[ad_1]

The rulings

Oct 20, 2022: The Competition Commission of India (CCI) fined Google Rs 1,337.76 crore and asked it to make several changes to its Android policies to forestall abuse of its dominant place within the cellular working system market. The regulator gave Google three months — till Jan 19 — to conform.

Oct 25: The CCI fined Google another Rs 936.44 crore over its Play Store billing policies and requested it to make a number of adjustments to those guidelines as properly, comparable to permitting third-party cost processors.

The appeals

Dec 21: Google approached the National Company Law Appellate Tribunal (NCLAT) in opposition to the Android order.

India’s competitors regulation provides firms 60 days to enchantment CCI orders on the NCLAT.

The tribunal refused to grant an interim stay and directed Google to deposit 10% of the effective with it in three weeks.

Jan 9, 2023: Google appealed the CCI’s second order — relating to its Play Store insurance policies — within the NCLAT.

Jan 11: Two days later, the tribunal as soon as once more refused Google interim aid and scheduled the following listening to for April 17. The tech giant then approached the Supreme Court.

Jan 20: A 3-judge bench on the Supreme Court delayed the Jan 19 implementation of the CCI’s Android directives by every week, however declined to dam them. It additionally requested the NCLAT to rule on Google’s enchantment by March 31.

The final result

Jan 25: A day earlier than the deadline, Google announced several changes to Android in India, comparable to permitting gadget makers to license its particular person apps for pre-installation and permit customers to decide on their default search engine. It additionally made some adjustments associated to its in-app billing system on the Play Store.

Jan 26: Some Indian web startups mentioned Google’s changes were merely cosmetic and accused the tech big of utilizing “delaying tactics”.

(With inputs from businesses)

