[ad_1]

Achieving self-reliance would require a massive jump in India’s manufacturing capacity. (File picture for representation)

Achieving self-reliance would require a massive jump in India’s manufacturing capacity. (File picture for representation)

Dear Readers,

Boosting manufacturing is seen as India’s best chance to create jobs for the thousands that enter the job market each year. One of Prime Minister Modi’s central focus areas, since he took charge, has been to boost manufacturing in India. His first term saw a concerted push in this direction through the “Make in India” initiative.

In his second term, especially in the wake of the Covid-19 disruption and a stand-off with China, this push has only become more comprehensive. The Atmanirbhar Bharat Abhiyan aims to make India a self-reliant country and resolutely pushes in the direction where India produces — instead of importing — most of the goods it needs for itself.

Of course, achieving self-reliance would require a massive jump in India’s manufacturing capacity.

To enable Indian businesses to boost productive capacity — either by augmenting existing factories or laying down new factories — the government sharply cut the corporate tax rate in 2019.

At the same time, India’s central bank, under the governorship of Shaktikanta Das, former Economic Affairs Secretary to the Government of India, has cut the benchmark interest rate in the economy by as much as 250 basis points (bps) between February 2019 and May 2020.

Over this period, the RBI has also worked with the banks to improve the transmission of these cuts to the banking system. Over the last 12 months, for instance, RBI has cut 150 bps and the MCLR (marginal cost lending rate or the rate that a bank charges the last customer seeking loan) has come down by 104 bps.

On the face of it, it is not just the nominal interest rates that have come down; even the real interest rates have come down.

Also Read | International flights explained: Why India’s air bubbles will not change the situation for most travelers

Real interest rate is essentially derived after subtracting the inflation rate from the nominal interest rate. So if the nominal interest rate is 10% and inflation is 8% then the real interest will be 2%.

Since RBI targets retail inflation, which is calculated by the Consumer Price Index (CPI), it is easy to believe that the real interest rates are coming down.

Real Interest (R) = Nominal Interest Rate (N) — Inflation Rate (I)

If N is falling sharply and I is increasing — the latest retail inflation was over 6% — then, R or the real interest rate must be falling.

A low real interest rate should encourage businesses to borrow more and make new investments in the economy.

Yet nothing of the sort is happening.

Why?

Because in common perception “inflation rate” refers to the “retail” (CPI) inflation in the economy — that is the inflation that you and I face as consumers.

Explainspeaking: The Rajasthan game could be long drawn out, but watch the hearing in Rajasthan HC closely

But businesses are not exactly like consumers. For instance, a steel-producing firm cares little what the inflation in fruits and vegetables is. What it bothers about is the wholesale inflation, especially in steel.

It helps to think of inflation as a proxy of the “pricing power” that a firm or industry enjoys. In any economy, this pricing power varies between businesses — say a steel producer, a sanitiser maker, a vegetable grower and a travel agency — depending on the market conditions such as the demand for their product, ability to store inventories etc.

So while calculating that “R” or the real interest rate for a firm in the manufacturing sector — say a steel manufacturer or a TV or car manufacturer — it would be odd to use “retail” inflation.

Since these products are sold wholesale, one should use Wholesale Price Index-based inflation. And while we are at it, even within the wholesale inflation we should only look at the non-food manufacturing inflation — otherwise called the “core-WPI”.

