[ad_1]

Beautiful and colourful aerial view of Mumbai skyline throughout twilight seen from Currey Road, on February 16, 2022 in Mumbai, India.

Pratik Chorge | Hindustan Times | Getty Images

India’s inventory markets have staged record-breaking rallies this 12 months, making the nation a favourite amongst its Asia-Pacific counterparts.

The Nifty 50 index has repeatedly notched recent all-time highs, reaching yet one more peak on Tuesday. The index is ready for an eighth 12 months of good points, up greater than 15% year-to-date.

Optimism about India’s progress prospects, elevated liquidity and better home participation have all contributed to the surge in inventory markets. In truth, India’s stock market value has overtaken Hong Kong’s to turn into the seventh largest on this planet.

As of the tip of November, the entire market capitalization of the National Stock Exchange of India was $3.989 trillion versus Hong Kong’s $3.984 trillion, in accordance with knowledge from the World Federation of Exchanges.

Numbers from the WFE additionally confirmed that India’s NSE noticed extra new inventory listings than the HKEX. India’s inventory market had 22 new listings vs. Hong Kong’s seven, as of November.

Here are the 5 the reason why India’s inventory markets have reached new highs this 12 months;

Growth prospects

India has been one in every of South Asia’s quickest rising economies, with expectations solely increase for subsequent 12 months.

The world’s most populous nation has grown at a persistently robust tempo this 12 months, with the newest studying on third-quarter GDP exhibiting a a lot higher-than-expected progress fee of seven.6%.

Bets on India driving progress in Asia have additionally been rising. S&P Global predicted India’s GDP for the fiscal year ending March 2024 hit 6.4%, greater than its earlier forecast of 6%.

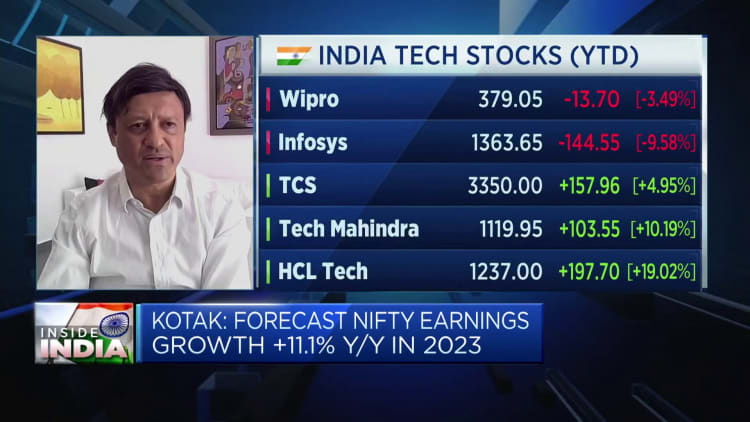

Strong earnings

The Indian inventory market has additionally proven sound fundamentals and sturdy earnings, that are anticipated to develop via 2024.

HSBC forecasts earnings progress of 17.8% for India in 2024 — among the many quickest charges in Asia. Sectors resembling banks, well being care and vitality, which have already executed properly this 12 months are finest positioned for 2024, in accordance with HSBC.

Sectors resembling autos, retailers, actual property and telecoms had been additionally comparatively properly positioned for 2024, whereas fast-moving shopper items, utilities and chemical compounds are amongst these HSBC mentioned had been unfavorable.

Domestic participation

There has additionally been an uptick in home participation in Indian inventory markets this 12 months, particularly in high-growth areas, in accordance with analysis by HSBC.

“While foreign investors tend to be active in large caps, it is local investors that dominate the small and mid-cap space, which partly explains the outperformance – fund flows into midcap-small schemes of domestic MFs (i.e. mutual funds with a mandate to invest in small/midcaps) have been disproportionately high,” HSBC famous.

It additionally expects this pattern to proceed into the following 12 months.

Rate cuts are coming

The Reserve Bank of India held its important lending fee steady at 6.5% final Friday and mentioned its expects the nation to develop at a tempo of seven% this 12 months. The central financial institution did warn that inflation, even because it continues to chill, nonetheless stays above its goal as underlying worth pressures had been cussed.

That, nonetheless, doesn’t imply market gamers aren’t anticipating fee cuts subsequent 12 months.

“We expect the policy pause to be extended for now and expect 100bp (basis points) of cumulative rate cuts starting from August 2024,” analysts at Nomura wrote in a consumer be aware.

Lower lending charges usually enhance liquidity and enhance extra risk-taking sentiment in inventory markets.

Policy continuity

As India gears up for a giant election 12 months in 2024, markets stay optimistic on additional coverage continuity.

Analysts predict it could possibly be one other victory for the ruling nationalist Bharatiya Janata Party, with recent polls and recent state elections exhibiting the right-wing BJP might retain energy.

“The ruling Bharatiya Janata Party (BJP) outdid its national and regional rivals at the recently held state elections. This strong run fed expectations of political stability at the upcoming general elections in April/May24, addressing earlier concerns that a weak showing at the state polls might have stoked a fiscally populist agenda in the coming months,” DBS senior economist Radhika Rao mentioned in a consumer be aware.

[adinserter block=”4″]

[ad_2]

Source link