[ad_1]

Readers hoping to purchase Heidrick & Struggles International, Inc. (NASDAQ:HSII) for its dividend might want to make their transfer shortly, because the inventory is about to commerce ex-dividend. The ex-dividend date happens someday earlier than the document date which is the day on which shareholders have to be on the corporate’s books with a purpose to obtain a dividend. The ex-dividend date is vital as the method of settlement entails two full enterprise days. So should you miss that date, you wouldn’t present up on the corporate’s books on the document date. Thus, you should purchase Heidrick & Struggles International’s shares earlier than the 4th of May with a purpose to obtain the dividend, which the corporate pays on the nineteenth of May.

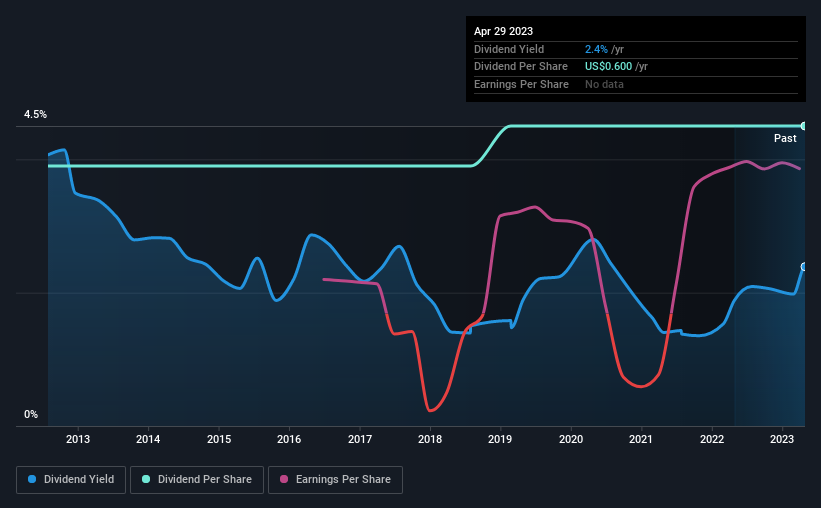

The firm’s upcoming dividend is US$0.15 a share, following on from the final 12 months, when the corporate distributed a complete of US$0.60 per share to shareholders. Looking on the final 12 months of distributions, Heidrick & Struggles International has a trailing yield of roughly 2.4% on its present inventory value of $25.11. Dividends are an vital supply of earnings to many shareholders, however the well being of the enterprise is essential to sustaining these dividends. So we have to examine whether or not the dividend funds are coated, and if earnings are rising.

See our latest analysis for Heidrick & Struggles International

Dividends are usually paid from firm earnings. If an organization pays extra in dividends than it earned in revenue, then the dividend could possibly be unsustainable. Heidrick & Struggles International has a low and conservative payout ratio of simply 16% of its earnings after tax. Yet money flows are much more vital than earnings for assessing a dividend, so we have to see if the corporate generated sufficient money to pay its distribution. Fortunately, it paid out solely 38% of its free money circulate up to now 12 months.

It’s encouraging to see that the dividend is roofed by each revenue and money circulate. This typically suggests the dividend is sustainable, so long as earnings do not drop precipitously.

Click here to see the company’s payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in corporations that generate sustainable earnings development typically make the perfect dividend prospects, as it’s simpler to carry the dividend when earnings are rising. If earnings decline and the corporate is pressured to chop its dividend, buyers might watch the worth of their funding go up in smoke. That’s why it is comforting to see Heidrick & Struggles International’s earnings have been skyrocketing, up 30% every year for the previous 5 years. Heidrick & Struggles International is paying out lower than half its earnings and money circulate, whereas concurrently rising earnings per share at a fast clip. Companies with rising earnings and low payout ratios are sometimes the perfect long-term dividend shares, as the corporate can each develop its earnings and improve the proportion of earnings that it pays out, primarily multiplying the dividend.

Many buyers will assess an organization’s dividend efficiency by evaluating how a lot the dividend funds have modified over time. Since the beginning of our knowledge, 10 years in the past, Heidrick & Struggles International has lifted its dividend by roughly 1.4% a 12 months on common. It’s good to see each earnings and the dividend have improved – though the previous has been rising a lot faster than the latter, presumably because of the firm reinvesting extra of its earnings in development.

Final Takeaway

Has Heidrick & Struggles International received what it takes to keep up its dividend funds? Heidrick & Struggles International has been rising earnings at a fast fee, and has a conservatively low payout ratio, implying that it’s reinvesting closely in its enterprise; a sterling mixture. Heidrick & Struggles International appears to be like stable on this evaluation total, and we might positively think about investigating it extra intently.

On that notice, you will wish to analysis what dangers Heidrick & Struggles International is going through. For instance – Heidrick & Struggles International has 2 warning signs we expect you ought to be conscious of.

A standard investing mistake is shopping for the primary fascinating inventory you see. Here you’ll find a full list of high-yield dividend stocks.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to carry you long-term centered evaluation pushed by basic knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link