[ad_1]

Acknowledgments

The authors wish to thank Syeda Batool and Sarah Feng on the Data Science, Research and Development Unit on the Treasury Board of Canada Secretariat, in addition to Kerem Soyak on the Clean Growth Hub at Innovation, Science and Economic Development Canada, for his or her collaboration and suggestions all through the examine.

Abstract

This evaluation offers a first-ever snapshot of the companies performing clear know-how actions which were funded by the federal authorities via Business Innovation and Growth Support (BIGS) applications. In 2020, the BIGS database lined a complete of 123 applications delivered by 18 federal departments, of which 15 had been clear know-how applications. Over the previous 5 years, the BIGS database lined a complete of 172 applications delivered by 19 departments. As nicely, BIGS applications have supplied assist to a median of 23,276 enterprises per 12 months, whereas a median of 918 enterprises had been supported by clear know-how applications.

Highlights

- The variety of clear know-how (clear tech) beneficiaries elevated from 436 to 1,335 enterprises between 2016 and 2020, and the full worth of the federal assist elevated from $84 million to $394 million in the identical interval.

- Clean tech supported companies are smaller and newer and report larger progress in contrast with companies supported by federal Business Innovation and Growth Support (BIGS) applications on the whole.

- In 2020, clear tech supported companies invested $200,000 extra on common in analysis and improvement and exported $61 million extra on common, in contrast with all BIGS-supported companies.

- Ownership of fresh tech supported companies is much less various, however the workforce is extra educated, in contrast with all BIGS-supported companies.

Introduction

The Government of Canada gives monetary and service-based assist to companies via applications that present actions comparable to funding, consulting companies to enterprises, industry-facing analysis and improvement (R&D), assist supplied immediately or in partnership, and assist for know-how improvement and exports. In partnership with the Treasury Board Secretariat, Statistics Canada produces details about the affect of those applications on their recipients through the Business Innovation and Growth Support (BIGS) statistical program. The authorities gives BIGS with the goal to extend enterprise financial efficiency, assist high-performing companies and contribute to improved variety outcomes in companies by boosting the participation of underrepresented teams within the financial system. It additionally goals to create jobs, improve wages and result in technological developments. As of 2020, the BIGS database contained 123 federal applications that cowl assist for clear know-how (clear tech), commercialization, exports, R&D and enterprise productiveness.

Clean tech has been an rising space of coverage analysis with the growing significance of decreasing environmental impacts. It is outlined as any good or service designed with the first function of contributing to remediating or stopping any kind of environmental harm or any good or service whose main function will not be environmental safety however that’s much less polluting or extra resource-efficient than equal regular merchandise that furnish an identical utility. The clear tech sector is a crucial a part of the Canadian financial system, with governments and companies taking part in a key function in its improvement. The worth of the environmental and clear tech merchandise sector in Canada accounted for 3.1% of Canadian gross home product (GDP) in 2020, and the share of the environmental and clear tech merchandise GDP out of complete GDP has remained comparatively secure for the reason that starting of the time sequence in 2007.Note Note In its local weather plan titled A Healthy Environment and a Healthy Economy, the Government of Canada outlines that “clean technology is a key driver of innovation, environmental improvements, economic growth and jobs,” with federal investments to scrub tech totalling greater than $3 billion between 2016 and 2020.Note Note As a outcome, extra initiatives are specializing in clear tech and, inside BIGS, there are quite a few clear tech applications. Examples of tasks funded via BIGS clear tech applications embrace clear and renewable vitality, vitality effectivity, low-carbon transition, and bioproducts.

Using BIGS knowledge, this evaluation targets the applications centered on supporting clear tech initiatives. This evaluation offers a profile of companies supported by federal BIGS clear tech applications in contrast with companies supported by any BIGS applications. It explores the financial and social traits of those companies by linking BIGS knowledge to Statistics Canada’s Business Register (BR) and Business Linkable File Environment (B-LFE).Note This evaluation highlights the financial contribution of assist to scrub tech in Canada and helps to tell coverage and applications concentrating on clear tech companies.

