[ad_1]

If you are searching for a multi-bagger, there’s just a few issues to maintain an eye fixed out for. Firstly, we’ll wish to see a confirmed return on capital employed (ROCE) that’s rising, and secondly, an increasing base of capital employed. Put merely, all these companies are compounding machines, that means they’re frequently reinvesting their earnings at ever-higher charges of return. So, after we ran our eye over Amkor Technology’s (NASDAQ:AMKR) pattern of ROCE, we appreciated what we noticed.

Return On Capital Employed (ROCE): What Is It?

For those that do not know, ROCE is a measure of an organization’s yearly pre-tax revenue (its return), relative to the capital employed within the enterprise. The formulation for this calculation on Amkor Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.10 = US$536m ÷ (US$6.7b – US$1.6b) (Based on the trailing twelve months to September 2023).

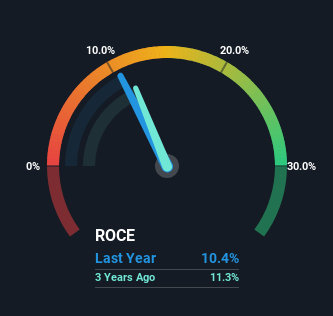

Therefore, Amkor Technology has an ROCE of 10%. In absolute phrases, that is a reasonably regular return, and it is considerably near the Semiconductor trade common of 11%.

View our latest analysis for Amkor Technology

Above you may see how the present ROCE for Amkor Technology compares to its prior returns on capital, however there’s solely a lot you may inform from the previous. If you are , you may view the analysts predictions in our free report on analyst forecasts for the company.

So How Is Amkor Technology’s ROCE Trending?

While the returns on capital are good, they have not moved a lot. The firm has employed 54% extra capital within the final 5 years, and the returns on that capital have remained secure at 10%. Since 10% is a average ROCE although, it is good to see a enterprise can proceed to reinvest at these first rate charges of return. Over lengthy durations of time, returns like these may not be too thrilling, however with consistency they will repay when it comes to share value returns.

The Key Takeaway

To sum it up, Amkor Technology has merely been reinvesting capital steadily, at these first rate charges of return. On high of that, the inventory has rewarded shareholders with a exceptional 475% return to those that’ve held over the past 5 years. So whereas buyers appear to be recognizing these promising developments, we nonetheless imagine the inventory deserves additional analysis.

If you’d prefer to know concerning the dangers going through Amkor Technology, we have found 1 warning sign that you have to be conscious of.

While Amkor Technology might not at present earn the very best returns, we have compiled a listing of corporations that at present earn greater than 25% return on fairness. Check out this free list here.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by basic knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link