[ad_1]

Buying shares in one of the best companies can construct significant wealth for you and your loved ones. While not each inventory performs effectively, when traders win, they will win large. Don’t consider it? Then take a look at the JF Technology Berhad (KLSE:JFTECH) share value. It’s 307% increased than it was 5 years in the past. And this is only one instance of the epic good points achieved by some long run traders. And within the final week the share value has popped 9.5%.

With that in thoughts, it is value seeing if the corporate’s underlying fundamentals have been the driving force of long run efficiency, or if there are some discrepancies.

View our newest evaluation for JF Technology Berhad

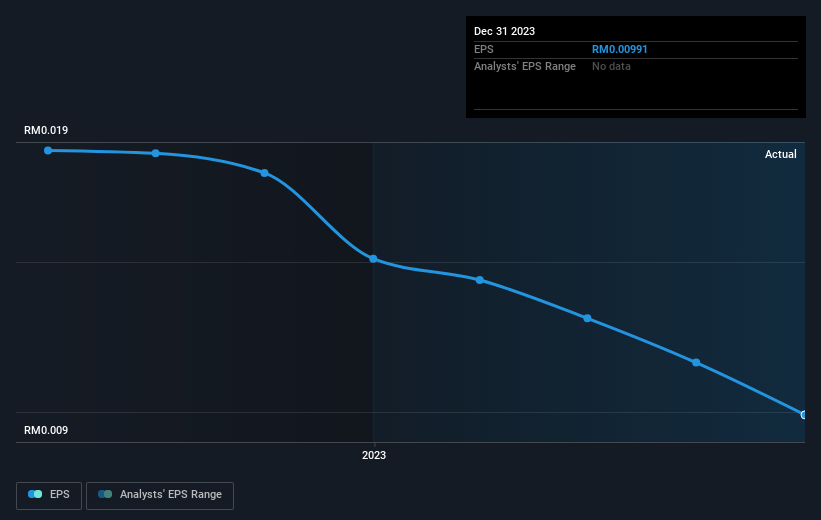

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share costs don’t all the time rationally replicate the worth of a enterprise. By evaluating earnings per share (EPS) and share value adjustments over time, we are able to get a really feel for a way investor attitudes to an organization have morphed over time.

Over half a decade, JF Technology Berhad managed to develop its earnings per share at 54% a yr. The EPS development is extra spectacular than the yearly share value achieve of 32% over the identical interval. So one may conclude that the broader market has turn out to be extra cautious in direction of the inventory. Having stated that, the market continues to be optimistic, given the P/E ratio of 93.38.

You can see how EPS has modified over time within the picture beneath (click on on the chart to see the precise values).

This free interactive report on JF Technology Berhad’s earnings, income and money stream is a superb place to begin, if you wish to examine the inventory additional.

What About Dividends?

When taking a look at funding returns, it is very important contemplate the distinction between whole shareholder return (TSR) and share value return. The TSR is a return calculation that accounts for the worth of money dividends (assuming that any dividend obtained was reinvested) and the calculated worth of any discounted capital raisings and spin-offs. It’s truthful to say that the TSR provides a extra full image for shares that pay a dividend. In the case of JF Technology Berhad, it has a TSR of 322% for the final 5 years. That exceeds its share value return that we beforehand talked about. This is essentially a results of its dividend funds!

A Different Perspective

We’re happy to report that JF Technology Berhad shareholders have obtained a complete shareholder return of 20% over one yr. And that does embrace the dividend. However, that falls wanting the 33% TSR every year it has made for shareholders, annually, over 5 years. Potential patrons would possibly understandably really feel they’ve missed the chance, nevertheless it’s all the time doable enterprise continues to be firing on all cylinders. I discover it very fascinating to have a look at share value over the long run as a proxy for enterprise efficiency. But to really achieve perception, we have to contemplate different data, too. Consider as an illustration, the ever-present spectre of funding threat. We’ve recognized 2 warning indicators with JF Technology Berhad (not less than 1 which is critical) , and understanding them must be a part of your funding course of.

If you’re like me, then you’ll not need to miss this free list of growing companies that insiders are buying.

Please word, the market returns quoted on this article replicate the market weighted common returns of shares that presently commerce on Malaysian exchanges.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by elementary information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link