[ad_1]

The most you possibly can lose on any inventory (assuming you do not use leverage) is 100% of your cash. But on the intense aspect, you can also make excess of 100% on a very good inventory. For occasion, the worth of PMB Technology Berhad (KLSE:PMBTECH) inventory is up a powerful 299% during the last 5 years. In the final week the share worth is up 3.1%.

With that in thoughts, it is price seeing if the corporate’s underlying fundamentals have been the motive force of long run efficiency, or if there are some discrepancies.

See our latest analysis for PMB Technology Berhad

There is not any denying that markets are typically environment friendly, however costs don’t at all times replicate underlying enterprise efficiency. One flawed however affordable approach to assess how sentiment round an organization has modified is to match the earnings per share (EPS) with the share worth.

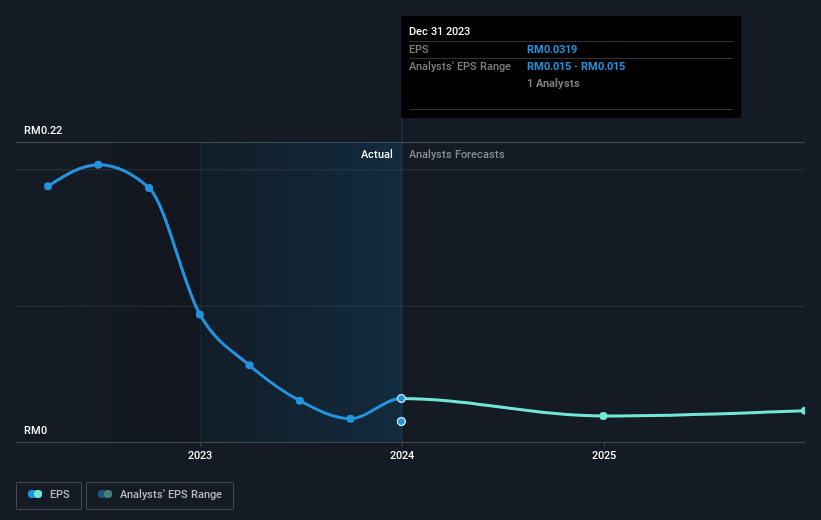

Over half a decade, PMB Technology Berhad managed to develop its earnings per share at 26% a yr. So the EPS development price is quite near the annualized share worth achieve of 32% per yr. This signifies that investor sentiment in direction of the corporate has not modified an excellent deal. In truth, the share worth appears to largely replicate the EPS development.

The picture beneath reveals how EPS has tracked over time (when you click on on the picture you possibly can see higher element).

We’re happy to report that the CEO is remunerated extra modestly than most CEOs at equally capitalized firms. It’s at all times price keeping track of CEO pay, however a extra necessary query is whether or not the corporate will develop earnings all through the years. Dive deeper into the earnings by checking this interactive graph of PMB Technology Berhad’s earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors ought to word that there is a distinction between PMB Technology Berhad’s complete shareholder return (TSR) and its share worth change, which we have coated above. The TSR is a return calculation that accounts for the worth of money dividends (assuming that any dividend acquired was reinvested) and the calculated worth of any discounted capital raisings and spin-offs. PMB Technology Berhad’s TSR of 305% for the 5 years exceeded its share worth return, as a result of it has paid dividends.

A Different Perspective

Investors in PMB Technology Berhad had a tricky yr, with a complete lack of 35%, in opposition to a market achieve of about 16%. However, understand that even the most effective shares will typically underperform the market over a twelve month interval. On the intense aspect, long run shareholders have made cash, with a achieve of 32% per yr over half a decade. If the elemental knowledge continues to point long run sustainable development, the present sell-off could possibly be a chance price contemplating. It’s at all times fascinating to trace share worth efficiency over the long term. But to grasp PMB Technology Berhad higher, we have to take into account many different components. For occasion, we have recognized 5 warning signs for PMB Technology Berhad (3 are a bit concerning) that you ought to be conscious of.

Of course PMB Technology Berhad might not be the most effective inventory to purchase. So it’s possible you’ll want to see this free collection of growth stocks.

Please word, the market returns quoted on this article replicate the market weighted common returns of shares that at present commerce on Malaysian exchanges.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to carry you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link