[ad_1]

AMC Entertainment Holdings (AMC) is expected to report their latest earnings’ numbers after the close of trading today. Let’s check out the charts and indicators to see if we want to get online for a ticket.

In this daily bar chart of AMC, below, we can see that prices have been finding buying interest (support) around $35 and trading around the 50-day moving average line. The 200-day line has a positive slope and intersects down around $28.

The On-Balance-Volume (OBV) line has been slowly creeping upwards the past five weeks and suggests that buyers of AMC are being more aggressive. The Moving Average Convergence Divergence (MACD) oscillator is just slightly below the zero line and a soon-to-happen buy signal.

In this weekly Japanese candlestick chart of AMC, below, we can see that prices made a long base pattern before their upside breakout this year. AMC is trading above the rising 40-week moving average line.

The weekly OBV line has been strong this year and supports the price gains seen so far.

The MACD oscillator has been in a take profit sell mode for a while but that could change as the two moving averages that make up this indicator have begun to narrow.

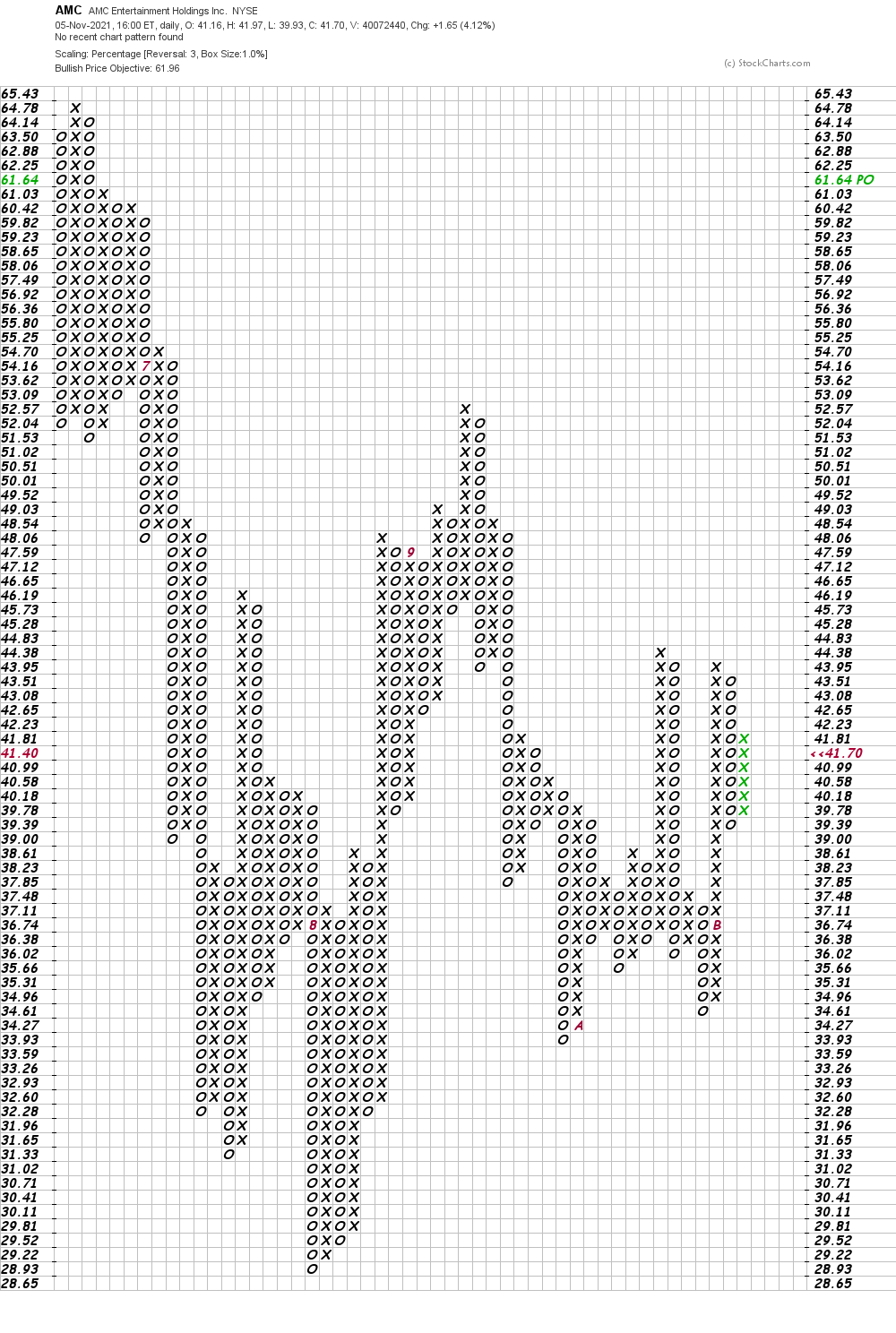

In this daily Point and Figure chart of AMC, below, we can see a potential upside price target in the $62 area.

Bottom line strategy: I have no special knowledge of what AMC might report for earnings but the charts and indicators of AMC look like they can support higher prices in the weeks ahead. Aggressive traders could go long, risking to $33. The $62 area is our price objective.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

[ad_2]

Source link