[ad_1]

Indian Consumer Durable Finance Market

Dublin, March 28, 2024 (GLOBE NEWSWIRE) — The “India Consumer Durable Finance Market, By Region, By Competition Forecast & Opportunities, 2019-2029” report has been added to ResearchAndMarkets.com’s providing.

Robust Growth in India’s Consumer Durable Finance Sector

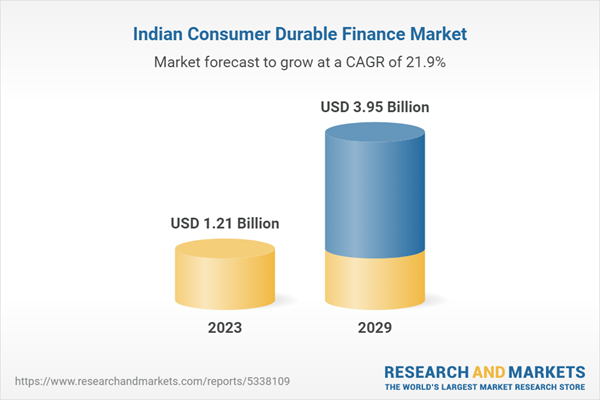

The shopper sturdy finance market in India has witnessed a large progress, accelerating from USD 1.21 billion in 2023 to a forecasted worth of USD 3.95 billion by the top of 2029. This progress trajectory represents a powerful CAGR of 21.85%. In the sunshine of accelerating shopper aspirations, rising buying energy, and the rising penetration of digital finance options, the market continues to exhibit robust progress potential.

Key Drivers of the Market

Foremost among the many components propelling the market ahead are the rising shopper aspirations and enhanced buying energy, particularly amongst India’s burgeoning middle-class demographic. Urbanization, earnings progress, and quickly evolving existence additionally play essential roles in shaping shopper conduct and fueling the demand for high-quality electrical and digital shopper items.

Parallelly, the enlargement of e-commerce and the widespread institution of retail chain shops throughout the nation have made shopper durables extra accessible whereas selling a tradition of aggressive financing choices and tailor-made mortgage merchandise, enormously benefiting customers.

Digital Transformation Catalyzing Market Dynamics

A major contributor to the market’s progress is the continued digital transformation that streamlines the mortgage software course of, integrates e-commerce financing, and allows data-driven credit score scoring. This integration has made shopper sturdy finance extra accessible and enticing to the nation’s digitally savvy populace.

Challenges & Regulatory Environment

While the market outlook is optimistic, challenges nonetheless exist, notably in relation to financial volatility and affordability. Factors reminiscent of earnings disparities, financial uncertainty, and credit score dangers proceed to have an effect on the market’s dynamics. Moreover, regulatory modifications and the necessity to guarantee strict adherence to compliance demand operational resilience from market contributors.

Retail and E-commerce Sectors: A Competitive Landscape

The Indian market has seen a major quantity of competitors come up from each conventional monetary establishments and fintech firms. As these entities vie for market share, adapting to technological developments stays a necessity for delivering the velocity and comfort that prospects now anticipate from digital mortgage companies.

Outlook and Market Development

The sector is ripe for innovation because the demand for premium and good shopper durables soars. Lenders are tailoring their choices to match shopper calls for and technological capabilities, extending mortgage tenures, and crafting product-specific monetary options. Additionally, strategic partnerships between monetary establishments and retail enterprises have paved the way in which for mutually useful collaborations, extending the market’s attain throughout completely different areas of the nation.

Segmental and Regional Market Insights

Smartphones proceed to reign as a principal section, encapsulating a major share of the market. In the urbanized and prosperous South area of India – comprising thriving economies reminiscent of Tamil Nadu and Karnataka – there’s a pronounced demand for shopper durables and related finance choices, underpinning the area’s significance within the market.

Conclusion

The Indian Consumer Durable Finance Market is ready for an upward trajectory, buoyed by a mixture of financial improvement, shopper demand, and advancing applied sciences. As the market presents ample alternatives, it stays a lovely area for funding and progress inside the monetary sector.

Key Attributes

|

Report Attribute |

Details |

|

No. of Pages |

90 |

|

Forecast Period |

2023 – 2029 |

|

Estimated Market Value (USD) in 2023 |

$1.21 Billion |

|

Forecasted Market Value (USD) by 2029 |

$3.95 Billion |

|

Compound Annual Growth Rate |

21.8% |

|

Regions Covered |

India |

A choice of firms talked about on this report consists of, however shouldn’t be restricted to:

-

Bajaj Capital Limited

-

Birla Global Finance Limited

-

Housing Development Finance Corporation

-

ICICI Group

-

LIC Finance Limited

-

L & T Finance Limited

-

Mahindra & Mahindra Financial Services Limited

-

Muthoot Finance Ltd

-

Cholamandalam

-

Tata Capital Financial Services Ltd

For extra details about this report go to https://www.researchandmarkets.com/r/d6ywey

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s main supply for worldwide market analysis stories and market knowledge. We offer you the most recent knowledge on worldwide and regional markets, key industries, the highest firms, new merchandise and the most recent traits.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[adinserter block=”4″]

[ad_2]

Source link