[ad_1]

A landmark normal election in India, scheduled for the summer time of 2024, will see the drivers of financial development shift halfway by means of the yr, in response to Goldman Sachs Research. Overall, regardless of meals and oil provide shocks maintaining inflation elevated, development is forecast to stay steady and resilient.

For 2023, our economists count on actual GDP development to come back in at 6.7% yr on yr, up from our earlier estimate of 6.4%. Among the 13 massive economies in Goldman Sachs Research’s global outlook for 2024, India’s projected development price is the best at 6.2%, with China in second at 4.8%, as of December 18. As the 2024 election approaches, “we expect consumption growth to be driven by subsidies and transfer payments,” write Goldman Sachs Research’s India economists Santanu Sengupta and Arjun Varma. “We have already seen increased allocation towards the rural employment program, higher cooking gas subsidies, and an extension of the food subsidy program.”

After the election, whilst the federal government slows down its capital expenditure, our economists count on non-public funding to speed up. Indian corporations are well-positioned to try this, Sengupta told CNBC. “Bank balance sheets are well-capitalized, manufacturing balance sheets are deleveraged, and we have a China-plus-one tailwind going on,” he stated.

India’s central financial institution isn’t prepared to chop charges within the first half of 2024

This previous yr, after a poor monsoon sparked spikes in meals inflation, the federal government took measures to cushion meals and oil provide shocks to make sure that they didn’t pinch shoppers by feeding into CPI inflation. Exports of rice have been suspended, and subsidies on cooking gasoline and meals have been prolonged. Our economists count on meals inflation to stay excessive within the first half of 2024 and count on headline inflation at 5.4% year-over-year throughout that interval, effectively above the Reserve Bank of India’s goal of 4.0%. For the entire yr, they count on headline inflation at 4.9%, with core inflation at 4.3%.

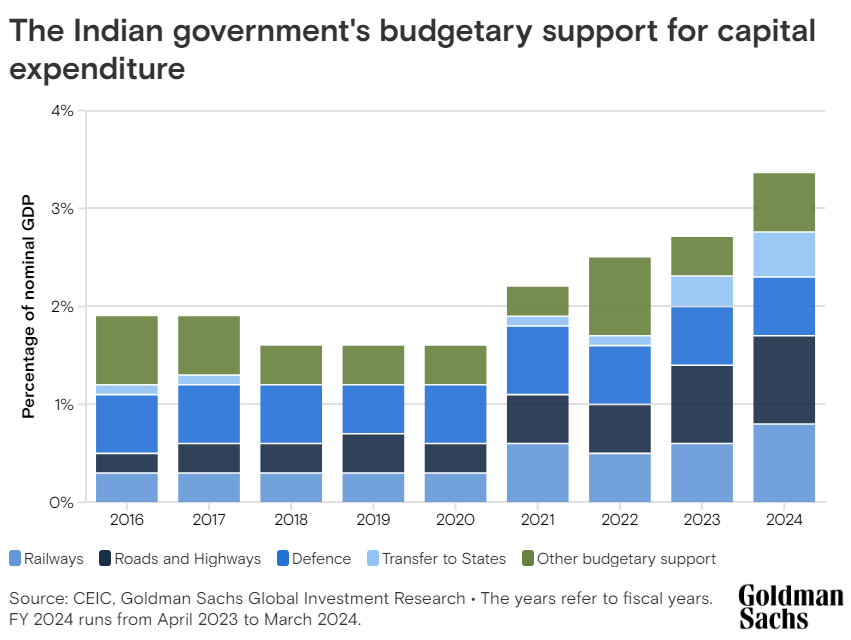

For these causes, Sengupta informed CNBC, the RBI might be sluggish to chop rates of interest. “We have a very shallow rate easing cycle baked into our forecast,” he stated. Our economists count on 25 foundation factors of coverage price cuts every within the third and fourth quarters of 2024. Additionally, they don’t count on the federal government to widen its fiscal deficit. “The growth in government capex seen in the past few years cannot be sustained going forward, in our view,” write Sengupta and Varma. A decline in public capital expenditure as a share of GDP is more likely to accompany different measures aimed toward containing the rise in authorities debt in coming years.