Number of fresh tech applications continues to develop

Of the 123 applications lined by BIGS in 2020, 15 completely supported clear tech tasks and enterprises (offered in Appendix Table A.1) and 22 broader ones supported—although not completely—clear tech tasks. The variety of clear tech applications has been growing 12 months over 12 months, increasing from a low of three in 2016 to 13 in 2019.

In 2020, the full worth of fresh tech assist was $394 million, representing 9.1% of all BIGS; 1,335 enterprises obtained this assist, representing 4.8% of all BIGS beneficiaries.Note Note As proven in Table 1, clear tech assist quantities have elevated from a smaller portion in 2016 of $84 million, representing 4.4% of all BIGS, as much as $108 million (5.7%) in 2017, $153 million (6.4%) in 2018 and $337 million (10.8%) in 2019. Likewise, clear tech supported companies have elevated from 436 beneficiaries in 2016 (1.9% of all BIGS beneficiaries) to 814 beneficiaries in 2017 (3.6%), 826 beneficiaries in 2018 (3.9%) and 1,178 beneficiaries in 2019 (5.3%).Note

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Number of fresh tech applications | 3 | 4 | 10 | 13 | 15 |

| Value of fresh tech assist (hundreds of {dollars}) | 84,133 | 108,458 | 152,762 | 337,488 | 393,715 |

| Number of fresh tech beneficiaries | 436 | 814 | 826 | 1,178 | 1,335 |

Clean tech beneficiaries are largely for-profit companies

In 2020, 89.5% of all BIGS companies had been for-profit companies, and, in parallel, 88.3% of beneficiaries of fresh tech applications had been for-profit companies. In addition, the vast majority of clear tech assist (82.0%) went to for-profit companies, with 5.7% of fresh tech assist going to non-profit (non-government) companies and 12.3% of fresh tech assist going to non-profit (authorities) companies.Note Nearly two-thirds of fresh tech assist was supplied on to companies by federal departments, whereas the remaining assist was supplied not directly via middleman organizations. By distinction, Chart 1 exhibits how middleman organizations had a better function in allocating clear tech funds to final beneficiaries than that they had in allocating BIGS funds on the whole, with 38.2% of fresh tech funds transiting via intermediaries in contrast with 11.2% for all BIGS funds. While 3.3% of fresh tech assist went to tasks involving the collaboration of a number of companions, this complete quantity was supplied immediately to those consortiums by federal departments.

