[ad_1]

Reliance-Disney deal | Image:Republic

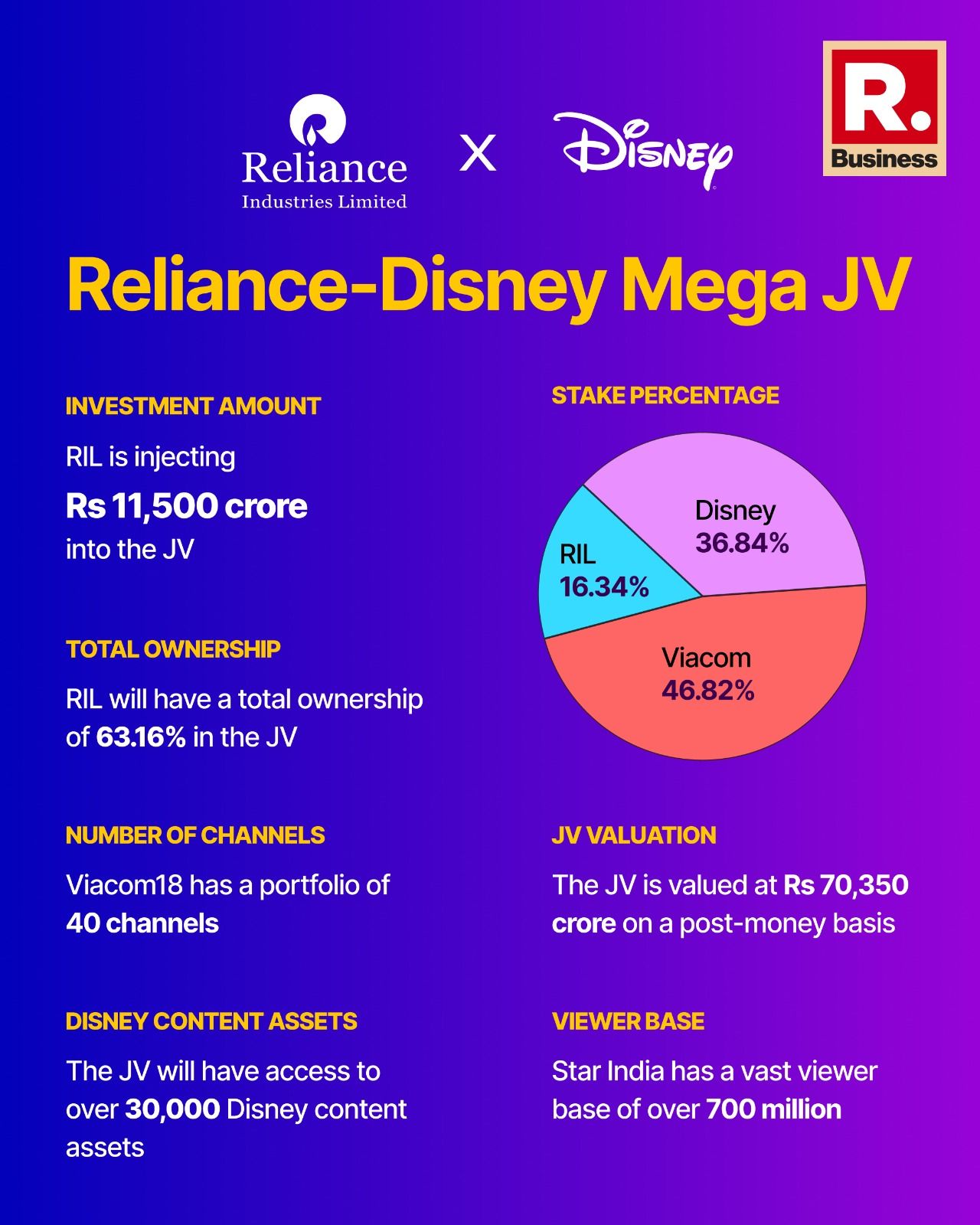

Reliance-Disney JV: In a serious transfer set to shake up the media {industry}, Reliance Industries Limited (RIL), backed by billionaire Mukesh Ambani, has launched into an important enterprise within the media and leisure sector by becoming a member of forces with Viacom 18 Media Private Limited and Walt Disney Company.

The settlement entails merging the media operations of Viacom18 and Star India right into a three way partnership (JV), marking a strategic transfer to spice up RIL’s foothold within the {industry}.

India media and leisure {industry}

The Media & Entertainment (M&E) {industry} in India is anticipated to hit $100 billion by 2030, as per Invest India. While an EY report stated that the {industry} is projected to develop from Rs 2.34 lakh crore ($29.2 billion) to Rs 2.83 lakh crore ($35.4 billion) by 2025, with a compound annual development charge (CAGR) of 10 per cent.

Furthermore, promoting income is forecasted to achieve Rs 39,400 crore ($5.42 billion) by 2024.

Traditional media, together with tv, print, filmed leisure, out-of-home (OOH), music, and radio, accounted for 58 per cent of the sector’s revenues in 2022.

Deal contours

Under the phrases of the deal, RIL will inject Rs 11,500 crore billion into the JV, securing a 16.34 per cent stake. The funding stresses upon RIL’s dedication to increasing its presence within the media panorama.

Through a subsidiary, Viacom18, RIL will keep management of the JV with a complete possession of 63.16 per cent, whereas Disney will maintain the remaining 36.84 per cent.

The transaction values the JV at Rs 70,350 crore on a post-money foundation, reflecting the most important potential and worth attributed to the mixed media property of Viacom18 and Star India, Motilal Oswal analysts famous.

The valuation metrics of the deal spotlight the strategic significance of the partnership and its potential for future development and profitability. Meanwhile, the collaboration will unite a various portfolio of media property, together with in style leisure and sports activities channels resembling Colors, StarPlus, StarGOLD, Star Sports, and Sports18.

Additionally, viewers may have entry to digital platforms like JioCinema and Hotstar, enhancing the attain and accessibility of content material throughout India, the brokerage stated.

Among the important thing highlights of the partnership is the unique rights granted to the JV to distribute Disney movies and productions in India. With entry to over 30,000 Disney content material property, the JV is about to supply an in depth array of leisure choices to shoppers nationwide.

Furthermore, the administration staff of the JV shall be led by Nita Ambani as Chairperson.

The mixed energy of Viacom18’s in depth channel portfolio, together with 40 channels and the JioCinema OTT platform, alongside Star India’s huge viewer base of over 700 million and the Disney+ Hotstar OTT platform, positions the JV as a formidable participant within the Indian media panorama.

With the merger of media property and the unique distribution rights to Disney content material, the JV goals to cater to the various leisure wants of Indian audiences whereas capitalising on the quickly evolving digital panorama, Motilal Oswal added.

The partnership marks an important milestone for RIL because it seeks to broaden its presence within the media and leisure sector, leveraging strategic collaborations to drive development and innovation within the dynamic Indian market.

Considering these components, Motilal Oswal has a ‘buy’ ranking on Reliance Industries for a goal worth of Rs 3,210 per share.

As of 1:20 pm, shares of Reliance Industries had been buying and selling 0.52 larger at Rs 2,924 per share.

[adinserter block=”4″]

[ad_2]

Source link