[ad_1]

If we need to discover a inventory that might multiply over the long run, what are the underlying tendencies we must always search for? Amongst different issues, we’ll need to see two issues; firstly, a rising return on capital employed (ROCE) and secondly, an growth within the firm’s quantity of capital employed. Basically because of this an organization has worthwhile initiatives that it could actually proceed to reinvest in, which is a trait of a compounding machine. With that in thoughts, we have observed some promising tendencies at Nine Entertainment Holdings (ASX:NEC) so let’s look a bit deeper.

What Is Return On Capital Employed (ROCE)?

For those that do not know, ROCE is a measure of an organization’s yearly pre-tax revenue (its return), relative to the capital employed within the enterprise. Analysts use this system to calculate it for Nine Entertainment Holdings:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.11 = AU$348m ÷ (AU$4.0b – AU$849m) (Based on the trailing twelve months to December 2023).

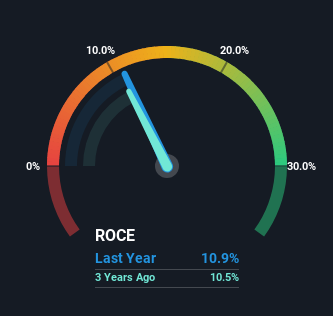

Therefore, Nine Entertainment Holdings has an ROCE of 11%. In absolute phrases, that is a passable return, however in comparison with the Media trade common of 8.6% it is significantly better.

See our latest analysis for Nine Entertainment Holdings

In the above chart we now have measured Nine Entertainment Holdings’ prior ROCE towards its prior efficiency, however the future is arguably extra essential. If you are , you may view the analysts predictions in our free analyst report for Nine Entertainment Holdings .

What The Trend Of ROCE Can Tell Us

Nine Entertainment Holdings’ ROCE progress is kind of spectacular. More particularly, whereas the corporate has stored capital employed comparatively flat during the last 5 years, the ROCE has climbed 22% in that very same time. So it is probably that the enterprise is now reaping the total advantages of its previous investments, for the reason that capital employed hasn’t modified significantly. The firm is doing properly in that sense, and it is price investigating what the administration staff has deliberate for long run progress prospects.

The Bottom Line

To sum it up, Nine Entertainment Holdings is accumulating larger returns from the identical quantity of capital, and that is spectacular. Since the inventory has solely returned 27% to shareholders during the last 5 years, the promising fundamentals is probably not acknowledged but by buyers. Given that, we would look additional into this inventory in case it has extra traits that might make it multiply in the long run.

Like most firms, Nine Entertainment Holdings does include some dangers, and we have discovered 4 warning signs that you ought to be conscious of.

While Nine Entertainment Holdings is not incomes the very best return, take a look at this free list of companies that are earning high returns on equity with solid balance sheets.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to convey you long-term centered evaluation pushed by basic knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link