Top Stories By Our Reporters

ETtech Budget Watch

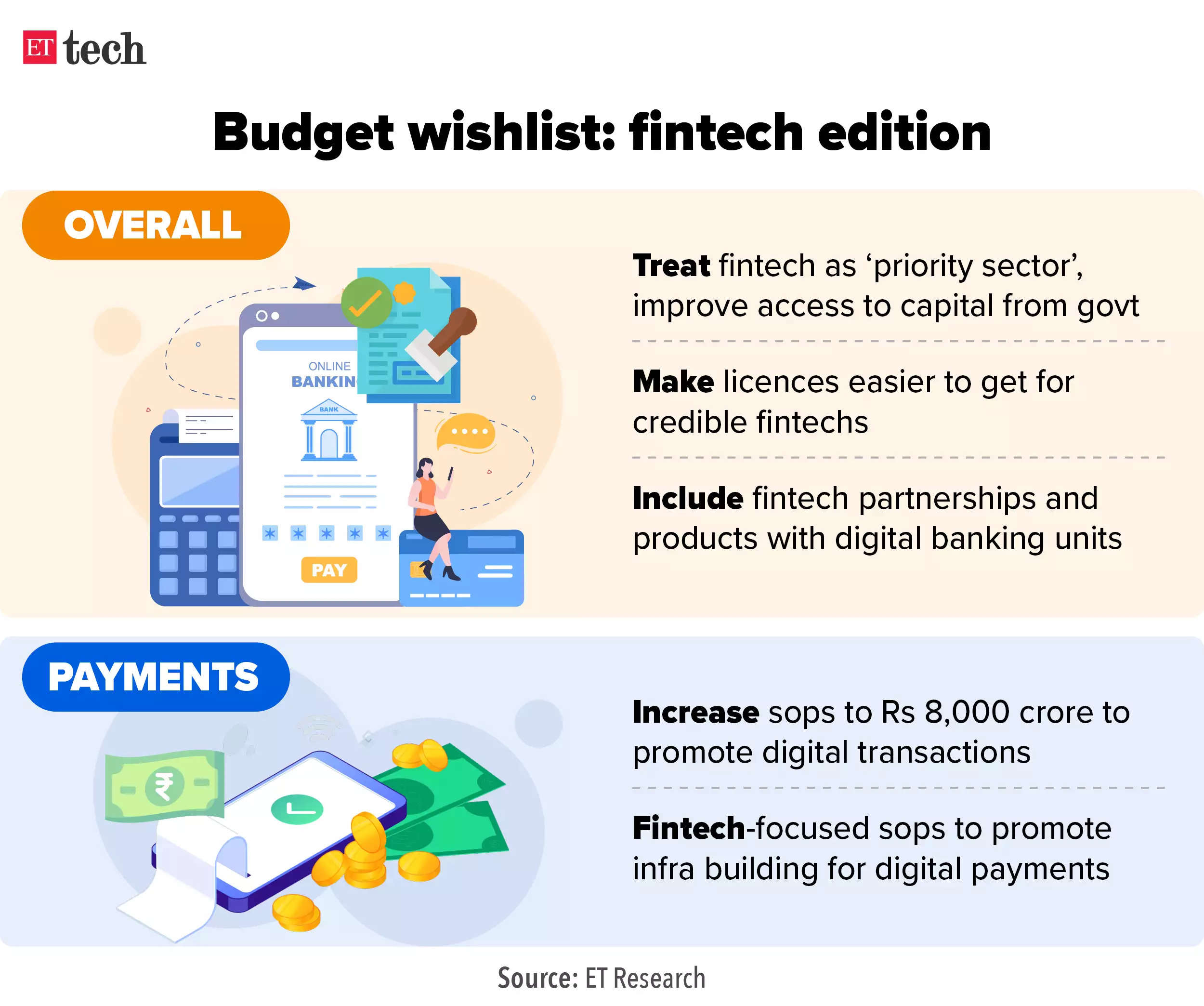

Fintechs anticipate sops, new funding avenues and extra: Indian fintechs are batting for incentives to help widen their participation in formal financial economy, business organisations and fintech founders informed ET. The fintech business – which has seen a number of regulatory reforms during the last 12 months – is searching for ‘priority sector’ standing for driving monetary inclusion, together with sops to cowl the price incurred for rising digital cost web within the nation.

