[ad_1]

Howard Marks put it properly when he stated that, somewhat than worrying about share value volatility, ‘The risk of everlasting loss is the danger I fear about… and each sensible investor I do know worries about.’ So it appears the good cash is aware of that debt – which is normally concerned in bankruptcies – is an important issue, whenever you assess how dangerous an organization is. Importantly, Chicken Soup for the Soul Entertainment, Inc. (NASDAQ:CSSE) does carry debt. But the extra necessary query is: how a lot threat is that debt creating?

When Is Debt Dangerous?

Debt and different liabilities grow to be dangerous for a enterprise when it can’t simply fulfill these obligations, both with free money move or by elevating capital at a lovely value. In the worst case state of affairs, an organization can go bankrupt if it can’t pay its collectors. However, a extra frequent (however nonetheless expensive) prevalence is the place an organization should challenge shares at bargain-basement costs, completely diluting shareholders, simply to shore up its stability sheet. By changing dilution, although, debt might be an especially good instrument for companies that want capital to spend money on progress at excessive charges of return. When we study debt ranges, we first contemplate each money and debt ranges, collectively.

See our latest analysis for Chicken Soup for the Soul Entertainment

How Much Debt Does Chicken Soup for the Soul Entertainment Carry?

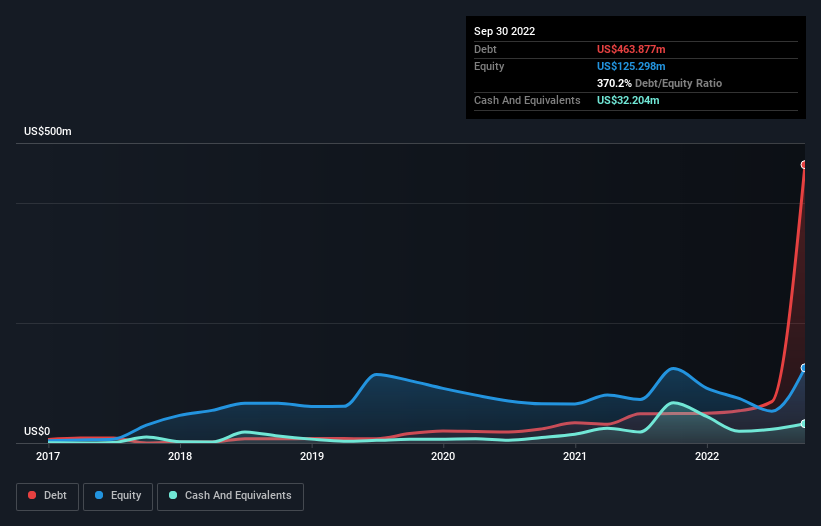

The picture under, which you’ll be able to click on on for better element, exhibits that at September 2022 Chicken Soup for the Soul Entertainment had debt of US$463.9m, up from US$49.0m in a single yr. However, it additionally had US$32.2m in money, and so its internet debt is US$431.7m.

How Strong Is Chicken Soup for the Soul Entertainment’s Balance Sheet?

Zooming in on the newest stability sheet information, we will see that Chicken Soup for the Soul Entertainment had liabilities of US$141.3m due inside 12 months and liabilities of US$650.8m due past that. Offsetting these obligations, it had money of US$32.2m in addition to receivables valued at US$96.1m due inside 12 months. So its liabilities complete US$663.8m greater than the mix of its money and short-term receivables.

The deficiency right here weighs closely on the US$130.2m firm itself, as if a toddler had been struggling underneath the load of an infinite back-pack filled with books, his sports activities gear, and a trumpet. So we undoubtedly suppose shareholders want to look at this one intently. After all, Chicken Soup for the Soul Entertainment would seemingly require a significant re-capitalisation if it needed to pay its collectors at the moment. When analysing debt ranges, the stability sheet is the apparent place to start out. But it’s future earnings, greater than something, that can decide Chicken Soup for the Soul Entertainment’s means to keep up a wholesome stability sheet going ahead. So if you happen to’re centered on the long run you may try this free report showing analyst profit forecasts.

In the final yr Chicken Soup for the Soul Entertainment wasn’t worthwhile at an EBIT stage, however managed to develop its income by 85%, to US$175m. With any luck the corporate will have the ability to develop its method to profitability.

Caveat Emptor

Even although Chicken Soup for the Soul Entertainment managed to develop its high line fairly deftly, the chilly laborious reality is that it’s dropping cash on the EBIT line. Its EBIT loss was a whopping US$60m. Combining this info with the numerous liabilities we already touched on makes us very hesitant about this inventory, to say the least. Of course, it could possibly enhance its scenario expectantly and good execution. But we expect that’s unlikely, given it’s low on liquid property, and burned by US$62m within the final yr. So we expect this inventory is dangerous, like strolling by a grimy canine park with a masks on. There’s little question that we study most about debt from the stability sheet. But finally, each firm can comprise dangers that exist outdoors of the stability sheet. For occasion, we have recognized 2 warning signs for Chicken Soup for the Soul Entertainment that you ought to be conscious of.

If you are eager about investing in companies that may develop income with out the burden of debt, then try this free list of growing businesses that have net cash on the balance sheet.

Valuation is advanced, however we’re serving to make it easy.

Find out whether or not Chicken Soup for the Soul Entertainment is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to convey you long-term centered evaluation pushed by basic information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link