[ad_1]

The worst end result, after shopping for shares in an organization (assuming no leverage), can be for those who lose all the cash you place in. But on the brilliant facet, for those who purchase shares in a top quality firm on the proper worth, you’ll be able to acquire properly over 100%. One nice instance is Micron Technology, Inc. (NASDAQ:MU) which noticed its share worth drive 119% larger over 5 years. In the final week shares have slid again 1.3%.

Now it is price taking a look on the firm’s fundamentals too, as a result of that may assist us decide if the long run shareholder return has matched the efficiency of the underlying enterprise.

Check out our latest analysis for Micron Technology

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share costs don’t at all times rationally replicate the worth of a enterprise. One approach to look at how market sentiment has modified over time is to have a look at the interplay between an organization’s share worth and its earnings per share (EPS).

During 5 years of share worth development, Micron Technology really noticed its EPS drop 30% per 12 months.

This means it is unlikely the market is judging the corporate primarily based on earnings development. Since the change in EPS would not appear to correlate with the change in share worth, it is price looking at different metrics.

We doubt the modest 0.6% dividend yield is attracting many patrons to the inventory. It just isn’t nice to see that income has dropped by 2.6% per 12 months over 5 years. It definitely surprises us that the share worth is up, however maybe a more in-depth examination of the information will yield solutions.

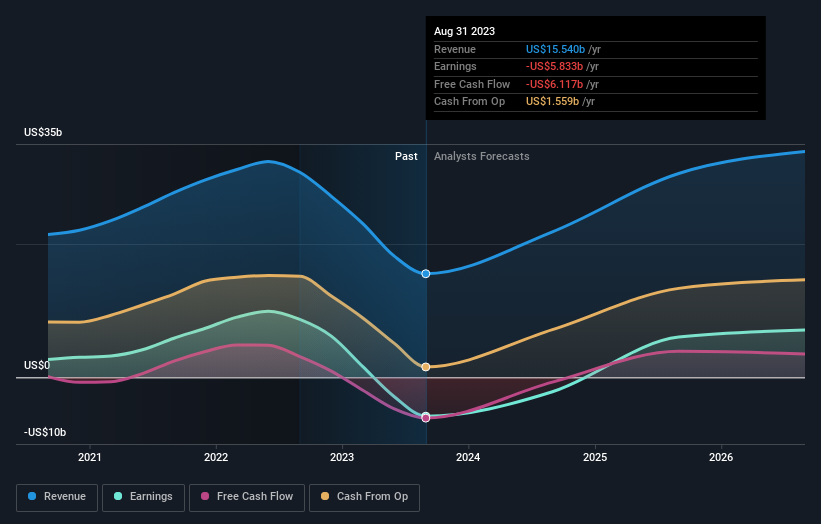

You can see under how earnings and income have modified over time (uncover the precise values by clicking on the picture).

Micron Technology is well-known by traders, and loads of intelligent analysts have tried to foretell the longer term revenue ranges. Given we now have fairly a great variety of analyst forecasts, it is perhaps properly price testing this free chart depicting consensus estimates.

What About Dividends?

When taking a look at funding returns, it is very important contemplate the distinction between whole shareholder return (TSR) and share worth return. The TSR incorporates the worth of any spin-offs or discounted capital raisings, together with any dividends, primarily based on the belief that the dividends are reinvested. So for firms that pay a beneficiant dividend, the TSR is commonly quite a bit larger than the share worth return. In the case of Micron Technology, it has a TSR of 123% for the final 5 years. That exceeds its share worth return that we beforehand talked about. The dividends paid by the corporate have thusly boosted the whole shareholder return.

A Different Perspective

It’s good to see that Micron Technology shareholders have acquired a complete shareholder return of 38% over the past 12 months. Of course, that features the dividend. That acquire is best than the annual TSR over 5 years, which is 17%. Therefore it looks like sentiment across the firm has been optimistic currently. In the perfect case state of affairs, this will likely trace at some actual enterprise momentum, implying that now could possibly be a good time to delve deeper. Before spending extra time on Micron Technology it might be wise to click here to see if insiders have been buying or selling shares.

But observe: Micron Technology might not be the perfect inventory to purchase. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please observe, the market returns quoted on this article replicate the market weighted common returns of shares that presently commerce on American exchanges.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to carry you long-term centered evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link