[ad_1]

Let’s discuss concerning the standard Marvell Technology, Inc. (NASDAQ:MRVL). The firm’s shares noticed an honest share value progress of 17% on the NASDAQGS over the previous few months. Shareholders might respect the latest value bounce, however the firm nonetheless has a option to go earlier than reaching its yearly highs once more. With many analysts masking the large-cap inventory, we might anticipate any price-sensitive bulletins have already been factored into the inventory’s share value. However, what if the inventory remains to be a discount? Let’s look at Marvell Technology’s valuation and outlook in additional element to find out if there’s nonetheless a discount alternative.

See our latest analysis for Marvell Technology

What Is Marvell Technology Worth?

According to our valuation mannequin, the inventory is presently overvalued by about 23%, buying and selling at US$70.16 in comparison with our intrinsic worth of $56.83. This signifies that the shopping for alternative has most likely disappeared for now. But, is there one other alternative to purchase low sooner or later? Given that Marvell Technology’s share is pretty unstable (i.e. its value actions are magnified relative to the remainder of the market) this might imply the worth can sink decrease, giving us one other probability to purchase sooner or later. This relies on its excessive beta, which is an effective indicator for share value volatility.

Can we anticipate progress from Marvell Technology?

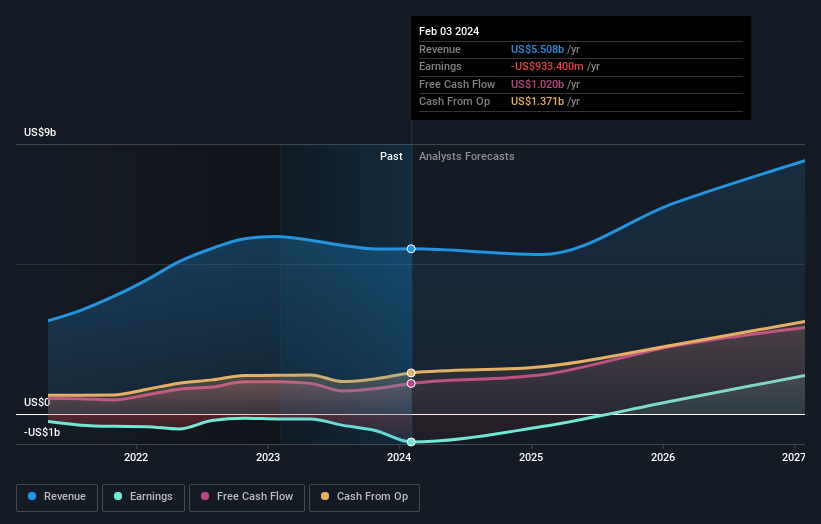

Future outlook is a crucial facet while you’re looking to buy a inventory, particularly if you’re an investor in search of progress in your portfolio. Buying an amazing firm with a strong outlook at an affordable value is at all times a great funding, so let’s additionally check out the corporate’s future expectations. In the upcoming yr, Marvell Technology’s earnings are anticipated to extend by 56%, indicating a extremely optimistic future forward. This ought to result in extra strong money flows, feeding into a better share worth.

What This Means For You

Are you a shareholder? It looks as if the market has nicely and actually priced in MRVL’s constructive outlook, with shares buying and selling above its honest worth. However, this brings up one other query – is now the proper time to promote? If you consider MRVL ought to commerce under its present value, promoting excessive and shopping for it again up once more when its value falls in direction of its actual worth could be worthwhile. But earlier than you make this resolution, check out whether or not its fundamentals have modified.

Are you a possible investor? If you’ve been retaining tabs on MRVL for a while, now is probably not the very best time to enter into the inventory. The value has surpassed its true worth, which implies there’s no upside from mispricing. However, the constructive outlook is encouraging for MRVL, which implies it’s price diving deeper into different components as a way to benefit from the following value drop.

Diving deeper into the forecasts for Marvell Technology talked about earlier will assist you perceive how analysts view the inventory going ahead. At Simply Wall St, we have now the analysts estimates which you can view by clicking here.

If you’re now not eager about Marvell Technology, you need to use our free platform to see our listing of over 50 other stocks with a high growth potential.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to convey you long-term centered evaluation pushed by basic information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link