The Indian financial system is well-cushioned towards exterior vulnerabilities

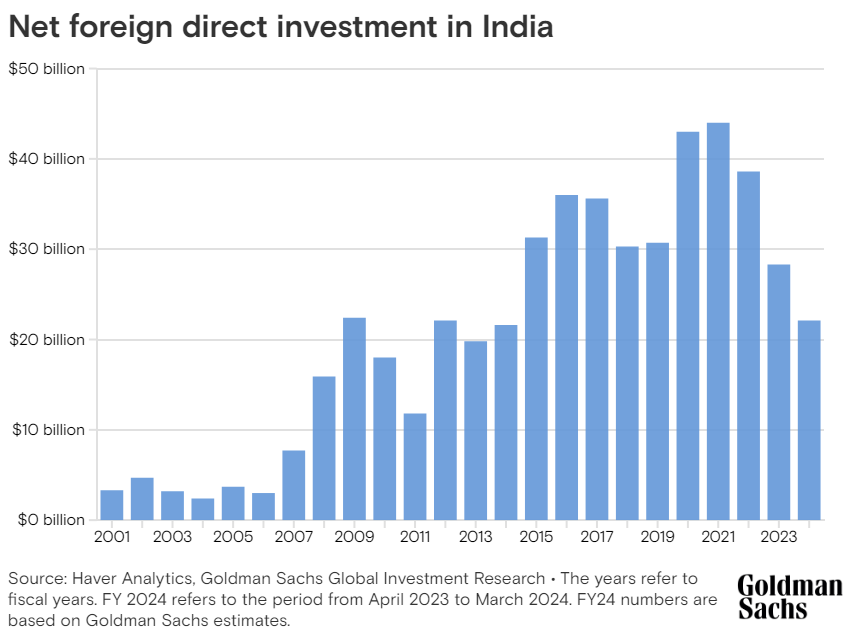

Inflows of overseas direct funding into India are more likely to stay muted, within the view of Goldman Sachs economists; web FDI has fallen sharply from a peak of $44 billion within the fiscal yr 2020-21, and Goldman Sachs Research estimates that it’ll drop decrease to $22.1 billion within the 2023-24 fiscal yr. Slower financial development amongst India’s buying and selling companions has impacted its development of exports in merchandise.

But the export of providers has been strong regardless of weaker demand from western international locations, and though development as a share of GDP might have peaked, Sengupta and Varma write, the sector will cushion India’s huge deficit within the commerce of products.

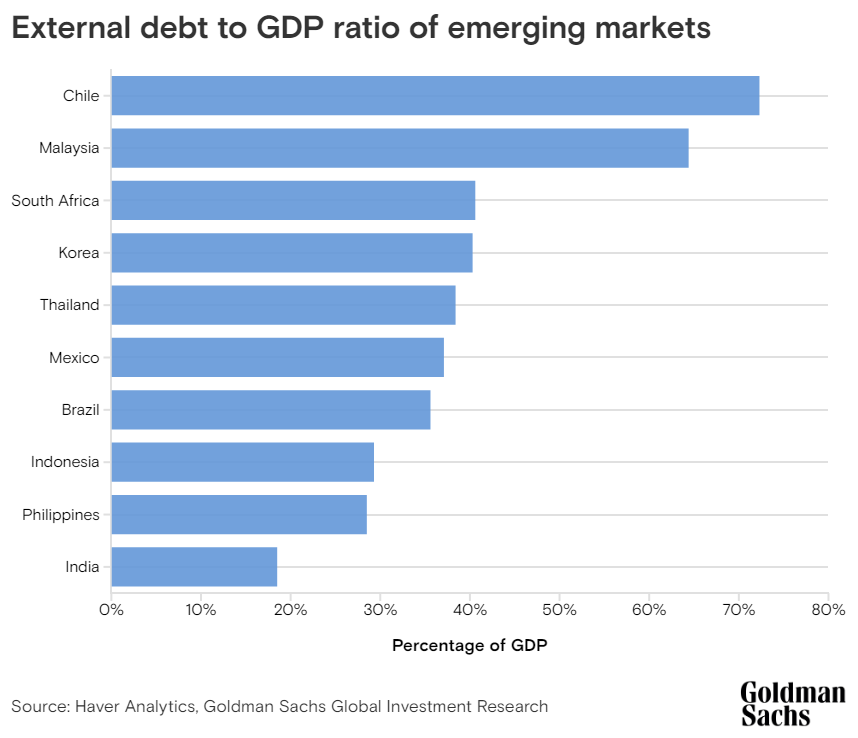

Other facets of India’s exterior obligations seem steady or promising as effectively. India has the bottom external-debt-to-GDP ratio amongst its friends out there: round 18%, in contrast with figures hovering round 40% for South Korea, Thailand, and South Africa. The RBI can also be more likely to proceed intervening within the foreign-exchange market to maintain the Indian rupee in a state of low volatility towards the greenback.

“Overall, it’s a flattish rupee,” Sengupta informed CNBC. The mixture of a friendlier Fed, ongoing disinflation, decrease oil costs, and still-solid US development supplies a extra conducive setting for rising market property and currencies. Accordingly, our economists count on the rupee to stay flat over the subsequent three-six months, and count on it to climb to round 81 to the greenback over a 12-month horizon.

This article is being supplied for academic functions solely. The info contained on this article doesn’t represent a advice from any Goldman Sachs entity to the recipient, and Goldman Sachs just isn’t offering any monetary, financial, authorized, funding, accounting, or tax recommendation by means of this text or to its recipient. Neither Goldman Sachs nor any of its associates makes any illustration or guarantee, specific or implied, as to the accuracy or completeness of the statements or any info contained on this article and any legal responsibility due to this fact (together with in respect of direct, oblique, or consequential loss or harm) is expressly disclaimed.

[adinserter block=”4″]

[ad_2]

Source link