[ad_1]

Key Insights

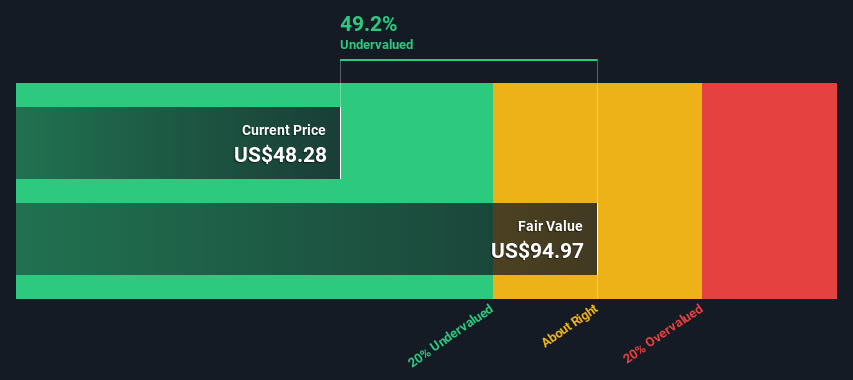

- Caesars Entertainment’s estimated truthful worth is US$95.0 primarily based on 2 Stage Free Cash Flow to Equity

- Current share value of US$48.3 suggests Caesars Entertainment is 49% undervalued

- Analyst price target for CZR is US$66.27 which is 30% beneath our truthful worth estimate

In this text we’re going to estimate the intrinsic worth of Caesars Entertainment, Inc. (NASDAQ:CZR) by taking the anticipated future money flows and discounting them to as we speak’s worth. We will use the Discounted Cash Flow (DCF) mannequin on this event. There’s actually not all that a lot to it, although it would seem fairly complicated.

We usually imagine that an organization’s worth is the current worth of all the money it should generate sooner or later. However, a DCF is only one valuation metric amongst many, and it isn’t with out flaws. For those that are eager learners of fairness evaluation, the Simply Wall St analysis model here could also be one thing of curiosity to you.

View our latest analysis for Caesars Entertainment

Step By Step Through The Calculation

We use what is called a 2-stage mannequin, which merely means we now have two totally different intervals of progress charges for the corporate’s money flows. Generally the primary stage is increased progress, and the second stage is a decrease progress section. To begin off with, we have to estimate the subsequent ten years of money flows. Where attainable we use analyst estimates, however when these aren’t out there we extrapolate the earlier free money move (FCF) from the final estimate or reported worth. We assume corporations with shrinking free money move will gradual their fee of shrinkage, and that corporations with rising free money move will see their progress fee gradual, over this era. We do that to replicate that progress tends to gradual extra within the early years than it does in later years.

Generally we assume {that a} greenback as we speak is extra useful than a greenback sooner or later, so we low cost the worth of those future money flows to their estimated worth in as we speak’s {dollars}:

10-year free money move (FCF) forecast

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Levered FCF ($, Millions) | US$1.26b | US$1.73b | US$2.09b | US$2.41b | US$2.68b | US$2.90b | US$3.09b | US$3.25b | US$3.39b | US$3.51b |

| Growth Rate Estimate Source | Analyst x3 | Analyst x2 | Est @ 20.87% | Est @ 15.20% | Est @ 11.24% | Est @ 8.46% | Est @ 6.52% | Est @ 5.16% | Est @ 4.20% | Est @ 3.54% |

| Present Value ($, Millions) Discounted @ 14% | US$1.1k | US$1.3k | US$1.4k | US$1.4k | US$1.4k | US$1.3k | US$1.2k | US$1.1k | US$1.0k | US$946 |

(“Est” = FCF progress fee estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$12b

After calculating the current worth of future money flows within the preliminary 10-year interval, we have to calculate the Terminal Value, which accounts for all future money flows past the primary stage. For numerous causes a really conservative progress fee is used that can’t exceed that of a rustic’s GDP progress. In this case we now have used the 5-year common of the 10-year authorities bond yield (2.0%) to estimate future progress. In the identical method as with the 10-year ‘progress’ interval, we low cost future money flows to as we speak’s worth, utilizing a value of fairness of 14%.

Terminal Value (TV)= FCF2032 × (1 + g) ÷ (r – g) = US$3.5b× (1 + 2.0%) ÷ (14%– 2.0%) = US$30b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$30b÷ ( 1 + 14%)10= US$8.0b

The whole worth, or fairness worth, is then the sum of the current worth of the longer term money flows, which on this case is US$20b. The final step is to then divide the fairness worth by the variety of shares excellent. Relative to the present share value of US$48.3, the corporate seems fairly undervalued at a 49% low cost to the place the inventory value trades at the moment. Remember although, that that is simply an approximate valuation, and like every complicated system – rubbish in, rubbish out.

Important Assumptions

The calculation above could be very depending on two assumptions. The first is the low cost fee and the opposite is the money flows. You do not must agree with these inputs, I like to recommend redoing the calculations your self and enjoying with them. The DCF additionally doesn’t contemplate the attainable cyclicality of an business, or an organization’s future capital necessities, so it doesn’t give a full image of an organization’s potential efficiency. Given that we’re Caesars Entertainment as potential shareholders, the price of fairness is used because the low cost fee, slightly than the price of capital (or weighted common price of capital, WACC) which accounts for debt. In this calculation we have used 14%, which is predicated on a levered beta of two.000. Beta is a measure of a inventory’s volatility, in comparison with the market as an entire. We get our beta from the business common beta of worldwide comparable corporations, with an imposed restrict between 0.8 and a pair of.0, which is an inexpensive vary for a steady enterprise.

SWOT Analysis for Caesars Entertainment

- No main strengths recognized for CZR.

- Interest funds on debt are usually not properly coated.

- Forecast to cut back losses subsequent yr.

- Has adequate money runway for greater than 3 years primarily based on present free money flows.

- Good worth primarily based on P/S ratio and estimated truthful worth.

- Significant insider shopping for over the previous 3 months.

- Debt is just not properly coated by working money move.

Next Steps:

Valuation is just one aspect of the coin by way of constructing your funding thesis, and it ideally will not be the only piece of study you scrutinize for an organization. It’s not attainable to acquire a foolproof valuation with a DCF mannequin. Preferably you’d apply totally different circumstances and assumptions and see how they’d impression the corporate’s valuation. If an organization grows at a unique fee, or if its price of fairness or danger free fee modifications sharply, the output can look very totally different. Why is the intrinsic worth increased than the present share value? For Caesars Entertainment, we have put collectively three pertinent components it’s best to have a look at:

- Financial Health: Does CZR have a wholesome stability sheet? Take a have a look at our free balance sheet analysis with six simple checks on key elements like leverage and danger.

- Management:Have insiders been ramping up their shares to make the most of the market’s sentiment for CZR’s future outlook? Check out our management and board analysis with insights on CEO compensation and governance elements.

- Other High Quality Alternatives: Do you want a very good all-rounder? Explore our interactive list of high quality stocks to get an concept of what else is on the market chances are you’ll be lacking!

PS. The Simply Wall St app conducts a reduced money move valuation for each inventory on the NASDAQGS day by day. If you wish to discover the calculation for different shares simply search here.

Valuation is complicated, however we’re serving to make it easy.

Find out whether or not Caesars Entertainment is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to convey you long-term centered evaluation pushed by basic information. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link