[ad_1]

The hike comes forward of Lok Sabha polls prone to be held in April-May this yr. With a complete subscriber base of 29 crore, EPFO stays one of the crucial engaging financial savings mechanisms the place returns don’t appeal to earnings tax if contributions, statutory and voluntary, add as much as underneath Rs 2.5 lakh yearly. With subscribers tending to stay with the scheme, EPF deposits additionally profit from compounding.

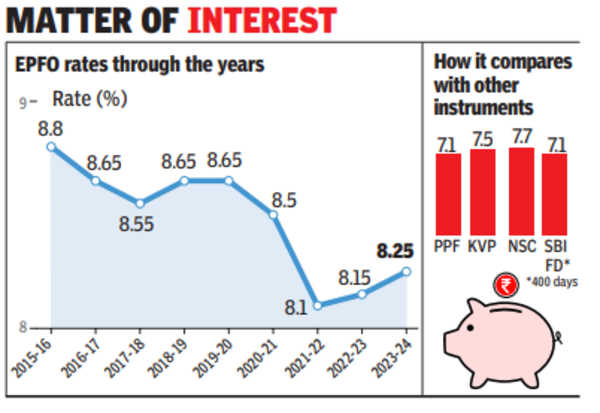

The rate of interest of 8.25% – the best in three years – was determined on the central board of trustees’ 235th assembly and the curiosity will start to be credited to subscribers’ accounts as soon as it’s permitted and notified by the Union finance ministry.

In March 2022, EPFO had lowered rate of interest for 2021-22 to eight.1% from 8.5% in 2020-21. This was the bottom since 1977-78, when it was 8%.

Union labour and employment minister Bhupender Yadav, who chairs the central board of trustees, mentioned, “The move is a step towards fulfilling PM Modi’s guarantee of strengthening social security for India’s workforce.”

The retirement fund physique, which noticed a 17.4% enhance in its earnings, additionally really useful the distribution of Rs 1.7 lakh crore on a complete principal quantity of Rs 13 lakh crore to EPF members in FY 2023-24 as in comparison with Rs 91,151.7 crore (on Rs 11 lakh crore) in 2022-23. The advice to disburse over Rs 1 lakh crore, govt mentioned, has been made for the primary time.

Pointing to EPF’s wholesome monetary efficiency and potential to earn robust returns for its members, the labour ministry mentioned EPFO has a “strong track record of distributing higher income to its members over the years while maintaining minimal credit risk”.

It additionally mentioned that the rate of interest provided by EPFO tends to be increased in comparison with different comparable funding avenues accessible and that EPFO’s funding technique is to “prioritise safety and preservation of principal while also seeking growth opportunities”.

[adinserter block=”4″]

[ad_2]

Source link