[ad_1]

After a one directional move since the March bottom, the major indices HAVE started showing some fatigue. The tech heavy indices took the brunt of the bear attack. Is the rebound from the March lows over or is this just a pause that refreshes? We break down the key things we are watching and why the risk may be overly concentrated in just one place.

Fear Remains Extremely Muted

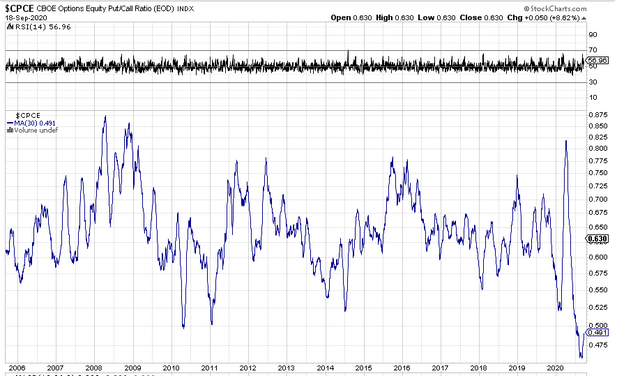

We watch a number of indicators that gauge the average amount of fear that investors are experiencing. The first one we look at is the moving average of the equity-only put-call ratio. When this is low, it implies complacency, and when it is high, it implies investors are panicking en masse.

The 30-day moving average of the put-call ratio is still at one of the lowest levels ever.

Source: StockCharts

In fact, the only time it has been lower was in the last three weeks. This suggests that there is a lot more corrective work to be done.

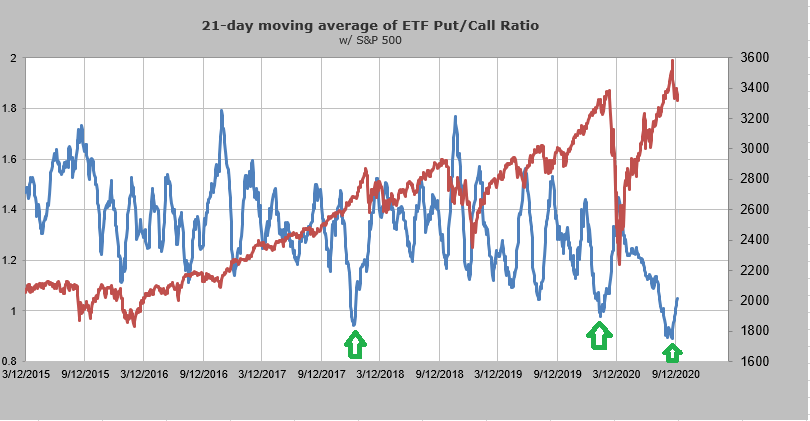

The second gauge we look at is the 21-day moving average of the ETF put-call ratio. This one is presented below, overlaid with the stock market index (SPY). No prizes for guessing which line in the chart represents SPY.

Source: Helene Meisler

What is interesting here is that the current levels are on par with where the big declines of February 2020 actually began.

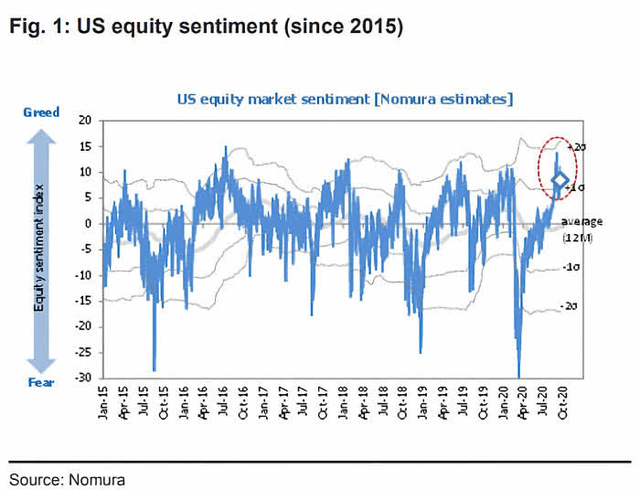

Finally, our third indicator, Nomura’s overall equity market sentiment gauge has also just come off its peak.

We can see that when it gets to the +20 range, it invariably bottoms by hitting the minus 15-20 range. Again, another metric showing we have a long way to go.