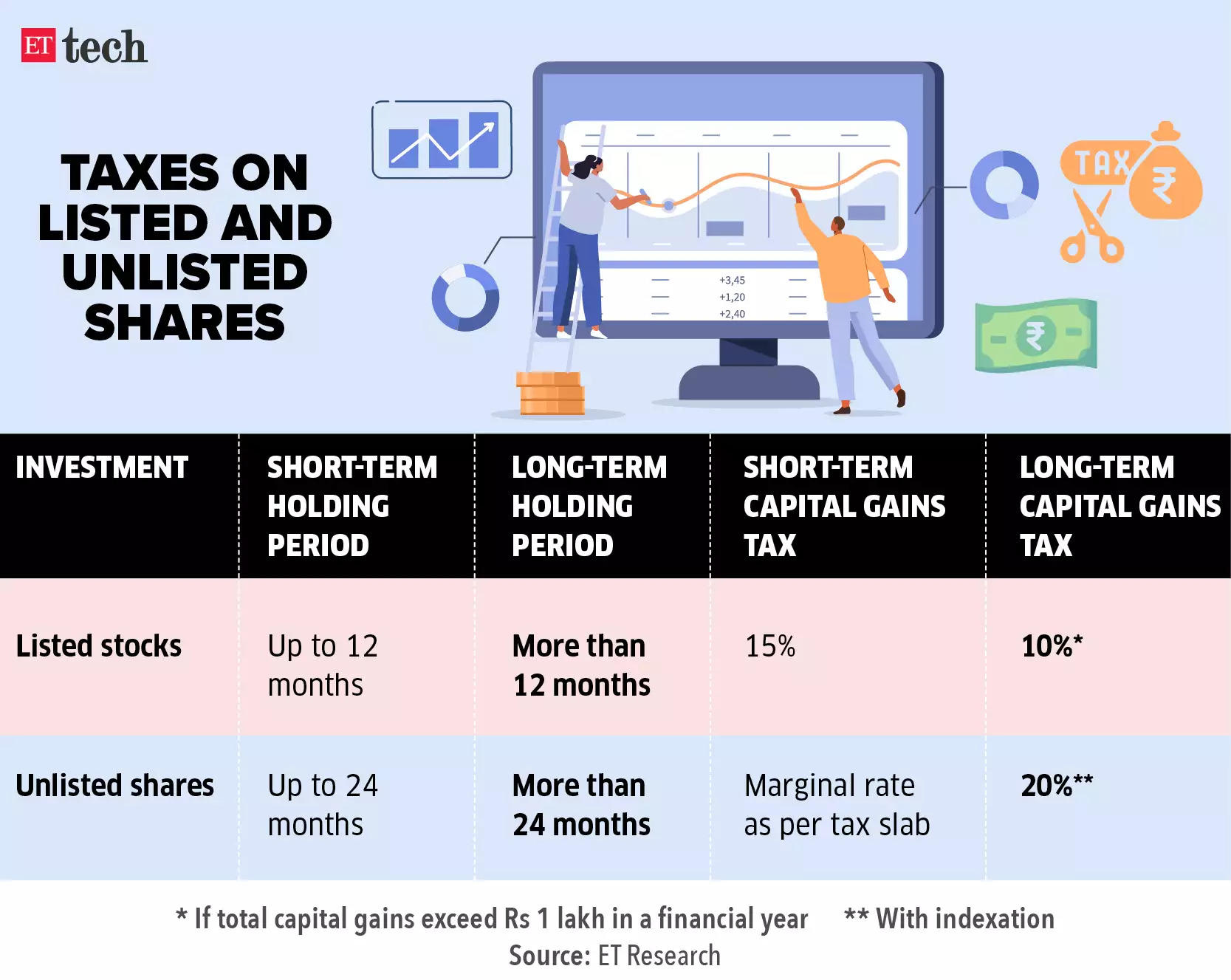

PE, VC buyers search tax parity: Private fairness (PE) and enterprise capitalist (VC) buyers have sought tax parity in the upcoming budget, saying {that a} differential tax therapy for listed and unlisted securities is distorting asset allocation choices.

“Essentially, we’re saying, a lot of investment in emerging sectors is still run by foreign capital, and we have not seen a dramatic shift in base,” Karthik Reddy, co-founder, Blume Ventures and chairperson of the Indian Venture and Alternate Capital Association (IVCA) informed ET.

To speed up public markets, advantages got to buyers 10-15 years in the past, and “we’re just saying normalise them,” he added.

Tech needs secure harbour charges, APA timelines: Technology corporations have requested the federal government to lower taxes in the upcoming budget, promote startups, and improve the benefit of doing enterprise. IT business foyer group Nasscom has urged the federal government to prescribe timelines for closure of advance pricing agreements (APAs). The authorities ought to streamline APAs, Mutual Agreement Procedures (MAPs), rules and benchmarking, mentioned PN Sudarshan, accomplice and TMT business chief, Deloitte.

In ecommerce and meals supply

ETtech unique | Accel, Tiger Global might exit Flipkart: Two of the early Flipkart backers — venture fund Accel Partners and New York-based investment firm Tiger Global are in talks to promote their remaining stake within the ecommerce firm — which collectively quantities to about 5% — to its guardian Walmart, sources informed us. The Bentonville-based American retail big might pay round $1.5 billion for this share buy, they mentioned.

While Accel owns somewhat over 1% stake, Tiger Global at present holds about 4% in Flipkart. Once a deal is finalised, Walmart’s stake in Flipkart will improve from its present holding of 72%.

Meesho tightens returns course of, sparks protests: Sellers are up in arms over ecommerce agency Meesho’s move to tighten control on product returns, sources have informed us. Meesho modified its product returns coverage following suggestions from its third-party logistics companions, the sources added. Over the previous few weeks sellers – particularly in Surat, one of many largest hubs for trend and attire retailers – have given Meesho adverse opinions and rankings on its app and stopped processing orders by means of the platform, retailers mentioned.

Zomato to wind up 10-minute meals supply biz: Zomato is shutting its 10-minute food delivery service Zomato Instant lower than a 12 months after it was launched because it chases profitability amid robust market circumstances. The firm lately informed its restaurant companions it might look to shut down the service, mentioned two sources aware about the event.

Zomato, nevertheless, mentioned that it’s not shuttering the 10-minute supply enterprise however rebranding the service. “Instant is not shutting down. We are working on a new menu with our partners and rebranding the business. All finishing stations remain intact, and no people are impacted by this decision,” the corporate mentioned.

