[ad_1]

Amidst a backdrop of broad-based revenue reserving and valuation considerations, Indian blue-chip shares have skilled a notable decline, with the NSE Nifty 50 and BSE Sensex each shedding worth in latest buying and selling periods. In these fluctuating market situations, buyers usually look in the direction of dividend shares as a possible supply of regular earnings and relative stability.

Top 10 Dividend Stocks In India

|

Name |

Dividend Yield |

Dividend Rating |

|

EPL (BSE:500135) |

2.29% |

★★★★★★ |

|

Narmada Gelatines (BSE:526739) |

2.74% |

★★★★★★ |

|

Vinyl Chemicals (India) (BSE:524129) |

2.93% |

★★★★★★ |

|

Castrol India (BSE:500870) |

3.74% |

★★★★★☆ |

|

Karnataka Bank (NSEI:KTKBANK) |

2.22% |

★★★★★☆ |

|

Balmer Lawrie (BSE:523319) |

3.45% |

★★★★★☆ |

|

Indian Oil (NSEI:IOC) |

3.11% |

★★★★★☆ |

|

PTC India (NSEI:PTC) |

4.45% |

★★★★★☆ |

|

Ruchira Papers (NSEI:RUCHIRA) |

4.23% |

★★★★★☆ |

|

Bank of Baroda (NSEI:BANKBARODA) |

2.16% |

★★★★★☆ |

Click here to see the full list of 70 stocks from our Top Dividend Stocks screener.

Below we highlight a few our favorites from our unique screener.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ITC Limited is a diversified conglomerate with operations in fast-moving shopper items, hospitality, paperboards and paper, packaging, agriculture, and knowledge expertise sectors in India and globally, boasting a market cap of roughly ₹5.21 trillion.

Operations: ITC Limited’s income is primarily derived from its FMCG – Cigarettes phase at ₹330.61 billion, adopted by FMCG – Others at ₹206.45 billion, Agri Business at ₹165.95 billion, and Paperboards, Paper & Packaging at ₹84.93 billion, with a smaller contribution from the Hotels division producing ₹29.81 billion.

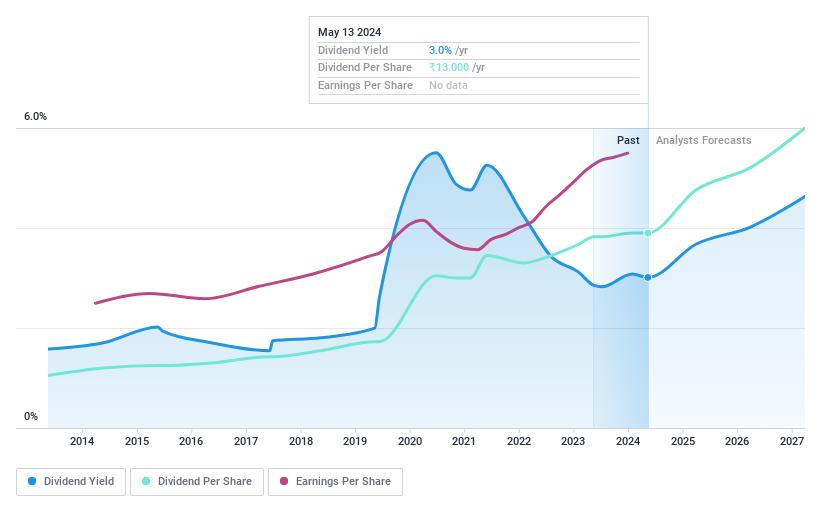

Dividend Yield: 3.1%

ITC Limited, a diversified conglomerate, has been a constant dividend payer with a latest interim dividend declared at INR 6.25 per share. Despite steady dividends over the previous decade and earnings development of 9.7% yearly over 5 years, the payout ratio suggests dividends aren’t effectively coated by earnings or money flows. The authorities’s choice to not divest its stake might present stability, whereas British American Tobacco’s partial stake sale might affect ITC’s inventory dynamics. ITC trades under analyst worth targets with potential for worth appreciation; nonetheless, its excessive money payout ratio of 103.7% raises questions concerning the sustainability of future dividends with out satisfactory money stream protection.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Akzo Nobel India Limited is an organization engaged within the manufacturing, distribution, and sale of paints and coatings inside India and throughout world markets, with a market capitalization of roughly ₹112.85 billion.

Operations: Akzo Nobel India Limited generates its income primarily from the coatings phase, which amounted to ₹39.40 billion.

