[ad_1]

Investors who take an curiosity in Lions Gate Entertainment Corp. (NYSE:LGF.A) ought to positively word that the CEO & Director, Jon Feltheimer, just lately paid US$9.12 per share to purchase US$456k value of the inventory. That’s a really strong purchase in our guide, and elevated their holding by a noteworthy 13%.

See our latest analysis for Lions Gate Entertainment

Lions Gate Entertainment Insider Transactions Over The Last Year

In the final twelve months, the most important single buy by an insider was when insider John Harkey purchased US$852k value of shares at a worth of US$8.52 per share. Although we prefer to see insider shopping for, we word that this huge buy was at considerably beneath the current worth of US$9.96. While it does recommend insiders take into account the inventory undervalued at decrease costs, this transaction would not inform us a lot about what they consider present costs.

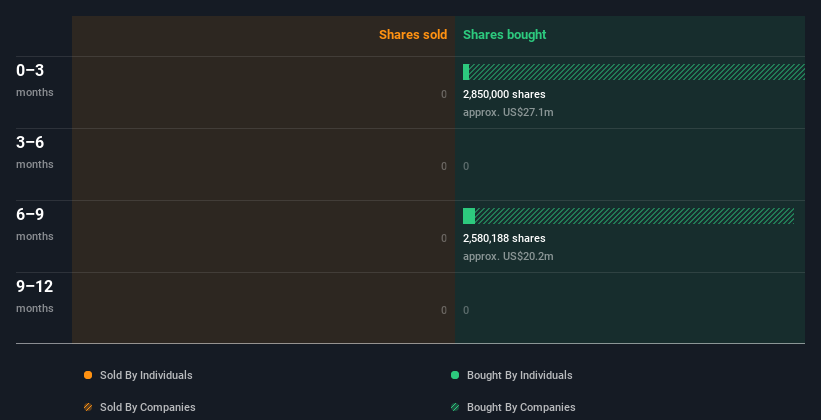

While Lions Gate Entertainment insiders purchased shares over the past 12 months, they did not promote. You can see the insider transactions (by firms and people) over the past 12 months depicted within the chart beneath. If you click on on the chart, you may see all the person transactions, together with the share worth, particular person, and the date!

Lions Gate Entertainment just isn’t the one inventory insiders are shopping for. So take a peek at this free list of growing companies with insider buying.

Insider Ownership

For a standard shareholder, it’s value checking what number of shares are held by firm insiders. We often prefer to see pretty excessive ranges of insider possession. Insiders personal 3.8% of Lions Gate Entertainment shares, value about US$87m. We’ve definitely seen larger ranges of insider possession elsewhere, however these holdings are sufficient to recommend alignment between insiders and the opposite shareholders.

So What Do The Lions Gate Entertainment Insider Transactions Indicate?

The current insider buy is heartening. We additionally take confidence from the long term image of insider transactions. However, we word that the corporate did not make a revenue over the past twelve months, which makes us cautious. When mixed with notable insider possession, these elements recommend Lions Gate Entertainment insiders are properly aligned, and that they might suppose the share worth is simply too low. So whereas it is useful to know what insiders are doing by way of shopping for or promoting, it is also useful to know the dangers {that a} specific firm is going through. To help with this, we have found 2 warning signs that it’s best to run your eye over to get a greater image of Lions Gate Entertainment.

But word: Lions Gate Entertainment might not be the perfect inventory to purchase. So take a peek at this free list of interesting companies with high ROE and low debt.

For the needs of this text, insiders are these people who report their transactions to the related regulatory physique. We presently account for open market transactions and personal tendencies of direct pursuits solely, however not spinoff transactions or oblique pursuits.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to deliver you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link