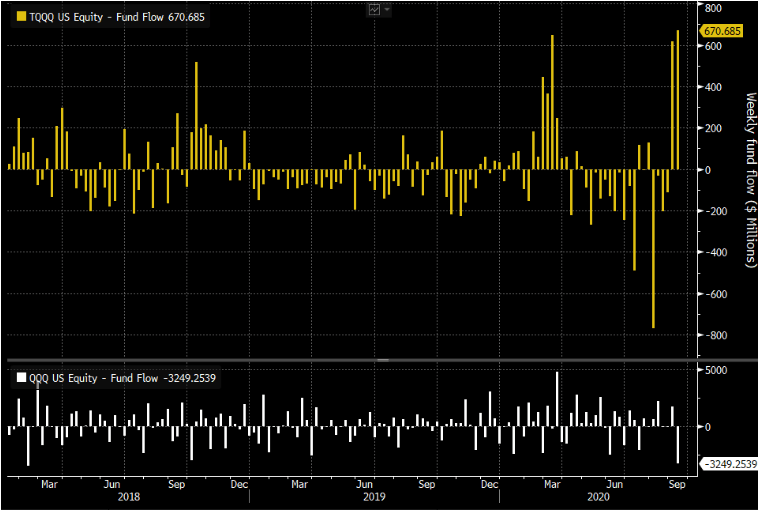

Money Flow Gauges

While put call and other sentiment indicators are useful, we also like to see how investors are acting with their cash. In that department, we found some similar fearless behavior. For starters, they have piled in over $1.2 billion in the last two weeks into the ProShares UltraPro ETF (TQQQ).

Source: Bloomberg

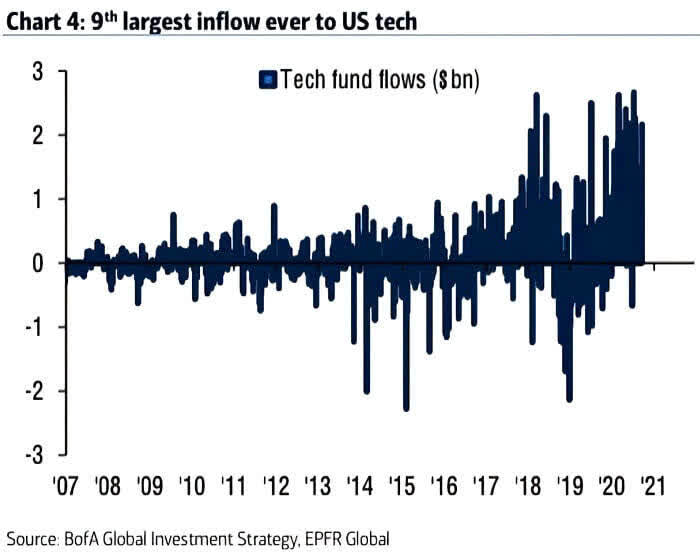

For the month of August, total inflows into technology funds were the ninth largest in the history of the data.