Data desk for Chart 1

| Type of beneficiary | Clean tech applications | All BIGS applications |

|---|---|---|

| % | ||

| Direct | 61.8 | 88.8 |

| Indirect | 38.2 | 11.2 |

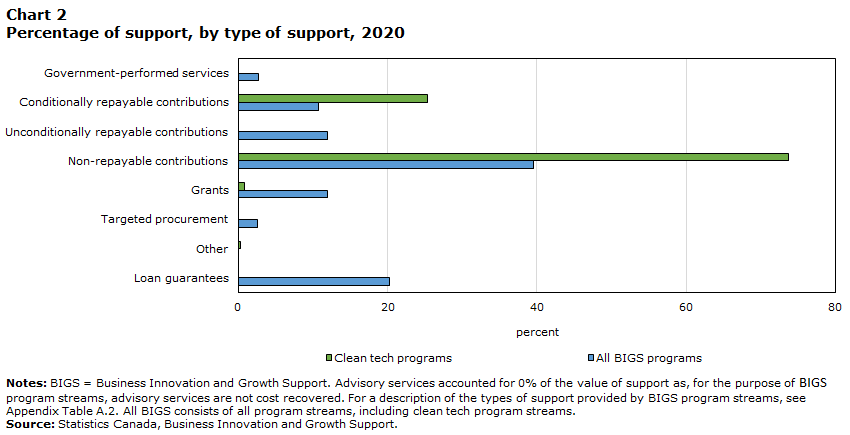

Clean tech assist was supplied to companies within the type of conditionally repayable contributions, grants, non-repayable contributions and different monetary assist (an outline of assist sorts is offered in Appendix Table A.2). The following chart exhibits that the commonest forms of assist obtained from clear tech applications had been non-repayable contributions (73.7%), adopted by conditionally repayable contributions (25.3%). While almost three-quarters of fresh tech assist had been supplied within the type of non-repayable contributions, they accounted for under two-fifths of all BIGS.

Data desk for Chart 2

| Type of assist | Clean tech applications | All BIGS applications |

|---|---|---|

| % | ||

| Advisory companies | 0.0 | 0.0 |

| Government-performed companies | 0.0 | 2.7 |

| Conditionally repayable contributions | 25.3 | 10.8 |

| Unconditionally repayable contributions | 0.0 | 12.0 |

| Non-repayable contributions | 73.7 | 39.6 |

| Grants | 0.8 | 12.0 |

| Targeted procurement | 0.0 | 2.6 |

| Other | 0.3 | 0.0 |

| Loan ensures | 0.0 | 20.2 |

Clean tech beneficiaries are typically newer and smaller companies

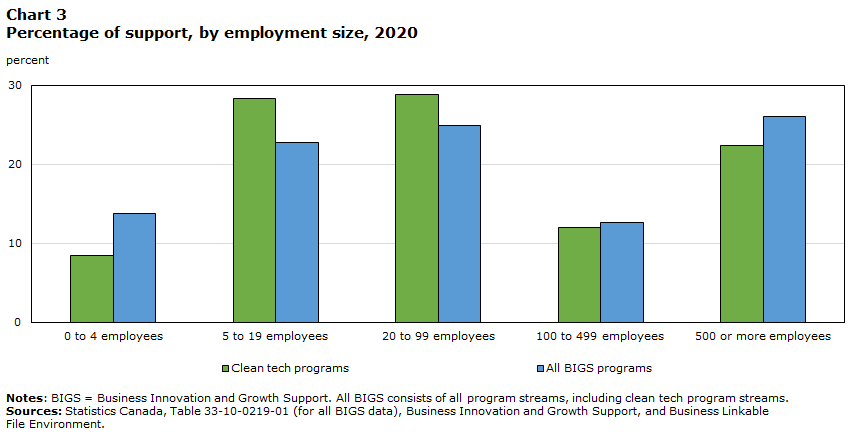

Charts 3 and 4 present the distributions of the worth of assist and variety of enterprises by employment measurement. While 22.4% of all clear tech assist was supplied to giant enterprises of 500 or extra staff, 92.7% of fresh tech beneficiaries had been small and medium-sized enterprises (SMEs).Note A bit of over one-third of fresh tech beneficiaries had been enterprises that had been established throughout the previous 5 years (34.6%).

In phrases of the common worth of assist per enterprise, clear tech supported SMEs obtained $226,000 on common from clear tech applications, which is larger than what all BIGS-supported SMEs obtained on the whole from any applications ($134,000 per SME on common). In distinction, giant clear tech supported enterprises obtained a decrease quantity from clear tech applications ($835,000 per enterprise on common) than giant enterprises obtained from any BIGS applications ($1,086,000 per enterprise on common).