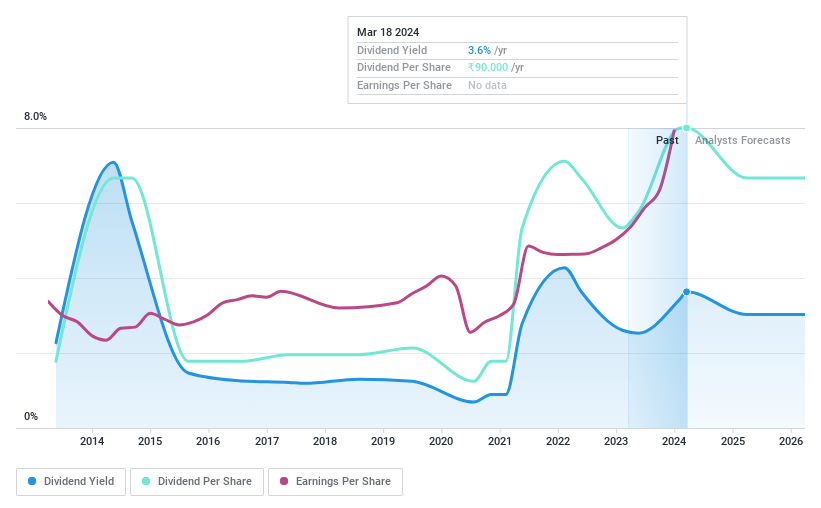

Dividend Yield: 3.6%

Akzo Nobel India’s dividend yield stands at a strong 3.63%, outshining the Indian market common. The firm’s latest earnings report confirmed a considerable year-over-year development of 31.5%, with revenues forecasted to climb by 11.44% yearly, signaling potential for continued monetary well being. Though dividends have skilled volatility over the previous decade, present earnings and money flows—with payout ratios of 82.6% and money payout ratio at 78.6% respectively—present protection for present payouts, presenting a balanced view on sustainability regardless of an unstable dividend monitor report. The Price-To-Earnings ratio sits under the market common at 27.3x, hinting at relative worth in pricing amidst latest regulatory challenges resolved underneath amnesty provisions, additional reinforcing its standing amongst dividend shares in India.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HCL Technologies Limited is a world enterprise offering software program improvement, enterprise course of outsourcing, and infrastructure administration companies with a market capitalization of roughly ₹4.45 trillion.

Operations: HCL Technologies Limited generates its income primarily by way of three segments: IT and Business Services at $9.63 billion, Engineering and R&D Services at $2.09 billion, and HCL Software at $1.41 billion.

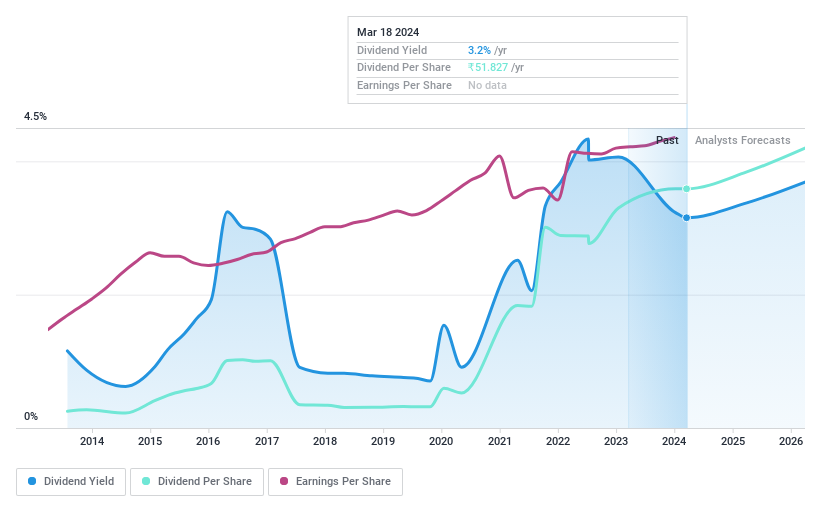

Dividend Yield: 3.2%

HCL Technologies, with a latest interim dividend declaration of ₹12 per share, maintains a dedication to shareholder returns. The firm’s strategic advances in AI by way of partnerships and product launches like HCLTech AI Force and FlexSpace 5G underline its deal with innovation-led development. Despite an earnings enhance of 6% over 5 years, the payout ratio at 86.5% and money payout ratio at 66% recommend dividends are well-supported by each earnings and money flows. However, historic volatility in dividend funds raises questions on long-term reliability amidst aggressive business dynamics.

Where To Now?

-

Access the complete spectrum of 70 Top Dividend Stocks by clicking on this hyperlink.

-

Got pores and skin within the recreation with these shares? Elevate the way you handle them by using Simply Wall St’s portfolio, the place intuitive instruments await to assist optimize your funding outcomes.

-

Join a group of good buyers by utilizing Simply Wall St. It’s free and delivers expert-level evaluation on worldwide markets.

Contemplating Other Strategies?

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We intention to convey you long-term centered evaluation pushed by elementary knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e mail editorial-team@simplywallst.com

[adinserter block=”4″]

[ad_2]

Source link