[ad_1]

Key Insights

-

Significant management over Globetronics Technology Bhd by particular person traders implies that most people has extra energy to affect administration and governance-related choices

-

51% of the enterprise is held by the highest 11 shareholders

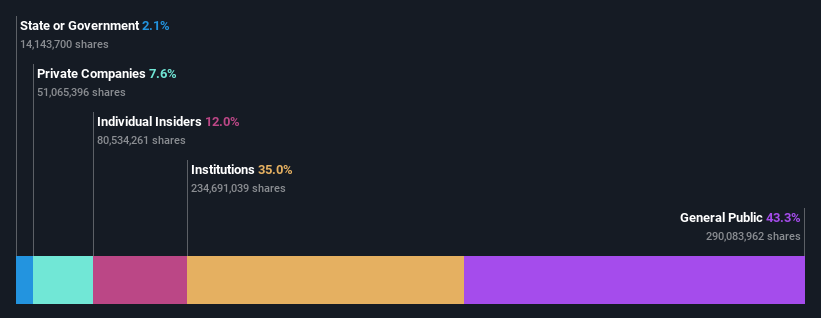

If you need to know who actually controls Globetronics Technology Bhd. (KLSE:GTRONIC), then you definitely’ll have to take a look at the make-up of its share registry. With 43% stake, particular person traders possess the utmost shares within the firm. That is, the group stands to profit essentially the most if the inventory rises (or lose essentially the most if there’s a downturn).

Institutions, however, account for 35% of the corporate’s stockholders. Institutions typically personal shares in additional established firms, whereas it is common to see insiders personal a good bit of smaller firms.

Let’s delve deeper into every kind of proprietor of Globetronics Technology Bhd, starting with the chart under.

Check out our latest analysis for Globetronics Technology Bhd

What Does The Institutional Ownership Tell Us About Globetronics Technology Bhd?

Institutional traders generally examine their very own returns to the returns of a generally adopted index. So they often do contemplate shopping for bigger firms which can be included within the related benchmark index.

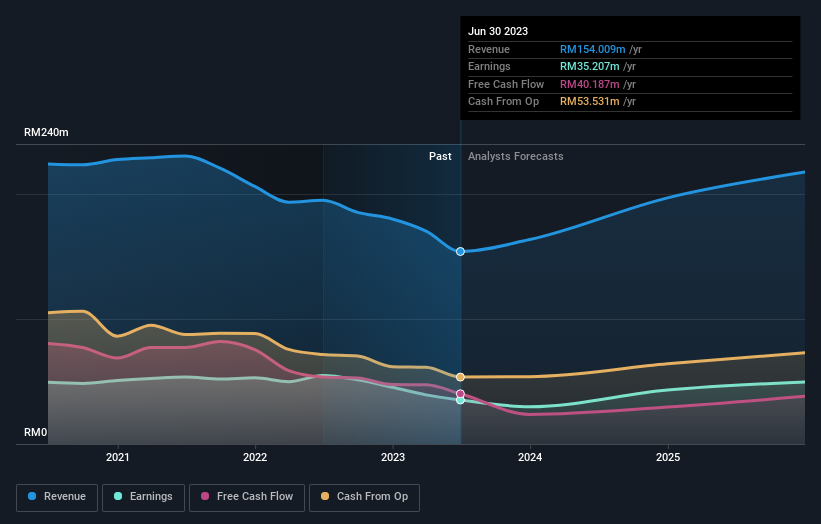

We can see that Globetronics Technology Bhd does have institutional traders; they usually maintain a superb portion of the corporate’s inventory. This implies the analysts working for these establishments have appeared on the inventory they usually prefer it. But identical to anybody else, they might be improper. It just isn’t unusual to see a giant share worth drop if two giant institutional traders attempt to promote out of a inventory on the similar time. So it’s price checking the previous earnings trajectory of Globetronics Technology Bhd, (under). Of course, needless to say there are different components to contemplate, too.

Globetronics Technology Bhd just isn’t owned by hedge funds. Our knowledge exhibits that Employees Provident Fund of Malaysia is the most important shareholder with 14% of shares excellent. For context, the second largest shareholder holds about 7.1% of the shares excellent, adopted by an possession of 5.8% by the third-largest shareholder.

A more in-depth take a look at our possession figures means that the highest 11 shareholders have a mixed possession of 51% implying that no single shareholder has a majority.

Researching institutional possession is an efficient technique to gauge and filter a inventory’s anticipated efficiency. The similar may be achieved by finding out analyst sentiments. There are loads of analysts protecting the inventory, so it may be price seeing what they’re forecasting, too.

Insider Ownership Of Globetronics Technology Bhd

The definition of an insider can differ barely between completely different nations, however members of the board of administrators all the time rely. The firm administration reply to the board and the latter ought to characterize the pursuits of shareholders. Notably, typically top-level managers are on the board themselves.

Most contemplate insider possession a constructive as a result of it might point out the board is nicely aligned with different shareholders. However, on some events an excessive amount of energy is concentrated inside this group.

Our most up-to-date knowledge signifies that insiders personal an inexpensive proportion of Globetronics Technology Bhd.. It has a market capitalization of simply RM986m, and insiders have RM118m price of shares in their very own names. We would say this exhibits alignment with shareholders, however it’s price noting that the corporate remains to be fairly small; some insiders could have based the enterprise. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The common public, who’re often particular person traders, maintain a 43% stake in Globetronics Technology Bhd. While this group cannot essentially name the pictures, it might actually have an actual affect on how the corporate is run.

Private Company Ownership

Our knowledge signifies that Private Companies maintain 7.6%, of the corporate’s shares. It’s laborious to attract any conclusions from this truth alone, so its price trying into who owns these non-public firms. Sometimes insiders or different associated events have an curiosity in shares in a public firm by a separate non-public firm.

Next Steps:

I discover it very fascinating to take a look at who precisely owns an organization. But to actually achieve perception, we have to contemplate different data, too. Be conscious that Globetronics Technology Bhd is showing 2 warning signs in our investment analysis , it’s best to learn about…

Ultimately the long run is most essential. You can entry this free report on analyst forecasts for the company.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which consult with the 12-month interval ending on the final date of the month the monetary assertion is dated. This is probably not in keeping with full yr annual report figures.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to convey you long-term centered evaluation pushed by basic knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link