[ad_1]

The move came over six years after the Rs 2,000 notes had been introduced into the system together with the demonetisation of Rs 1,000 and the previous Rs 500 notes in November 2016 to satisfy the pressing requirement on the time.

The central financial institution cited lack of use and the truth that the banknotes had been nearing the tip of their four-five-year lifecycle as causes for the withdrawal.

RBI: Usual guidelines to use for deposit of Rs 2k notes, Rs 20k restrict for every change

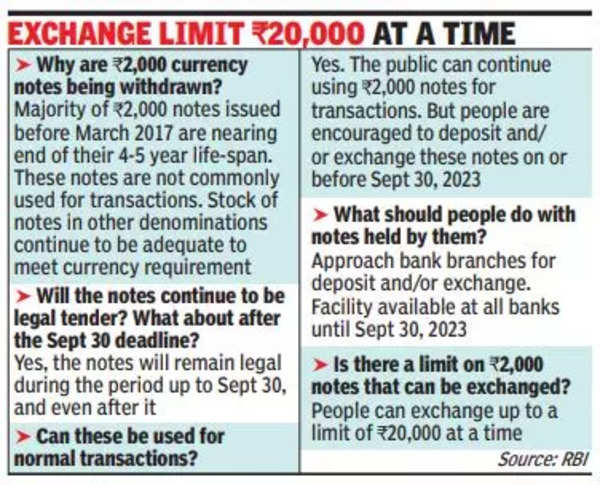

While saying the withdrawal of Rs 2,000 banknotes, the Reserve Bank of India on Friday gave individuals the choice of depositing these notes with banks or exchanging them for different denomination notes as much as a restrict of Rs 20,000 at a time.

For these depositing the notes, the standard procedures and guidelines will apply. Those eager to change them can solely accomplish that as much as a restrict of Rs 20,000 at a time, ranging from May 23, 2023, at any financial institution department.

“In accordance with the RBI’s ‘Clean note policy’, the decision to withdraw the Rs 2,000 banknotes has been made,” RBI mentioned in a press launch on Friday night.

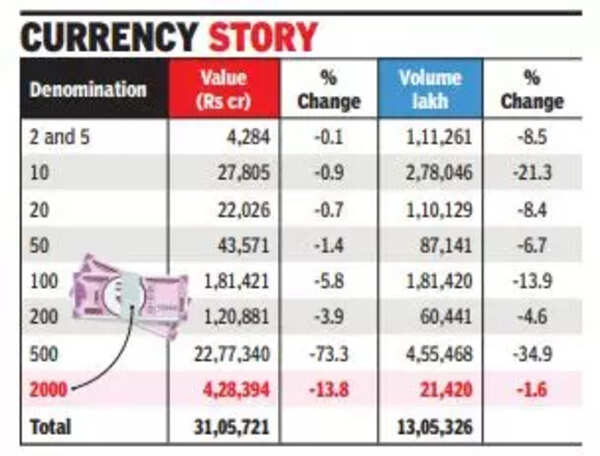

At the tip of March, there have been Rs 3.6 lakh crore of Rs 2,000 banknotes, constituting 10.8% of the notes in circulation. This is a major drop from the Rs 6.7 lakh crore printed after demonetisation (representing 37.3% of the overall notes in circulation). “Moreover, it has been observed that the Rs 2,000 denomination is not commonly used for transactions, while an adequate stock of banknotes in other denominations is available to meet the public’s currency requirement,” RBI mentioned.

With UPI and fee wallets turning into mass use merchandise any disruption is a distant chance.

00:59

What has the government achieved by introducing the Rs 2,000 word and now by withdrawing it: NCP chief Clyde Crasto

The central financial institution in contrast the train to withdrawing notes with fewer security measures in 2013-14. In January 2014, RBI introduced the withdrawal of all banknotes printed earlier than 2005 and introduced a three-month window. The deadline was later prolonged to January 1, 2015, then to June 30, 2016. This extension was attainable because the notes continued to be authorized tender and had been solely withdrawn from circulation.

In latest months, as different denominations grew to become available, the target of introducing the Rs 2000 word was fulfilled, resulting in the cessation of its printing in 2018-19, RBI mentioned.

01:18

Shiv Sena (Uddhav faction) chief targets PM Modi after RBI scraps Rs 2000 notes

Bankers mentioned that these notes weren’t getting used a lot in day-to-day transactions however the truth that such a big quantity continued to be held with the general public, pointed to its use as a “store of value”.

“As witnessed during demonetisation, we expect the deposit accretion of banks could improve marginally in the near term. This will ease the pressure on deposit rate hikes and could also result in a moderation in short-term interest rates,” mentioned Karthik Srinivasan, Senior Vice President, Group Head – Financial Sector Ratings, ICRA Ltd. Separate pointers have been issued to banks on this regard.

02:27

‘Proves 2016 demonetisation transfer incorrect’: How Congress leaders panned Modi govt over withdrawal of Rs 2000 notes

In addition to financial institution branches, the 19 regional places of work (ROs) of RBI with Issue Departments will even present the power for exchanging Rs 2000 banknotes as much as the restrict of Rs 20,000 at a time, commencing from May 23, 2023.

The RBI has suggested banks to discontinue the issuance of Rs 2000 denomination banknotes with quick impact.

“Now at least the government should accept that their decision to introduce a Rs 2,000 currency note was wrong. This will likely result in a loss of confidence in the currency itself. Now again, people will be in a panic. Banks need to be equipped to exchange. There is every possibility that Jan dhan accounts will be used to exchange. Government should exercise necessary precautions or otherwise, this may result in one more fiasco,” mentioned Devidas Tuljapurkar of the All-India Bank Employees Association.

03:02

RBI scraps Rs 2000 denomination notes from circulation, will proceed to stay authorized tender

[adinserter block=”4″]

[ad_2]

Source link