of last March registered a 4-year cycle low. Despite the viscous decline in stocks, the S&P still bottomed well above the most previous 4-year cycle low in 2016.

Suffice it to say, the next prime buying opportunity in stocks will be the next intermediate cycle low. Considering the 1000+ point gain in the S&P since March, we could at least see a 300-500 point decline before we finally print that ICL.

Recent volatility has spiked the VIX over 37. Conditions such as these make us lean towards option selling strategies in order to take advantage of the high implied volatility. We sell options over buying them because:

- We do not have to be right on direction. In fact, if we were to sell an out-of-the-money naked put, for example, we could profit on the trade if the stock went up, went sideways or even went down (strike price – premium = breakeven) somewhat within the expiration period.

- We get paid due to the decaying nature of these assets. Options really lose value in the final couple of weeks before they expire, which is why we normally focus on expiration periods of around a month or so.

- Volatility is mean-reverting, which means that over time, it should revert to something close to its mean.

One such stock which has plenty of implied volatility at present is AMC Entertainment Holdings, Inc. (AMC). Furthermore, the stock is cheap ($6.52) and its options have plenty of liquidity. Therefore, before we get into strategy, let’s see how the stock’s technicals and financials stand up. As always with cheap stocks, we are looking for any red flags which increase downside risk.

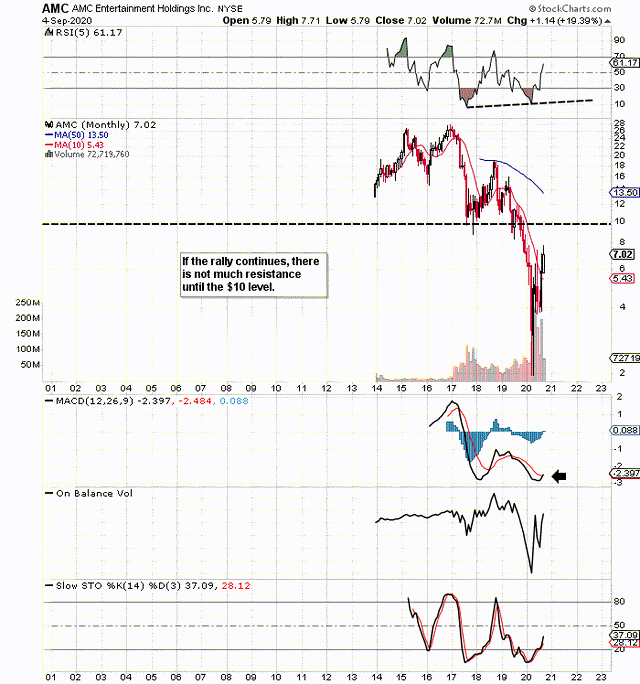

On the long-term chart, we see that price has regained the 10-month moving average. We see bullish divergences on the RSI indicator, and the MACD indicator looks like it is about to give a Buy signal. The encouraging thing about this trend is that there is no real resistance on the long-term chart until around the $10 level. This level is well over 30% north of where shares are trading at present.

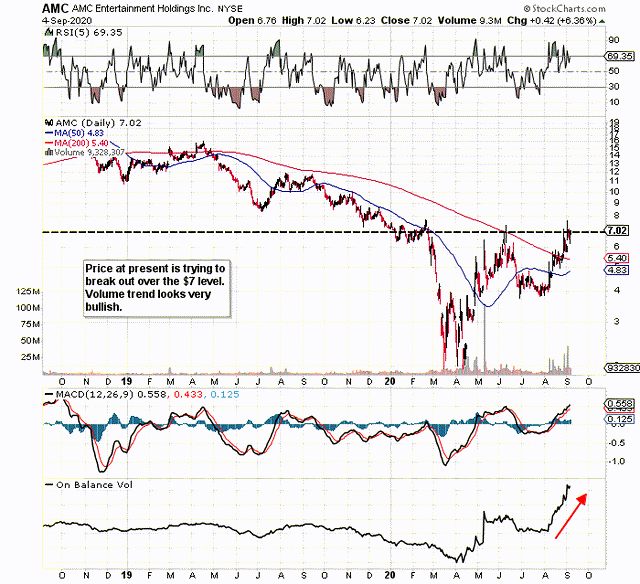

On the daily chart, we see that the 50-day moving average has now turned up, and buying volume has remained very strong for the past 30 days. Price at present is encountering resistance around the $7 level. If we can get a sustained breakout above this resistance level, it definitely would clear the way to the $10 level.

From a profitability standpoint, AMC reported $236 million of EBIT in fiscal 2019 and an interest coverage ratio of 0.5. These numbers have changed drastically since the pandemic took hold, with the firm deciding to dilute its holdings in order to raise capital. As the US gets closer to a functioning vaccine, AMC (like the market in general) stock seems to be benefiting from the positive vaccine commentary which may trigger studios to release their major leases over the next few months.

Either way, considering its leverage, time is definitely not on the firm’s side. AMC has over $5.5 billion of long-term debt on its balance sheet, but its market cap only comes in at $767 million. Management will be hoping that recent re-openings will put an end to state lockdowns and the public will return in droves to wanting entertainment. We will know a lot more over the next six weeks.

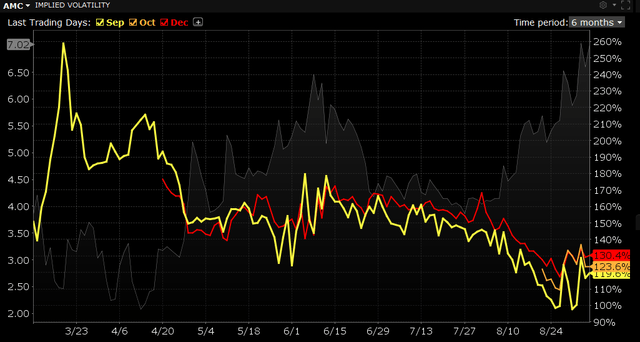

Because of all this uncertainty, implied volatility in AMC has remained well over 100% for the next three months and continues to increase, as we can see below. We definitely would be looking at something with defined risk in here due to how leveraged the company’s financials are. As mentioned earlier though, since the market is a forward-looking mechanism, shares could easily bounce back quickly to $10+ per share, especially if bullish vaccine commentary with respect to timelines continue to hit the news.

(Source: Interactive Brokers)

Therefore, to sum up, as stated, from a trading standpoint, we like AMC because it is a cheap stock with plenty of liquidity in its options. At present, implied volatility in this stock is well above normal, which would make us favour selling options in here. Risk management is key in here though, due to clear downside risk red flags such as the firm’s leverage. Something like financing the purchase of a call option with the sale of a put spread might be the play here. We will put on something in here shortly.

———————-

Elevation Code’s blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not not stop until it reaches $1 million.

———————–

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link