[ad_1]

India Residential Construction Market Number Of Homes Sold In India

Dublin, March 08, 2024 (GLOBE NEWSWIRE) — The “India Residential Construction – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2019 – 2029” report has been added to ResearchAndMarkets.com’s providing.

The India Residential Construction Market measurement is estimated at USD 189.80 billion in 2024, and is predicted to achieve USD 272.67 billion by 2029, rising at a CAGR of seven.51% throughout the forecast interval 2024-2029.

The price of uncooked supplies in India was on the rise, and because the COVID-19 pandemic, the fee saved growing. A purpose behind this enhance in the price of uncooked supplies is the scarcity of provide of uncooked supplies due to the disruptive provide chain. Along with these, there has additionally been the introduction of a number of taxes by the state governments on these supplies which might be additionally contributing to the growing prices. The shortage of constructing supplies raises the price of total development, which is projected to hamper the expansion of the Indian residential development market.

The authorities’s flagship initiative, the Pradhan Mantri Awas Yojana (Urban), which was launched in June 2015, aimed to supply housing for all in city areas. To make the market extra accessible to small and retail traders, the Securities and Exchange Board of India has lowered the minimal utility worth for Real Estate Investment Trusts (REITs) from INR 50,000 (USD 611.14) to INR 10,000-15,000 (USD 122.23-183.34). As a outcome, residence gross sales quantity in seven main Indian cities accelerated by 113% year-on-year within the third quarter of 2021. Private fairness funding inflows into India’s actual property sector totaled USD 3.3 billion within the first half of FY21-22. The high three cities, Mumbai (39%), Delhi (19%), and Bengaluru (19%), collectively attracted practically 77% of the full investments.

Under the Pradhan Mantri Awas Yojana, the Indian authorities sanctioned the development of three.61 lakh properties in November 2021. In addition, with the clearance of the brand new housing models, 1.14 crore properties have been authorized for this system. It is anticipated that the Indian Government’s inexpensive housing program will proceed to help the expansion of the residential development sector from a short- to medium-term perspective, which is able to subsequently help the expansion of India’s residential development trade. The central authorities is anticipated to approve extra housing models beneath the PMAY scheme over the following 4 to eight quarters.

Need for Affordable Housing is Driving the Market

Indian governments, since independence have targeted on the problem of inexpensive housing within the context of poverty discount. In 2015, the federal government introduced a housing program that geared toward offering a protected residence to each Indian. Furthermore, the introduction of Real Estate Regulation Authorities in 2017 is supposed to extend transparency out there and strengthen the rights of patrons. As of May 2022, there have been over a million housing models accomplished throughout the north Indian state of Uttar Pradesh throughout the Housing for All (HFA) program since 2014. In the monetary yr 2022, the federal government of India allotted 200 billion Indian rupees (USD 2.44 billion) for Pradhan Mantri Awaas Yojana-Gramin.

The nationwide 2021 Budget, together with INR 50,000 crore (USD 6111.43 billion) allotted to the Ministry of Housing and Urban Development (MoHUA) and the creation of a 3.5 billion USD fund to help the completion of stalled housing initiatives, there’s robust authorities help for the housing sector on the nationwide degree. In India, the place urbanization is predicted to extend from 33% to over 40% of the inhabitants by 2030, there will probably be a necessity for 25 million additional mid-range and cheap housing models, in keeping with Invest India. In 2022, the full variety of accomplished homes in city areas of India beneath the Pradhan Mantri Awas Yojana (PMAY, The Prime Minister’s Housing Plan) reached 5.4 million. The demand for housing amenities for the city poor lies at round 11 million housing complexes in 2020.

Moreover, the trade has benefited from the push for coverage that has resulted in laws just like the Real Estate Regulatory Authority (RERA), the introduction of Real Estate Investment Trusts (REITs), and SWAMIH (Special Window for Completion of Construction of Affordable and Mid-Income Housing Projects). It is anticipated that elevated spending on residential initiatives by the state and central governments will proceed to spice up trade development over the forecast interval within the nation.

