[ad_1]

Even when a enterprise is shedding cash, it is potential for shareholders to become profitable in the event that they purchase an excellent enterprise on the proper worth. For instance, though software-as-a-service enterprise Salesforce.com misplaced cash for years whereas it grew recurring income, should you held shares since 2005, you’d have performed very properly certainly. But whereas the successes are well-known, buyers mustn’t ignore the very many unprofitable firms that merely burn by way of all their money and collapse.

So ought to Technology Metals Australia (ASX:TMT) shareholders be nervous about its money burn? In this text, we outline money burn as its annual (unfavorable) free money stream, which is the sum of money an organization spends annually to fund its development. First, we’ll decide its money runway by evaluating its money burn with its money reserves.

Check out our latest analysis for Technology Metals Australia

Does Technology Metals Australia Have A Long Cash Runway?

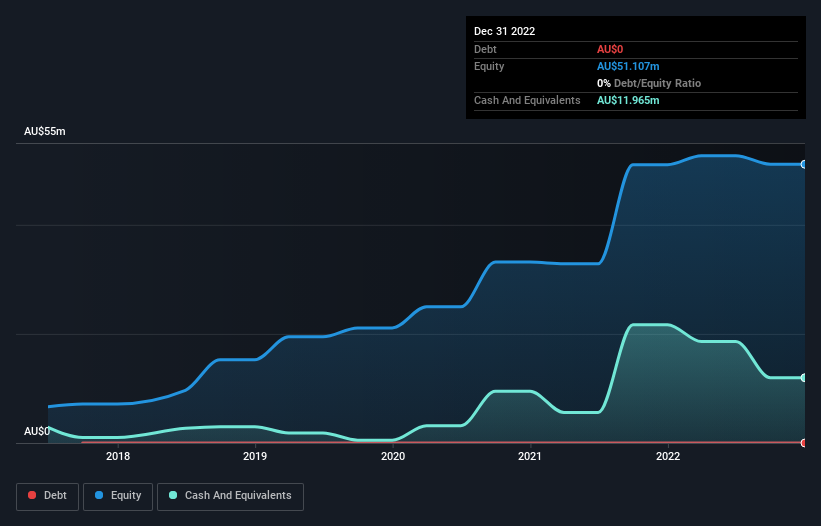

You can calculate an organization’s money runway by dividing the amount of money it has by the speed at which it’s spending that money. When Technology Metals Australia final reported its steadiness sheet in December 2022, it had zero debt and money price AU$12m. Looking on the final 12 months, the corporate burnt by way of AU$1.2m. Therefore, from December 2022 it had 9.6 years of money runway. While this is just one measure of its money burn state of affairs, it actually provides us the impression that holders don’t have anything to fret about. The picture beneath exhibits how its money steadiness has been altering over the previous few years.

How Is Technology Metals Australia’s Cash Burn Changing Over Time?

Technology Metals Australia did not document any income over the past 12 months, indicating that it is an early stage firm nonetheless growing its enterprise. Nonetheless, we are able to nonetheless look at its money burn trajectory as a part of our evaluation of its money burn state of affairs. With money burn dropping by 11% it appears administration really feel the corporate is spending sufficient to advance its enterprise plans at an acceptable tempo. Technology Metals Australia makes us a bit of nervous because of its lack of considerable working income. We desire many of the shares on this list of stocks that analysts expect to grow.

Can Technology Metals Australia Raise More Cash Easily?

While Technology Metals Australia is displaying a stable discount in its money burn, it is nonetheless price contemplating how simply it may increase extra cash, even simply to gas sooner development. Generally talking, a listed enterprise can increase new money by way of issuing shares or taking over debt. Many firms find yourself issuing new shares to fund future development. By evaluating an organization’s annual money burn to its complete market capitalisation, we are able to estimate roughly what number of shares it must challenge with a purpose to run the corporate for an additional 12 months (on the similar burn price).

Since it has a market capitalisation of AU$66m, Technology Metals Australia’s AU$1.2m in money burn equates to about 1.9% of its market worth. So it may virtually actually simply borrow a bit of to fund one other 12 months’s development, or else simply increase the money by issuing a couple of shares.

Is Technology Metals Australia’s Cash Burn A Worry?

As you’ll be able to in all probability inform by now, we’re not too nervous about Technology Metals Australia’s money burn. For instance, we predict its money runway means that the corporate is on an excellent path. Its weak level is its money burn discount, however even that wasn’t too unhealthy! After contemplating a variety of things on this article, we’re fairly relaxed about its money burn, because the firm appears to be in an excellent place to proceed to fund its development. Separately, we checked out totally different dangers affecting the corporate and noticed 4 warning signs for Technology Metals Australia (of which 2 do not sit too properly with us!) it is best to learn about.

Of course Technology Metals Australia might not be the perfect inventory to purchase. So it’s possible you’ll want to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to deliver you long-term targeted evaluation pushed by basic knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link