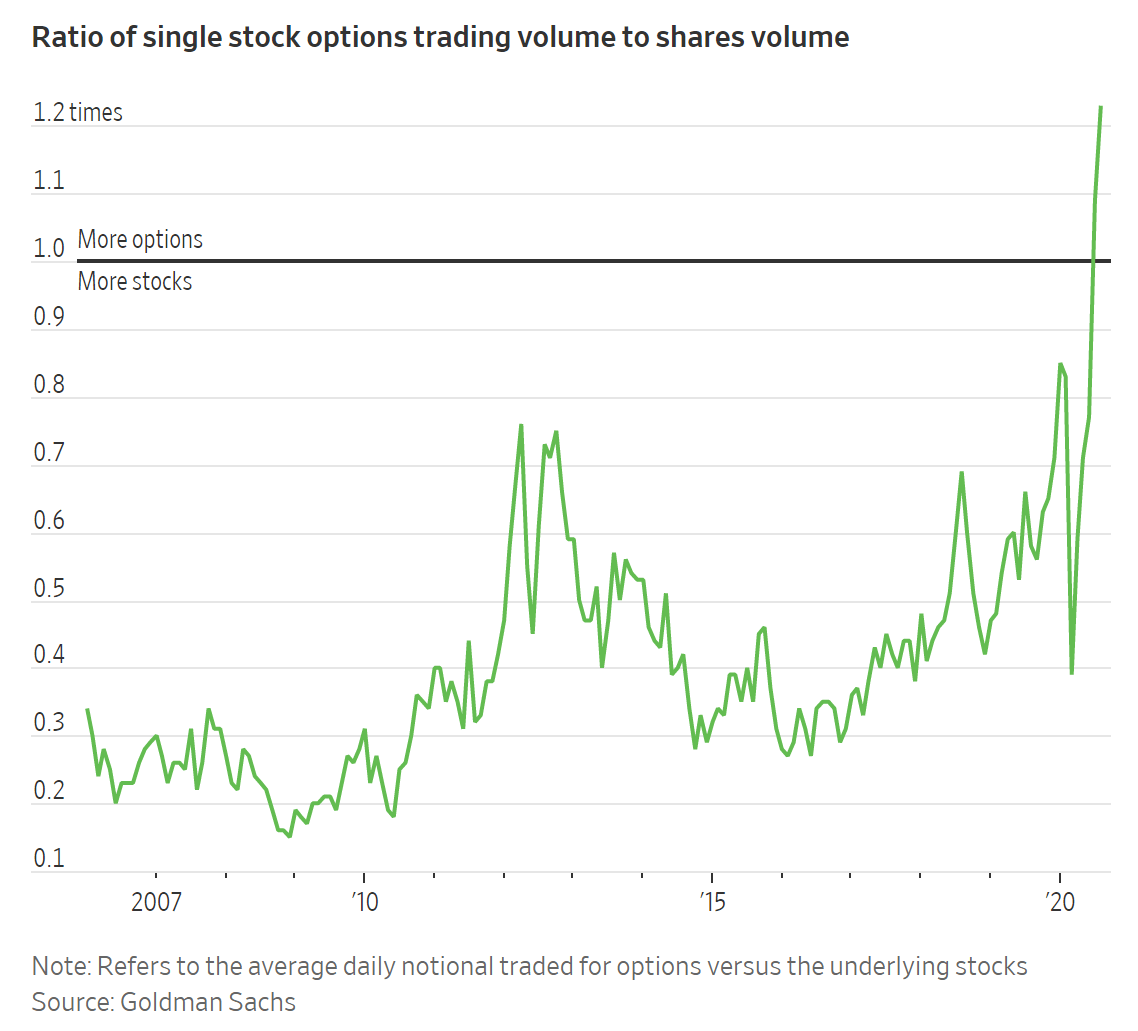

We also see that single stock option volumes have exploded up to all-time highs. Levels again suggestive that a lot more corrective work needs to be done.

All these data points show that investors have embraced the “technology only goes up” mantra and likely to face some more turbulent times as sentiment resets.

Insiders Laughing All The Way To The Bank

Back in late March we brought this chart to the attention of our readers. Insiders were loading up in droves.

Across the world, insiders saw cheap stock prices and bought stock like they never had. That was a strong buy signal. Today they are selling and selling hard.

The last time they sold with such fervor, stocks struggled for the next few months.