Data desk for Chart 3

| Employment measurement | Clean tech applications | All BIGS applications |

|---|---|---|

| % | ||

| 0 to 4 staff | 8.4 | 13.7 |

| 5 to 19 staff | 28.3 | 22.8 |

| 20 to 99 staff | 28.9 | 24.9 |

| 100 to 499 staff | 12.0 | 12.6 |

| 500 or extra staff | 22.4 | 26.0 |

Data desk for Chart 4

| Employment measurement | Clean tech applications | All BIGS applications |

|---|---|---|

| % | ||

| 0 to 4 staff | 21.6 | 31.0 |

| 5 to 19 staff | 41.4 | 34.9 |

| 20 to 99 staff | 23.3 | 22.1 |

| 100 to 499 staff | 6.4 | 7.9 |

| 500 or extra staff | 7.3 | 4.2 |

As for the distribution of the worth of assist obtained from all BIGS applications, the 4 provinces with the best variety of companies—Ontario, Quebec, Alberta and British Columbia—obtained the very best proportions of the worth of fresh tech assist. Manitoba and Saskatchewan obtained a comparatively larger share of the worth of fresh tech assist (2.5% and 6.2%, respectively) than their share of all the worth of BIGS assist obtained (2.1% and a pair of.9%, respectively), whereas Ontario and Quebec obtained a decrease share of the worth of fresh tech assist (31.3% and 16.8%, respectively) than their share of all the worth of BIGS assist obtained (36.2% and 25.0%, respectively).

In 2020, 19.8% of the full worth of federal innovation assist to Saskatchewan was allotted to scrub tech companies, the very best amongst all areas. In British Columbia, 16.6% of the full worth of federal innovation assist went to scrub tech, and, in Manitoba, 10.9% of the full worth of federal innovation assist went to scrub tech. While these three provinces had the next focus of fresh tech assist, these provinces additionally had the very best revenues from gross sales of environmental and clear tech items and companies. Ontario and Quebec accounted for 70% of all environmental and clear tech items offered in 2020, adopted by Saskatchewan and Manitoba mixed, then British Columbia.Note The image stays the identical when trying on the order of the main provinces throughout the Environmental and Clean Technology Products Economic Account. With respect to output, Ontario (37.9%) accounted for over one-third of the full worth of environmental and clear tech merchandise, whereas Quebec (24.6%) accounted for over one-quarter and British Columbia (15.4%) for one-seventh.Note

Services-producing sector receiving extra clear tech assist than goods-producing sector

By sector, the goods-producing industries obtained 39.1% of fresh tech assist and the services-producing industries obtained 60.9% of that assist.Note However, the proportion of assist obtained by goods-producing industries was larger from clear tech applications in contrast with all BIGS applications, the place goods-producing industries obtained 24.2% of all assist.

The variety of clear tech beneficiaries represented 5.2% of all BIGS beneficiaries within the goods-producing sector and 4.9% of all BIGS beneficiaries within the services-producing sector. The quantity of fresh tech assist represented 15.0% of complete BIGS within the goods-producing sector and seven.4% of complete BIGS within the services-producing sector.

Data desk for Chart 5

| Industry | Clean tech applications | All BIGS applications |

|---|---|---|

| % | ||

| Agriculture, forestry, fishing and searching | 2.0 | 1.9 |

| Mining, quarrying, and oil and fuel extractionData table for chart 5 Note 1 | 2.1 | 0.5 |

| Utilities | 16.0 | 2.3 |

| Construction | 3.1 | 1.6 |

| Manufacturing | 15.9 | 17.9 |

| Wholesale Trade | 4.2 | 2.3 |

| Retail Trade | 0.4 | 3.8 |

| Transporation and warehousing | 1.3 | 3.2 |

| Information and cultural industries | 1.1 | 4.5 |

| Finance and insurance coverage | 0.4 | 0.7 |

| Professional, scientific and technical companies | 28.8 | 24.6 |

| Management of corporations and enterprises | 6.3 | 1.8 |

| Educational companies | 4.1 | 15.4 |

| Health care and social help | 1.0 | 2.1 |

| Arts, leisure and recreation | 0.0 | 0.8 |

| Accommodation and meals companies | 0.3 | 6.8 |

| Other companies (besides public administration) | 2.7 | 4.6 |

| Public administration | 8.3 | 3.0 |

| Other sectorsData table for chart 5 Note 2 | 2.0 | 2.1 |

In the goods-producing sector, the industries that had the very best proportion of fresh tech beneficiaries had been manufacturing (19.1%) and agriculture, forestry, fishing and searching (6.9%). By distinction, the industries that had the very best proportion of the worth of fresh tech assist had been utilities (16.0%) and manufacturing (15.9%). In phrases of the common worth of assist per enterprise, utilities had the very best, with a median of $2.2 million of fresh tech assist per enterprise.

