[ad_1]

Regular readers will know that we love our dividends at Simply Wall St, which is why it is thrilling to see African Media Entertainment Limited (JSE:AME) is about to commerce ex-dividend within the subsequent three days. Typically, the ex-dividend date is one enterprise day earlier than the report date which is the date on which an organization determines the shareholders eligible to obtain a dividend. The ex-dividend date is essential as the method of settlement entails two full enterprise days. So in case you miss that date, you wouldn’t present up on the corporate’s books on the report date. Accordingly, African Media Entertainment traders that buy the inventory on or after the thirteenth of December is not going to obtain the dividend, which can be paid on the nineteenth of December.

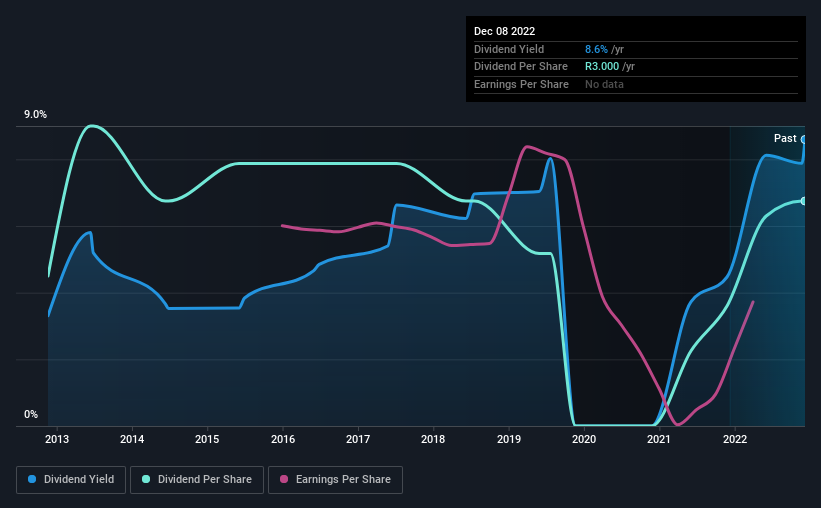

The firm’s subsequent dividend fee can be R1.00 per share, and within the final 12 months, the corporate paid a complete of R2.80 per share. Looking on the final 12 months of distributions, African Media Entertainment has a trailing yield of roughly 8.6% on its present inventory worth of ZAR34.9. Dividends are an essential supply of revenue to many shareholders, however the well being of the enterprise is essential to sustaining these dividends. That’s why we must always all the time test whether or not the dividend funds seem sustainable, and if the corporate is rising.

Check out our latest analysis for African Media Entertainment

Dividends are normally paid out of firm earnings, so if an organization pays out greater than it earned then its dividend is normally at higher danger of being minimize. It paid out 75% of its earnings as dividends final 12 months, which isn’t unreasonable, however limits reinvestment within the enterprise and leaves the dividend susceptible to a enterprise downturn. We’d be frightened concerning the danger of a drop in earnings. Yet money move is often extra essential than revenue for assessing dividend sustainability, so we must always all the time test if the corporate generated sufficient money to afford its dividend. It distributed 34% of its free money move as dividends, a snug payout stage for many firms.

It’s encouraging to see that the dividend is roofed by each revenue and money move. This typically suggests the dividend is sustainable, so long as earnings do not drop precipitously.

Click here to see how much of its profit African Media Entertainment paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are difficult from a dividend perspective. If enterprise enters a downturn and the dividend is minimize, the corporate might see its worth fall precipitously. African Media Entertainment’s earnings per share have fallen at roughly 8.8% a 12 months over the earlier 5 years. Such a pointy decline casts doubt on the long run sustainability of the dividend.

Many traders will assess an organization’s dividend efficiency by evaluating how a lot the dividend funds have modified over time. African Media Entertainment has delivered a median of 4.1% per 12 months annual enhance in its dividend, based mostly on the previous 10 years of dividend funds. That’s attention-grabbing, however the mixture of a rising dividend regardless of declining earnings can usually solely be achieved by paying out extra of the corporate’s earnings. This will be precious for shareholders, however it could possibly’t go on eternally.

To Sum It Up

Has African Media Entertainment obtained what it takes to take care of its dividend funds? The payout ratios are inside an affordable vary, implying the dividend could also be sustainable. Declining earnings are a critical concern, nonetheless, and will pose a menace to the dividend in future. While it does have some good issues going for it, we’re a bit ambivalent and it could take extra to persuade us of African Media Entertainment’s dividend deserves.

If you are not too involved about African Media Entertainment’s means to pay dividends, it is best to nonetheless be conscious of a number of the different dangers that this enterprise faces. We’ve identified 4 warning signs with African Media Entertainment (at least 1 which is potentially serious), and understanding these ought to be a part of your funding course of.

If you are out there for sturdy dividend payers, we suggest checking our selection of top dividend stocks.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to carry you long-term centered evaluation pushed by basic information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link