Source: StockCharts

Fundamentals

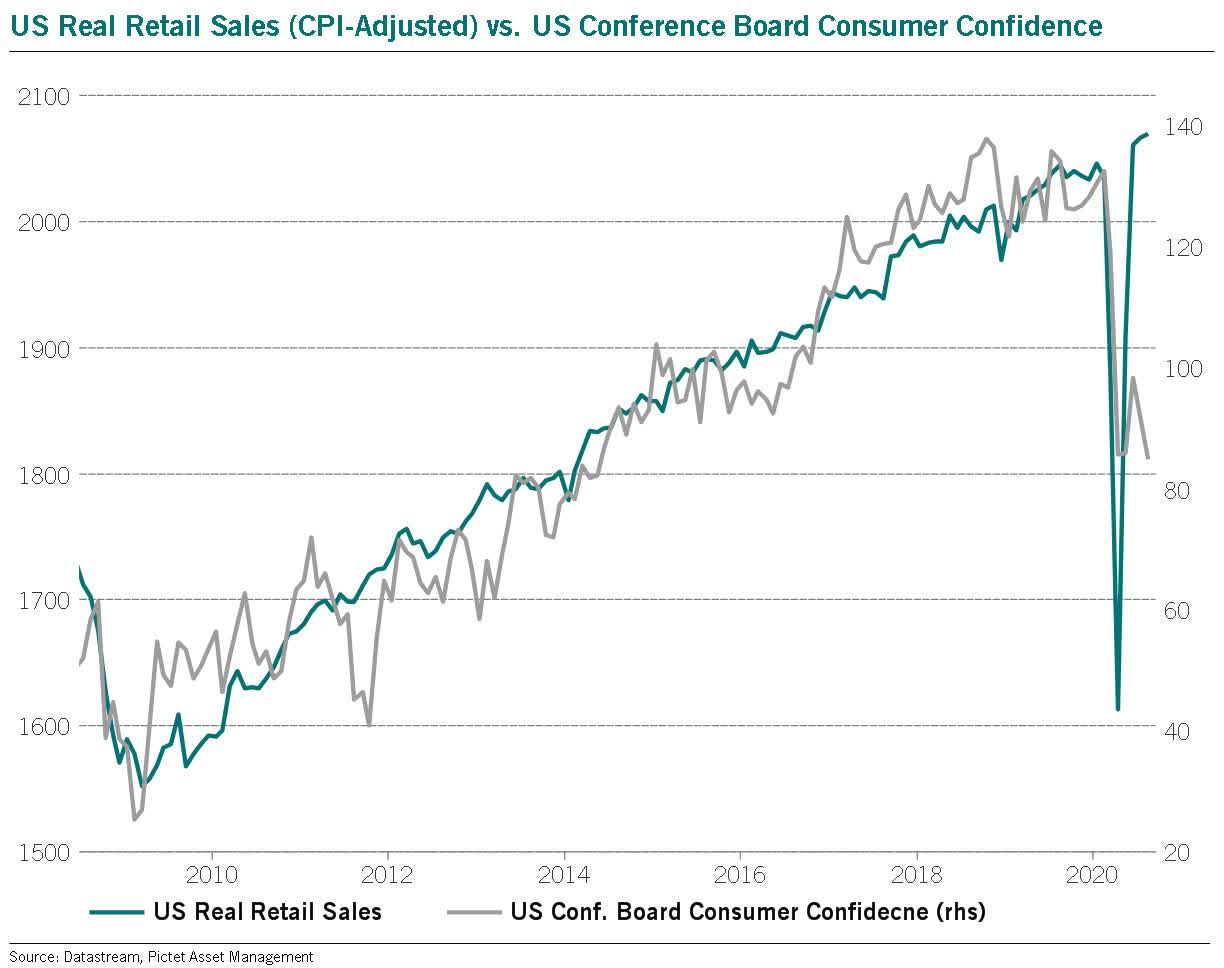

While there are many gauges to assess fundamentals, one that we think is most relevant for today’s markets the US Real Retail Sales versus Consumer Confidence. Historically, the two have tracked each other very closely. Until now.

There is one fundamental reason for this gigantic gap and that is the large transfer payments from the US government to individuals. In other words, spending is way out of line with what the consumer confidence would dictate and that is because they have had access to boatloads of government money. That giant gap which was opened up will close over time, either from consumer confidence bouncing, sales declining or a combination of the two. As the impact of the last stimulus bill is fast fading, the next round of stimulus will be critical. That stimulus looks increasingly more likely for 2021 than 2020 though.

Source: Good Judgement Project

Conclusion

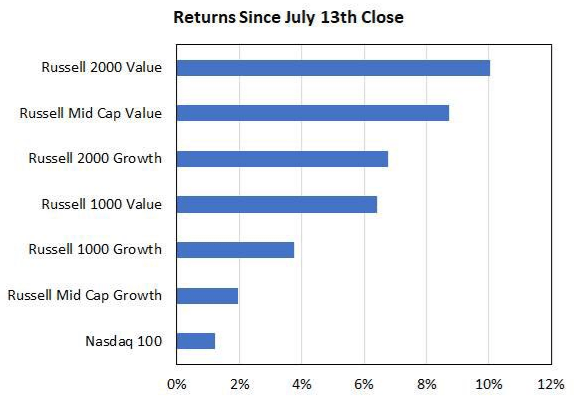

The biggest bullish point from our vantage is that value is finally beginning to dial up the heat.

This could of course be another false start, but the enthusiasm with which investors have continued to pile into technology on this decline makes us think we have finally made a big turn. For now, however, we are remaining patient and picking up select value plays using cash secured puts.

If you enjoyed this article, please scroll up and click on the “Follow” button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the “Follow” button next to my name to not miss my future articles.

Disclosure: I am/we are short QQQ, SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

[ad_2]

Source link