In the services-producing sector, the skilled, scientific and technical companies {industry} and the general public administration {industry} had the very best proportion of fresh tech beneficiaries (37.9% and 6.2%, respectively) and the very best proportion of the worth of fresh tech assist (28.8% and eight.3%, respectively). The administration of corporations and enterprises {industry} had the very best common worth of assist per enterprise within the services-producing sector, with a median of $1 million of fresh tech assist per enterprise.

The manufacturing {industry} and the skilled, scientific and technical companies {industry} benefited essentially the most in Quebec, Ontario, and British Columbia and the territories. In Quebec, the agriculture, forestry, fishing and searching {industry} had a excessive variety of clear tech beneficiaries (6.6% of the province’s clear tech beneficiaries) and the utilities {industry} had a excessive quantity of the province’s clear tech assist (17.2%). In Ontario, the knowledge and cultural industries comprised 6.6% of the province’s clear tech beneficiaries and the wholesale commerce {industry} obtained 9.3% of the province’s clear tech assist. For British Columbia and the territories, agriculture, forestry, fishing and searching additionally had a excessive variety of beneficiaries, with 10.9% of the area’s clear tech beneficiaries, and development obtained 9.6% of the area’s clear tech assist.

Results from assist are larger amongst companies benefiting from clear tech applications

In 2020, 625,000 individuals had been employed by clear tech supported companies, representing 13.8% of staff from all BIGS beneficiaries, and clear tech beneficiaries produced $187 billion in complete income, representing 10.0% of the income generated by all BIGS beneficiaries. The share of staff from all BIGS beneficiaries who’re employed by clear tech supported companies elevated from 12.8% in 2019 and 9.0% in 2018. Likewise, the proportion of the full income generated from BIGS beneficiaries that got here from clear tech supported companies elevated from 9.9% in 2019 and eight.1% in 2018. When solely SMEs had been thought of, 33,000 individuals had been employed in clear tech supported companies, and these SMEs produced $13 billion in complete income. Clean tech beneficiaries invested $200,000 extra on common in R&D and exported $61 million extra on common in contrast with all BIGS beneficiaries.

Clean tech beneficiaries even have constructive progress charges for a lot of financial variables. The median three-year change in productiveness for enterprises that obtained clear tech assist between 2018 and 2021 was $14,300 per worker, in contrast with $13,500 per worker for all BIGS program contributors. The median three-year share income progress from 2018 for clear tech beneficiaries was 13.3% (in contrast with 7.2% for all BIGS), and the median three-year share employment progress was 6.5% (in contrast with 2.4% for all BIGS). Taking a better take a look at income progress for 2020, 21.4% of fresh tech beneficiaries had been excessive progress enterprisesNote in comparison with 16.3% of all BIGS beneficiaries that had been excessive progress enterprises.

Many elements may clarify the upper income and employment progress for clear tech beneficiaries, together with the kind of assist and beneficiary. As beforehand talked about, clear tech beneficiaries have the next share of assist obtained not directly via intermediaries within the type of non-repayable contributions. This kind of distribution of assist is mostly related to larger income and employment progress.

In 2020, two-thirds (67.4%) of fresh tech beneficiaries noticed constructive income progress in contrast with the earlier 12 months, whereas 57.4% of all BIGS-supported companies had constructive income progress over the identical interval. This discovering was according to the proportion of fresh tech beneficiaries with constructive income progress in earlier years. Revenue grew for 71.2% of fresh tech supported companies in 2019 and for 72.2% of fresh tech supported companies in 2018.

