[ad_1]

Microchip Technology’s (NASDAQ:MCHP) inventory is up by a substantial 7.3% over the previous month. Given that the market rewards sturdy financials within the long-term, we surprise if that’s the case on this occasion. Particularly, we can be listening to Microchip Technology’s ROE at present.

Return on fairness or ROE is a crucial issue to be thought of by a shareholder as a result of it tells them how successfully their capital is being reinvested. In less complicated phrases, it measures the profitability of an organization in relation to shareholder’s fairness.

View our latest analysis for Microchip Technology

How Do You Calculate Return On Equity?

ROE may be calculated by utilizing the formulation:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, based mostly on the above formulation, the ROE for Microchip Technology is:

34% = US$2.2b ÷ US$6.5b (Based on the trailing twelve months to March 2023).

The ‘return’ is the earnings the enterprise earned over the past yr. Another manner to consider that’s that for each $1 value of fairness, the corporate was in a position to earn $0.34 in revenue.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we’ve realized that ROE measures how effectively an organization is producing its earnings. Depending on how a lot of those earnings the corporate reinvests or “retains”, and the way successfully it does so, we’re then in a position to assess an organization’s earnings progress potential. Assuming all else is equal, firms which have each a better return on fairness and better revenue retention are normally those which have a better progress price when in comparison with firms that do not have the identical options.

Microchip Technology’s Earnings Growth And 34% ROE

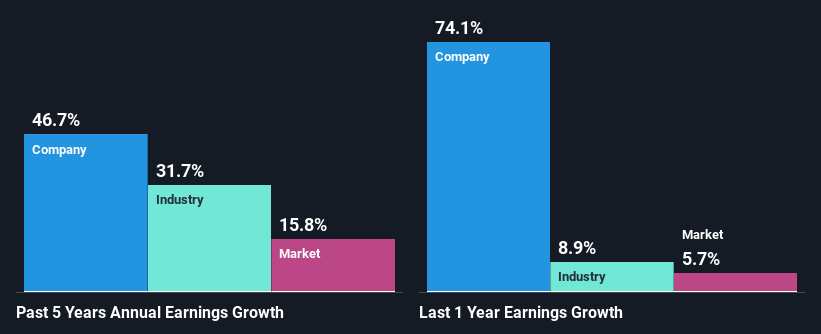

Firstly, we acknowledge that Microchip Technology has a considerably excessive ROE. Additionally, the corporate’s ROE is larger in comparison with the trade common of 16% which is kind of exceptional. So, the substantial 47% internet earnings progress seen by Microchip Technology over the previous 5 years is not overly stunning.

We then in contrast Microchip Technology’s internet earnings progress with the trade and we’re happy to see that the corporate’s progress determine is larger compared with the trade which has a progress price of 32% in the identical interval.

Earnings progress is a large consider inventory valuation. The investor ought to attempt to set up if the anticipated progress or decline in earnings, whichever the case could also be, is priced in. By doing so, they are going to have an thought if the inventory is headed into clear blue waters or if swampy waters await. Is Microchip Technology pretty valued in comparison with different firms? These 3 valuation measures would possibly provide help to resolve.

Is Microchip Technology Making Efficient Use Of Its Profits?

The excessive three-year median payout ratio of 55% (implying that it retains solely 45% of earnings) for Microchip Technology means that the corporate’s progress wasn’t actually hampered regardless of it returning many of the earnings to its shareholders.

Additionally, Microchip Technology has paid dividends over a interval of not less than ten years which signifies that the corporate is fairly severe about sharing its earnings with shareholders. Existing analyst estimates recommend that the corporate’s future payout ratio is predicted to drop to 36% over the subsequent three years. Accordingly, the anticipated drop within the payout ratio explains the anticipated improve within the firm’s ROE to 51%, over the identical interval.

Summary

In whole, we’re fairly pleased with Microchip Technology’s efficiency. We are significantly impressed by the appreciable earnings progress posted by the corporate, which was seemingly backed by its excessive ROE. While the corporate is paying out most of its earnings as dividends, it has been in a position to develop its earnings regardless of it, in order that’s most likely a superb signal. Having stated that, the corporate’s earnings progress is predicted to decelerate, as forecasted within the present analyst estimates. Are these analysts expectations based mostly on the broad expectations for the trade, or on the corporate’s fundamentals? Click here to be taken to our analyst’s forecasts page for the company.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to convey you long-term centered evaluation pushed by elementary information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link