[ad_1]

Cognizant Technology Solutions’ (NASDAQ:CTSH) inventory is up by a substantial 6.6% over the previous month. Since the market normally pay for an organization’s long-term fundamentals, we determined to check the corporate’s key efficiency indicators to see in the event that they may very well be influencing the market. Specifically, we determined to check Cognizant Technology Solutions’ ROE on this article.

Return on fairness or ROE is a crucial issue to be thought-about by a shareholder as a result of it tells them how successfully their capital is being reinvested. In different phrases, it’s a profitability ratio which measures the speed of return on the capital offered by the corporate’s shareholders.

Check out our latest analysis for Cognizant Technology Solutions

How To Calculate Return On Equity?

The system for ROE is:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, based mostly on the above system, the ROE for Cognizant Technology Solutions is:

16% = US$2.1b ÷ US$13b (Based on the trailing twelve months to September 2023).

The ‘return’ is the quantity earned after tax during the last twelve months. That implies that for each $1 price of shareholders’ fairness, the corporate generated $0.16 in revenue.

Why Is ROE Important For Earnings Growth?

So far, we have discovered that ROE is a measure of an organization’s profitability. Depending on how a lot of those income the corporate reinvests or “retains”, and the way successfully it does so, we’re then capable of assess an organization’s earnings progress potential. Generally talking, different issues being equal, companies with a excessive return on fairness and revenue retention, have the next progress fee than companies that don’t share these attributes.

Cognizant Technology Solutions’ Earnings Growth And 16% ROE

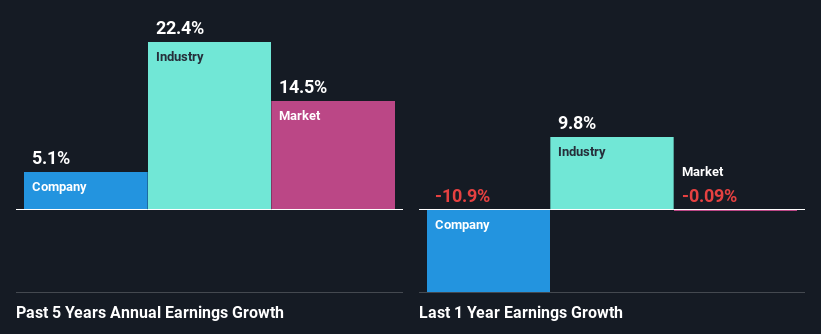

To start with, Cognizant Technology Solutions appears to have a good ROE. Further, the corporate’s ROE compares fairly favorably to the trade common of 13%. This definitely provides some context to Cognizant Technology Solutions’ first rate 5.1% internet revenue progress seen over the previous 5 years.

Next, on evaluating with the trade internet revenue progress, we discovered that Cognizant Technology Solutions’ reported progress was decrease than the trade progress of twenty-two% over the previous couple of years, which isn’t one thing we prefer to see.

Earnings progress is a big think about inventory valuation. The investor ought to attempt to set up if the anticipated progress or decline in earnings, whichever the case could also be, is priced in. By doing so, they’ll have an concept if the inventory is headed into clear blue waters or if swampy waters await. Is CTSH pretty valued? This infographic on the company’s intrinsic value has the whole lot it is advisable know.

Is Cognizant Technology Solutions Making Efficient Use Of Its Profits?

Cognizant Technology Solutions has a wholesome mixture of a average three-year median payout ratio of 26% (or a retention ratio of 74%) and a good quantity of progress in earnings as we noticed above, which means that the corporate has been making environment friendly use of its income.

Moreover, Cognizant Technology Solutions is decided to maintain sharing its income with shareholders which we infer from its lengthy historical past of seven years of paying a dividend. Upon finding out the newest analysts’ consensus knowledge, we discovered that the corporate is predicted to maintain paying out roughly 25% of its income over the subsequent three years. As a consequence, Cognizant Technology Solutions’ ROE shouldn’t be anticipated to vary by a lot both, which we inferred from the analyst estimate of 16% for future ROE.

Summary

Overall, we’re fairly happy with Cognizant Technology Solutions’ efficiency. Particularly, we like that the corporate is reinvesting closely into its enterprise, and at a excessive fee of return. As a consequence, the first rate progress in its earnings is no surprise. That being so, the newest analyst forecasts present that the corporate will proceed to see an growth in its earnings. To know extra in regards to the firm’s future earnings progress forecasts check out this free report on analyst forecasts for the company to find out more.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We intention to deliver you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link