Data desk for Chart 6

| AVG yearly progress in income | Clean tech applications | All BIGS applications |

|---|---|---|

| % | ||

| 0 or unfavourable progress | 32.6 | 42.6 |

| greater than 0 to 10 % progress | 63.3 | 54.2 |

| greater than 10 % progress | 4.1 | 3.2 |

Compared with all Business Innovation and Growth Support beneficiaries, the clear tech supported workforce is extra educated however the possession is much less various

More staff in clear tech supported companies had a college diploma in 2019, in contrast with all BIGS-supported companies. In 2019, the common share of staff’ schooling ranges throughout clear tech supported companies was 22.0% with a highschool diploma or much less, 22.7% with a trades certificates or school diploma, and 55.3% with a college diploma or extra.Note Across all schooling ranges, the common annual wages for clear tech applications had been above these for all BIGS applications. The share of complete annual wages will increase with the schooling degree for clear tech beneficiaries and for all BIGS-supported companies.

Data desk for Chart 7

| Education degree | Clean tech applications | All BIGS applications |

|---|---|---|

| tens of millions of {dollars} | ||

| High faculty diploma or much less | 3,567,712 | 6,235,983 |

| Trade certificates or school diploma | 6,640,721 | 14,650,169 |

| University diploma or extra | 10,597,297 | 20,715,281 |

The homeowners of fresh tech beneficiaries had been primarily male and born in Canada. Compared with all homeowners of BIGS beneficiaries, the homeowners of enterprises that obtained clear tech assist had been much less various. Women-owned enterprises accounted for 17.0% of fresh tech beneficiaries in 2020, and immigrant-owned enterprises accounted for 23.1% of fresh tech beneficiaries in 2019 (20.3% and 21.1% of all BIGS beneficiaries, respectively).Note Although the range of householders will not be evenly distributed, the variety of women-owned clear tech beneficiaries rose from 2018 to 2020, growing to 189 companies in 2020 from 162 companies in 2019 and 104 companies in 2018.

Appendix

| Department/company | Program stream title | Subprogram stream names | Year |

|---|---|---|---|

| Agriculture and Agri-Food Canada | Agricultural Clean Technology Program | Note …: not relevant | 2018, 2019, 2020 |

| Environment and Climate Change Canada | Low Carbon Economy Challenge | Note …: not relevant | 2019, 2020 |

| Fisheries and Oceans Canada | Fisheries and Aquaculture Clean Technology Adoption Program | Note …: not relevant | 2018, 2019, 2020 |

| Innovation, Science and Economic Development Canada | Sustainable Development Technology Canada | SD Tech Fund | 2016, 2017, 2018, 2019, 2020 |

| National Research Council of Canada | Industrial Research Assistance Program | Youth Employment Program | 2016, 2017, 2018, 2019, 2020 |

| Natural Resources Canada | Contributions in assist of Clean Energy for Rural and Remote Communities Program | Note …: not relevant | 2018, 2019, 2020 |

| Natural Resources Canada | Contributions in assist of Clean Growth within the Natural Resource Sectors Innovation Program | Note …: not relevant | 2019, 2020 |

| Natural Resources Canada | Contributions in Support of Electric Vehicles and Alternative Fuel Infrastructure Deployment Initiative | Note …: not relevant | 2017, 2018, 2019, 2020 |

| Natural Resources Canada | Contributions in Support of the Energy Innovation Program | Note …: not relevant | 2016, 2017, 2018, 2019, 2020 |

| Natural Resources Canada | Contributions in Support of the Smart Grid Program | Note …: not relevant | 2020 |

| Natural Resources Canada | Electric Vehicle Infrastructure Demonstration Program | Note …: not relevant | 2019, 2020 |

