[ad_1]

Summary

- The entertainment industry is one of the worst-hit amid the pandemic and continues to experience hindrances to operate under full capacity.

- Many companies from this sector were provisionally closed during the June quarter 2020 due to the lockdown and social distancing norms to prevent the virus spread.

- Village Roadshow reported a 21.5% drop in revenue and is currently operating on a negative cash basis. It expects the situation to prevail for several months.

- OML experienced a 33% drop in its 1H FY2020 revenue during COVID-19 pandemic due to extended COVID-19 lockdown periods, cross border closures, social distancing restrictions.

- Seeing the trading conditions, OML is not in a position to comment on earnings guidance.

The entertainment and media industry is amongst those industries which were hit hard during the COVID-19 pandemic as a result of lockdowns and social distancing measures.

The businesses in the entertainment sector had an adverse impact because of the drop in the audience and public visiting these places. With the ease in the lockdown restriction, few of the businesses have become operation but at reduced capacity.

Theme parks, casinos, and theatres were shut for an extended period, and the recent surge in cases in Victoria further dampened the spirits. However, there has been a gradual resumption of operations for the entertainment industry players following ease in lockdown guidelines. Social distancing norms, though, will continue to have an impact on the overall footfall.

Against this backdrop, lets us look at two media and entertainment industry players – Village Roadshow and oOh!media Limited.

DO READ: Five tips for Investors looking at Casino and Entertainment Stocks

Village Roadshow Limited (ASX:VRL)

Founded in 1954, Village Roadshow Limited today operates core businesses like Theme Parks, Cinema Exhibition, Film and DVD Distribution and Marketing Solutions.

Village Roadshow was amongst those companies which were adversely impacted by the COVID-19 pandemic. The Company’s theme parks and cinemas were closed from March 2020 till June 2020. In July 2020, all parks and the majority of cinemas apart from the theatres in Victoria reopened.

The cinemas and theme parks are operational presently, albeit with a reduced capacity to obey the social distancing rules in the relevant states.

Hence, the Company had to decide on implementing cost reduction strategies to reduce the impact during the business closure. Further, VRL also obtained a debt facility of A$70 million from current lenders and the Queensland Treasury Corporation.

Another development during FY2020 was the sale of Edge Loyalty Systems to Blackhawk Network (Australia). The transaction was completed on 31 October 2019, and the proceeds generated through this deal were used for the repayment of the debt.

On 06 August 2020, Village Roadshow entered into an Implementation Deed with BGH Capital Pty Ltd for a possible acquisition of the former by the latter.

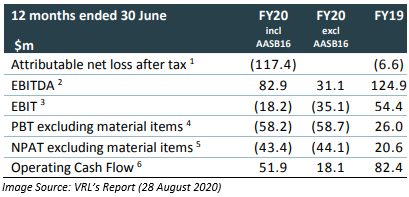

FY2020 Results:

- Income from continuing operations declined 21.5% to A$786.179 million.

- Loss after tax from continuing operations for the period was A$122.568 million.

FY2021 Outlook:

Based on the prevailing situation, Village Roadshow feels that the current environment and expectations around future trading conditions are subjected to change, especially when considering unknown factors. These comprise of extended COVID-19 lockdown periods, cross border closures, social distancing restrictions along with the status of a vaccine.

The Company also highlighted that as a result of the continuing Queensland border closure with Victoria and New South Wales, its Theme Park would take time to regain.

VRL expects favourable trading from November onwards, backed by the opening of its key attractions at the New Atlantis Precinct – Vortex before December 2020.

In Cinema Exhibition, all cinemas in Victoria are presently shut and are presumed to reopen in October 2020.

Village Roadshow is presently operating on a negative cash basis. The Company anticipates the situation to continue for several months. The additional A$70 million facility will assist the Company during 1H FY2021 to recover from the pandemic impact. VRL expects that the extra debt facility will be adequate for the Company to fund its cash requirements for the subsequent 12 months.

Stock Information:

By the end of the trading session, VRL shares settled flat at A$2.110.

oOh!media Limited (ASX:OML)

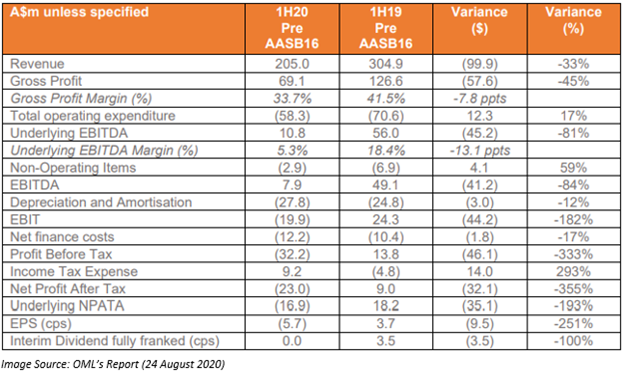

oOh!media Limited is a leading Out of Home media company experienced a 33% drop in its 1H FY2020 revenue during COVID-19 pandemic to A$205 million.

As per Brendon Cook, the CEO of oOh!media Limited, COVID-19 induced restrictions have resulted in an unprecedented decline in Out of Home audiences in Australia as well as New Zealand. Because of the general economic slow-down, the Company witnessed a significant drop in the revenue for the Q2 FY2020. However, the Company was quick enough regarding the implementation of measures to tackle the current volatility while ensuring that the business stays well placed to help from long term structural growth in Out Of Home markets.

Also, in the recent report published by the S&P Dow Jones Indices, the Company has been removed from the S&P/ASX 200 Index.

Let’s take a quick look at the half-yearly results of OML ended 30 June 2020.

- Underlying EBITDA which was A$56 million in 1H FY2019 dropped to A$10.8 million in 1H FY2020.

- Underlying NPATA, which was A$18.2 million profit in 1H FY2019 turned to a loss of A$16.9 million in 1H FY2020.

- Reported Net Loss after Tax of A$27.5 million

Outlook for FY2020:

In Q3 FY2020, the Company confirmed that there was an increase in trading, pacing at 60% of August 2019 compared to May 2020, which was pacing at 25% of May 2019.

Trading situations continue to be uncertain, and the Company feels that it is difficult to forecast, and it does not consider it appropriate to provide earnings guidance for FY2020.

Stock Information:

By the end of the trading session, OML shares settled at A$1.025, up 0.985% from the previous close.

Conclusion:

In the prevailing uncertain times, it is difficult to predict when things would get back to normal. Businesses continue to experience significant challenges as they operate in a reduced capacity. It is still unclear when the entertainment industry would be operating at full capacity.

The recovery of the industry would depend on various factors like continued reduction in the number of new cases of in Victoria and NSW and the availably of an effective vaccine.

Did You Know:

[ad_2]

Source link