Also learn | Zomato looking to hire 800 people, says CEO Deepinder Goyal

Startups layoffs, exits

Ecommerce agency Dealshare has laid off around 100 employees, or over 6% of its 1,500-strong workforce. Confirming the event, Dealshare founder Sourjyendu Medda mentioned the choice is linked to its marketing strategy for the following monetary 12 months with give attention to profitability.

With this improvement, Dealshare joins a rising variety of startups which have fired staff within the new 12 months to chop prices and rationalise operations amid a protracted funding squeeze and progress slowdown.

ShareChat cofounders Farid Ahsan and Bhanu Pratap Singh will step down from their energetic roles on the vernacular social media platform they began eight years in the past, cofounder and CEO Ankush Sachdeva informed employees in an inner e-mail.

Also Read | ShareChat fires about 500, CEO says ‘overestimated the market’

With virtually all large know-how firms asserting international layoffs one after the opposite, professionals within the sector in India are frantically on the lookout for safer choices. Fearing extra layoffs, staff within the tech business are looking for more stable jobs that often strictly exclude startups, mentioned recruitment consultants at corporations together with Transearch, ABC Consultants, Adecco, Careernet and CIEL HR Services.

Meanwhile, Google has paused its Program Electronic Review Management (PERM), a key step in buying an employer-sponsored inexperienced card.The tech big has despatched an e-mail to overseas staff, notifying them that the tech big will pause any new filings of PERM, leaving staff in a limbo.A PERM utility is a essential first step within the inexperienced card (everlasting residence) course of.

Tech coverage

Google makes a number of adjustments to Android and Play Store billing; Startups say calls it ‘delaying tactics’: Google has announced several key changes to the way in which it runs its flagship Android working system for smartphones and the Google Play Store in India to adjust to Competition Commission of India’s (CCI) two rulings. The adjustments got here a day forward of the January 26 deadline put in place by the Supreme Court.

Meanwhile, startups in India say the tech giant is employing ‘delaying tactics’, coverage tweaks ‘cosmetic in nature’. Google is following the ‘identical playbook’ that it employed in Europe and South Korea and is exploiting “loopholes” to point out compliance with the orders that have been to come back into impact on January 26, builders informed ET.

New tips on social media influencers to deliver transparency however result in larger prices, says DigitalROI: The new guidelines to social media influencers to manage promotions might result in larger prices for advertisers as they could have to spend extra on creating compliant content material, mentioned DigitalROI. Last week, the federal government introduced endorsement tips for celebrities and social media influencers mandating disclosure of advantages if they’re selling a product or a model by means of their social media platforms. Failing to take action will entice a penalty as much as Rs50 lakh.

Tech firms flag points with Delhi’s EV fleet draft coverage proposals: A gaggle of tech firms has flagged sure proposals envisaged within the Delhi government’s draft aggregator policy floated final July, which seeks to transform cabs and supply fleets within the nationwide capital to electrical automobiles in a phased method. Industry physique IndiaTech, which represents firms comparable to Ola, Zomato and Zepto, has argued in its illustration to the Delhi authorities that the implementation of the coverage might create a burden on supply executives and cab drivers who personal or lease automobiles.

In different information

It price PhonePe Rs 8,000 crore to come back to India, says Sameer Nigam: PhonePe cofounder and chief executive Sameer Nigam on Wednesday mentioned ever for the reason that startup utterly shifted domicile from Singapore to India in October, about 20 unicorns and their buyers have enquired concerning the course of and are actively trying to transfer right here. However, he added that ”our buyers paid virtually Rs 8,000 crore in taxes simply to permit us to come back again to India.”

Rajasthan HC tells DGGI to halt coercive motion in opposition to MyTeam11: The Rajasthan High Court has asked the Directorate General of GST Intelligence (DGGI) to chorus from taking coercive motion in opposition to Jaipur-based gaming firm MyTeam11. This adopted a petition by the corporate after DGGI issued a show-cause discover alleging that it was “misclassifying” the sale of ‘actionable claims’ as companies and thereby avoiding tax.

(Graphics & illustrations by Rahul Awasthi)

[adinserter block=”4″]

[ad_2]

Source link