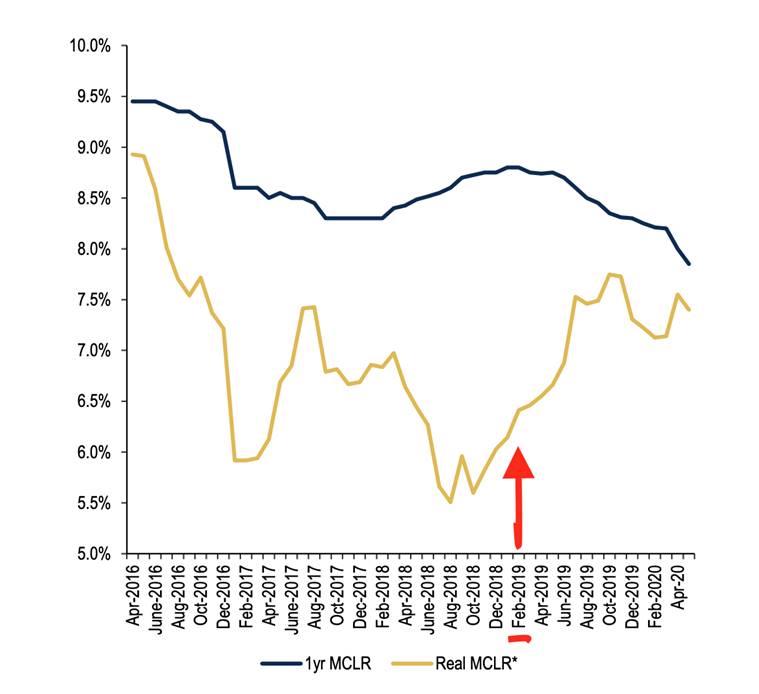

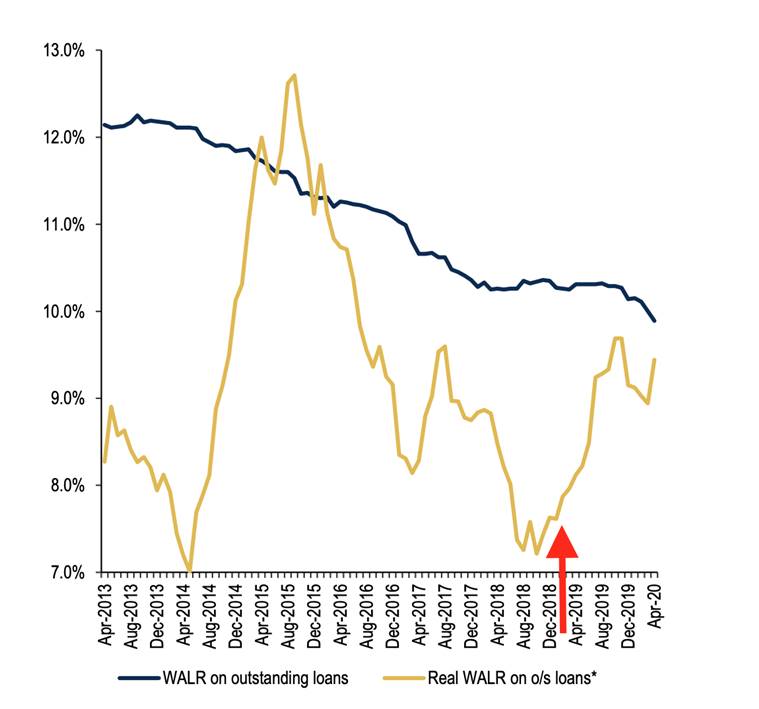

Charts 1 and 2 (source: Bank of America Securities) show what happens to the real interest rate for the manufacturing sector when we calculate the real interest rate by using core-WPI as the inflation rate (I) in the equation above.

Contrary to common perception, real interest rates have actually gone up since the time Shaktikanta Das has taken over as the Governor of RBI.

Chart 1 maps the real MCLR.

Chart 2 maps the real WALR (weighted average lending rate). Unlike the MCLR, which is lower because it is for the newest borrower, the WALR is the interest rate charged on all the outstanding loans of a bank, and as such, is much higher than MCLR.

Why? Because the core-WPI has decelerated even faster than the rate at which nominal interest rates have come down.

📣 Express Explained is now on Telegram. Click here to join our channel (@ieexplained) and stay updated with the latest

This odd situation has arisen because retail and wholesale inflation rates are diverging. The RBI targets the retail inflation but, as shown above, the relevant inflation rate to monitor for boosting investments right now could be the core-WPI.

In about a fortnight, the RBI’s Monetary Policy Committee will reconvene and take a call on how to boost credit in the economy. It would be interesting to see how it responds to this quandary.

Stay safe.

Udit

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Explained News, download Indian Express App.

© IE Online Media Services Pvt Ltd

[ad_2]

Source link