[ad_1]

While some traders are already properly versed in monetary metrics (hat tip), this text is for many who want to study Return On Equity (ROE) and why it will be significant. To hold the lesson grounded in practicality, we’ll use ROE to raised perceive GrafTech International Ltd. (NYSE:EAF).

Return on fairness or ROE is a key measure used to evaluate how effectively an organization’s administration is using the corporate’s capital. Put one other means, it reveals the corporate’s success at turning shareholder investments into earnings.

View our latest analysis for GrafTech International

How To Calculate Return On Equity?

Return on fairness will be calculated through the use of the formulation:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, primarily based on the above formulation, the ROE for GrafTech International is:

76% = US$251m ÷ US$330m (Based on the trailing twelve months to March 2023).

The ‘return’ is the yearly revenue. One option to conceptualize that is that for every $1 of shareholders’ capital it has, the corporate made $0.76 in revenue.

Does GrafTech International Have A Good Return On Equity?

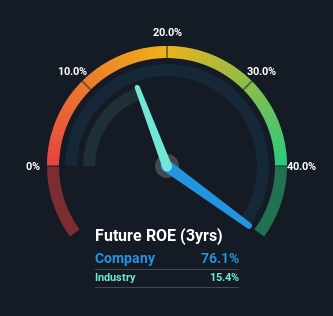

By evaluating an organization’s ROE with its business common, we will get a fast measure of how good it’s. However, this technique is just helpful as a tough examine, as a result of corporations do differ fairly a bit inside the identical business classification. As is evident from the picture beneath, GrafTech International has a greater ROE than the common (15%) within the Electrical industry.

That’s what we prefer to see. With that stated, a excessive ROE does not all the time point out excessive profitability. Aside from adjustments in internet earnings, a excessive ROE will also be the end result of excessive debt relative to fairness, which signifies danger.

How Does Debt Impact ROE?

Companies often want to take a position cash to develop their earnings. That money can come from retained earnings, issuing new shares (fairness), or debt. In the primary two circumstances, the ROE will seize this use of capital to develop. In the latter case, the usage of debt will enhance the returns, however won’t change the fairness. That will make the ROE look higher than if no debt was used.

GrafTech International’s Debt And Its 76% ROE

It’s value noting the excessive use of debt by GrafTech International, resulting in its debt to fairness ratio of two.79. Its ROE is fairly spectacular however, it will have most likely been decrease with out the usage of debt. Debt does convey further danger, so it is solely actually worthwhile when an organization generates some first rate returns from it.

Conclusion

Return on fairness is a method we will evaluate its enterprise high quality of various corporations. In our books, the very best high quality corporations have excessive return on fairness, regardless of low debt. If two corporations have the identical ROE, then I might usually choose the one with much less debt.

But ROE is only one piece of a much bigger puzzle, since prime quality companies usually commerce on excessive multiples of earnings. Profit development charges, versus the expectations mirrored within the worth of the inventory, are a very vital to think about. So you may wish to take a peek at this data-rich interactive graph of forecasts for the company.

Of course GrafTech International will not be the very best inventory to purchase. So chances are you’ll want to see this free collection of other companies that have high ROE and low debt.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to convey you long-term targeted evaluation pushed by basic knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link