[ad_1]

Profitable solar tracker company Array Technologies is going public the old-fashioned way and eschewing the SPAC method being employed by other renewable companies such as QuantumScape and ChargePoint. Did we mention the company was profitable?

Solar tracker builder Array Technologies is going public on the Nasdaq exchange with an initial offering of $100 million, according to its S-1.

Array Technologies, headquartered in Albuquerque, New Mexico, is the No. 2 global solar tracker maker, behind Nextracker and ahead of PV Hardware, according to Wood Mackenzie. Other tracker vendors include Soltec, Arctech, SolarSTI, GameChange Solar and Solar Steel.

Oaktree Capital, an investor, will hold numerous seats on the public company’s board.

Different tracker vendors have different engineering approaches. According to the S-1, “Array Technologies uses less than one motor per megawatt which compares with more than 25 motors per megawatt for our largest competitor. Using fewer motors per megawatt lowers the cost, reduces the number of failure points, and minimizes the maintenance requirements of our system. Fewer motors per megawatt also reduces the number of motor controllers and the amount of wiring and other ancillary parts that are required for the system, which further reduces cost, simplifies installation and improves reliability.”

Here are five takeaways from the report.

- Array Technologies has been profitable in 2020: The company logged a net income of $76 million on revenue of $552 million in the first six months of this year — a revenue growth of 145% compared to the same period in 2019. The company had positive EBITDA in 2019, although it posted a net loss of $5.2 million.

- As of June 30, 2020, Array Technologies had 343 full-time employees.

- CEO James Fusaro’s total compensation package in 2019 was $3.5 million.

- As of June 30, 2020, there were more than 17 GW of Array Technology trackers operating worldwide, including over 14 GW in the U.S., representing nearly 30% of the total utility scale solar generation capacity installed in the U.S.

- As of August 31, 2020, the firm had $689 million of executed contracts and awarded orders for tracker systems with anticipated shipment dates in 2020 and 2021, representing a 65% increase relative to the same date last year.

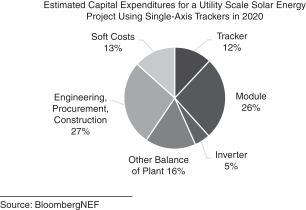

- Trackers represent between 10% and 15% of the cost of constructing a ground-mounted solar energy project, and approximately 70% of all ground-mounted solar energy projects constructed in the U.S. during 2019 utilized trackers according to BloombergNEF and IHS Markit, respectively.

In 2019, two customers, Blattner Energy and EDF Renewables, made up 28.7% of the firm’s revenue and were the only customers constituting greater than 10% of total revenue. For the six months ended June 30, 2020, two customers, EDF Renewables and Lightsource Renewable Energy US LLC, constituted more than 10% of total revenue.

Array Technologies is going public the traditional way. Going public through a SPAC (A shell company that raises money through an IPO to buy a private operating company) is the exit method of choice these days for venture-funded startups, cleantech and otherwise. Aspiring auto makers such as Nikola, Canoo and Fisker, hungry for growth capital, have gone the SPAC route. And two battery companies, QuantumScape and Eos Energy Storage are set to go public via merger with a SPAC.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

[ad_2]

Source link