| Natural Resources Canada | Contributions in assist of the Emerging Renewable Power Program | Note …: not relevant | 2018, 2019, 2020 |

| Natural Resources Canada | Energy Efficient Buildings Program | Note …: not relevant | 2018, 2019, 2020 |

| Natural Resources Canada | Grants and Contributions in assist of Clean Technology Challenges (as a part of the Impact Canada Initiative) | Note …: not relevant | 2018, 2019, 2020 |

| Natural Resources Canada | Oil and Gas Clean Tech Program | Note …: not relevant | 2020 |

| Type of assist | Description | |||||||

|---|---|---|---|---|---|---|---|---|

| Advisory service | An exterior service the place knowledge, data or recommendation is conveyed to an enterprise. For the aim of Business Innovation and Growth Support program streams, advisory companies aren’t price recovered. Examples of advisory companies are growing consciousness of Government of Canada insurance policies, applications and companies or offering data via a web based database, publication or name centre. | |||||||

| Non-repayable contribution | A type of contribution exempts from compensation for such functions which can be specified within the Directive on Transfer Payments. | |||||||

| Consortium member | An enterprise that isn’t the recipient of assist however is a joint member of a challenge with no less than one recipient of assist. Support for this enterprise is anticipated to have an financial affect. | |||||||

| Unconditionally repayable contribution | A switch cost that’s repayable partly or in full for which no situation of compensation is laid out in a funding settlement. | |||||||

| Grant | A switch cost topic to pre-established eligibility and different entitlement standards. A grant will not be topic to being accounted for by a recipient nor usually topic to audit by the division or company. The recipient could also be required to report on outcomes achieved. | |||||||

| Service absolutely cost-recovered | A service that’s supplied to the consumer, the place the price of the service is assumed in full by the consumer. | |||||||

| Conditionally repayable contribution | A contribution the place compensation obligations are triggered by predetermined occasions or circumstances and the place compensation in full might not be required. | |||||||

| Service partially cost-recovered | A service that’s supplied to the consumer, the place the price of the service is partially however not utterly assumed by the consumer. | |||||||

| Targeted procurement | Use of federal procurement as an instrument for enterprise innovation or assist programming to attain financial or innovation coverage goals. | |||||||

Methodology

From September 27, 2021, to August 31, 2022, federal departments and businesses supplied administrative knowledge on program stream data for fiscal 12 months 2020-2021 with the reference interval of April 1, 2020 to March 31, 2021. Similar assortment and reference dates had been finished for earlier years. The knowledge acquisition is predicated on a template crammed in by the businesses and federal departments, with data of transactions for all innovation and progress assist program streams. The knowledge obtained by Statistics Canada are then handled, with modifying of the transactions finished in collaboration with the directors of this system streams and Treasury Board Secretariat subject-matter specialists, after which linked to the Business Linkable File Environment on the enterprise degree. Data of curiosity from the Business Linkable File Environment had been extracted for every matched enterprise to create a linked microdata set that was used to provide tabular estimates and econometric evaluation.

References

Statistics Canada, Business Innovation and Growth Support and Business Linkable File Environment (2023).

Statistics Canada (2022). Environmental and Clean Technology Products Economic Account, 2020. Ottawa, Canada : Statistics Canada, January (https://www150.statcan.gc.ca/n1/daily-quotidien/220106/dq220106d-eng.htm).

Government of Canada (2021). A Healthy Environment and a Healthy Economy. Ottawa, Canada : Environment and Climate Change Canada, March (https://www.canada.ca/en/services/environment/weather/climatechange/climate-plan/climate-plan-overview/healthy-environment-healthy-economy.html).

Statistics Canada (2022). Annual Survey of Environmental Goods and Services, 2020. Ottawa, Canada : Statistics Canada, March (https://www150.statcan.gc.ca/n1/daily-quotidien/220323/dq220323e-eng.htm).

[adinserter block=”4″]

[ad_2]

Source link