[ad_1]

Greatech Technology Berhad (KLSE:GREATEC) has had a tough three months with its share worth down 19%. However, inventory costs are often pushed by an organization’s monetary efficiency over the long run, which on this case appears to be like fairly promising. Specifically, we determined to check Greatech Technology Berhad’s ROE on this article.

Return on Equity or ROE is a check of how successfully an organization is rising its worth and managing traders’ cash. In brief, ROE exhibits the revenue every greenback generates with respect to its shareholder investments.

View our latest analysis for Greatech Technology Berhad

How To Calculate Return On Equity?

ROE might be calculated through the use of the formulation:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, primarily based on the above formulation, the ROE for Greatech Technology Berhad is:

21% = RM131m ÷ RM618m (Based on the trailing twelve months to March 2023).

The ‘return’ is the yearly revenue. That signifies that for each MYR1 value of shareholders’ fairness, the corporate generated MYR0.21 in revenue.

What Has ROE Got To Do With Earnings Growth?

So far, we have realized that ROE is a measure of an organization’s profitability. We now want to guage how a lot revenue the corporate reinvests or “retains” for future development which then provides us an thought in regards to the development potential of the corporate. Assuming all else is equal, corporations which have each a better return on fairness and better revenue retention are often those which have a better development price when in comparison with corporations that do not have the identical options.

Greatech Technology Berhad’s Earnings Growth And 21% ROE

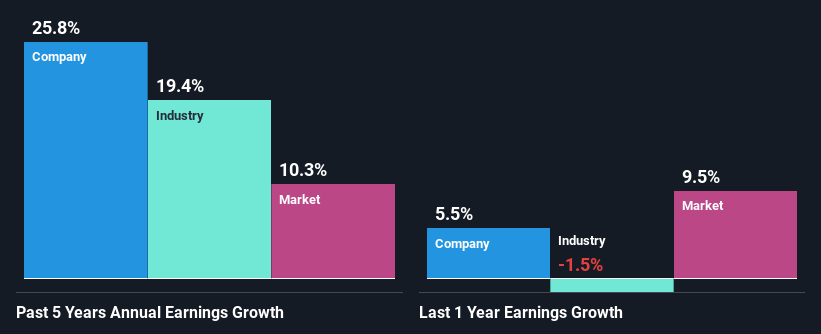

At first look, Greatech Technology Berhad appears to have a good ROE. Further, the corporate’s ROE compares fairly favorably to the business common of 12%. Probably on account of this, Greatech Technology Berhad was capable of see a formidable web earnings development of 26% over the past 5 years. We reckon that there may be different components at play right here. For instance, it’s potential that the corporate’s administration has made some good strategic selections, or that the corporate has a low payout ratio.

Next, on evaluating with the business web earnings development, we discovered that Greatech Technology Berhad’s development is kind of excessive when in comparison with the business common development of 19% in the identical interval, which is nice to see.

Earnings development is a large consider inventory valuation. It’s essential for an investor to know whether or not the market has priced within the firm’s anticipated earnings development (or decline). By doing so, they are going to have an thought if the inventory is headed into clear blue waters or if swampy waters await. One good indicator of anticipated earnings development is the P/E ratio which determines the worth the market is prepared to pay for a inventory primarily based on its earnings prospects. So, it’s possible you’ll wish to check if Greatech Technology Berhad is trading on a high P/E or a low P/E, relative to its business.

Is Greatech Technology Berhad Making Efficient Use Of Its Profits?

Greatech Technology Berhad would not pay any dividend at present which primarily signifies that it has been reinvesting all of its earnings into the enterprise. This undoubtedly contributes to the excessive earnings development quantity that we mentioned above.

Conclusion

In complete, we’re fairly proud of Greatech Technology Berhad’s efficiency. Particularly, we like that the corporate is reinvesting closely into its enterprise, and at a excessive price of return. Unsurprisingly, this has led to a formidable earnings development. Having stated that, the corporate’s earnings development is predicted to decelerate, as forecasted within the present analyst estimates. To know extra in regards to the newest analysts predictions for the corporate, take a look at this visualization of analyst forecasts for the company.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to deliver you long-term targeted evaluation pushed by basic knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link