Increasing Investments in Residential Property Drives the Market

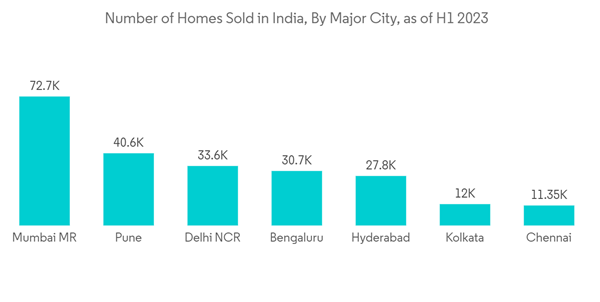

India has seen super city progress. It is estimated that by 2030, greater than 400 million folks will probably be residing in cities in India. The demand for residential properties has been fuelled by India’s increasing city inhabitants, rising family incomes, and decade-long low mortgage charges, which have elevated gross sales quantity. In the primary half of 2022, round 44 thousand housing models had been offered in Mumbai, India’s most demanding residential housing market. There was a complete of 158,705 residential properties offered throughout the interval.

In 2021, over 232 thousand housing models had been launched on the residential market throughout India. Even although there’s a large demand for housing within the nation, residential launches have been on a relatively excessive degree over the previous few years. Moreover, in 2021, Hyderabad recorded a rise in housing launches within the residential market of India by 179 %. The nationwide capital area of Delhi recorded 110 % extra launches than in 2020.

Mumbai Metropolitan Region recorded the best residential property launches in Q1 2022. The metropolis alone accounted for 92 % quarter-on-quarter and 126 % year-on-year change and launched greater than 28,000 new housing models in Q1 2022 as in opposition to 12,000 in Q1 2021. In the primary quarter of 2022, East Pune noticed the utmost variety of new residential models and accounted for 28 % of the full new undertaking launches. The monetary and know-how hub of India, Gurugram, launched about 3,800+ new residential models in Q1, 2022 (witnessing quarterly development of 35 %). The metropolis consists of 5 main zones, together with Golf Course Road, New Gurgaon, Central Gurgaon, Southern Peripheral Road, and Dwarka Expressway.

Hyderabad is among the high contributors, accounting for an 83 % year-on-year enhance within the variety of new launches within the latest quarter. Of all zones within the metropolis, West Hyderabad furnished the utmost variety of homes, which accounted for 52 % of the full launches within the metropolis. This was adopted by North Hyderabad, which comprised about one-third of the full new initiatives launched within the metropolis throughout Q1 2022. East Bengaluru witnessed the best variety of new residential property launches with 52 % share, adopted by North Bengaluru.

India Residential Construction Industry Overview

The Indian residential development market has change into more and more aggressive and fragmented, with a lot of native and regional gamers and some world gamers. Some of the most important gamers in India embody Delhi Land & Finance, Merlin Group, StepsStone Builders, Godrej Properties Limited, Prestige Group, and plenty of others. Key gamers are increasing their initiatives to satisfy the growing demand from finish customers.

Key Topics Covered:

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

4.1 Current Market Scenario

4.2 Technological Innovations within the Residential Construction Sector

4.3 Industry Value Chain/Supply Chain Analysis

4.4 Government Initiatives and Regulatory Aspects within the Indian Residential Construction Market

4.5 Insights into Rental Yields

4.6 Insights into Affordable Housing Support Provided by Government and Public-private Partnerships

4.7 Insights into Services allied to Construction (Design and Engineering, Fit-out Services, Facility administration, and many others.)

4.8 Insights into Costs Related to Construction and Building Materials

4.9 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

5.1 Market Drivers

5.1.1 Government Initiatives Promoting Affordable Housing

5.1.2 Economic Growth and Rising Disposable Incomes

5.2 Market Restraints/Challenges

5.2.1 Shortage of Skilled Labor

5.2.2 Fluctuating Construction Materials Costs

5.3 Market Opportunities

5.3.1 Growing Awareness of Sustainable and Energy Efficient Construction Practices

5.3.2 Surge in Renovation and Retrofitting Projects

5.4 Industry Attractiveness – Porter’s Five Forces Analysis

6 MARKET SEGMENTATION

6.1 By Type

6.1.1 Apartments and Condominiums

6.1.2 Villas

6.1.3 Other Types

6.2 By Construction Type

6.2.1 New Construction

6.2.2 Renovation

7 COMPETITIVE LANDSCAPE

7.1 Overview (Market Concentration and Major Players)

7.2 Company Profiles

8 FUTURE OF THE MARKET

For extra details about this report go to https://www.researchandmarkets.com/r/skymc5

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s main supply for worldwide market analysis experiences and market information. We give you the most recent information on worldwide and regional markets, key industries, the highest corporations, new merchandise and the most recent traits.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[adinserter block=”4″]

[ad_2]

Source link