[ad_1]

Hall of Fame Resort & Entertainment (NASDAQ:HOFV) Full Year 2023 Results

Key Financial Results

-

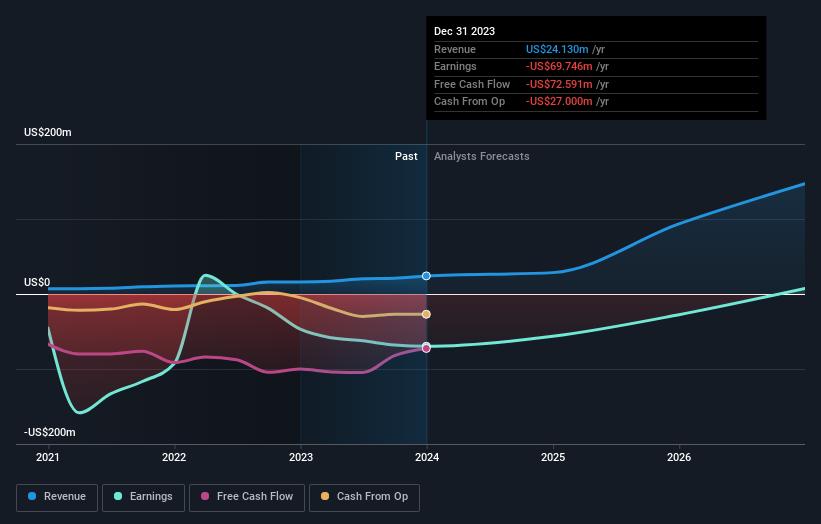

Revenue: US$24.1m (up 51% from FY 2022).

-

Net loss: US$69.7m (loss widened by 49% from FY 2022).

-

US$11.97 loss per share (additional deteriorated from US$9.01 loss in FY 2022).

All figures proven within the chart above are for the trailing 12 month (TTM) interval

Hall of Fame Resort & Entertainment EPS Misses Expectations

Revenue was according to analyst estimates. Earnings per share (EPS) missed analyst estimates by 9.2%.

Looking forward, income is forecast to develop 46% p.a. on common through the subsequent 3 years, in comparison with a 9.8% development forecast for the Hospitality business within the US.

Performance of the American Hospitality industry.

The firm’s shares are down 5.5% from every week in the past.

Risk Analysis

It’s mandatory to contemplate the ever-present spectre of funding threat. We’ve identified 3 warning signs with Hall of Fame Resort & Entertainment (at least 1 which is concerning), and understanding them must be a part of your funding course of.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We intention to deliver you long-term centered evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link