[ad_1]

It is normally uneventful when a single insider buys inventory. However, When fairly a couple of insiders purchase shares, because it occurred in SkyCity Entertainment Group Limited’s (NZSE:SKC) case, it is unbelievable information for shareholders.

While insider transactions should not a very powerful factor in the case of long-term investing, logic dictates it’s best to pay some consideration as to whether insiders are shopping for or promoting shares.

See our latest analysis for SkyCity Entertainment Group

SkyCity Entertainment Group Insider Transactions Over The Last Year

In the final twelve months, the most important single buy by an insider was when Non-Executive Director David Robert Attenborough purchased NZ$229k value of shares at a value of NZ$2.29 per share. That signifies that an insider was glad to purchase shares at above the present value of NZ$1.92. It’s very attainable they remorse the acquisition, nevertheless it’s extra seemingly they’re bullish in regards to the firm. To us, it is essential to think about the worth insiders pay for shares. As a common rule, we really feel extra optimistic a few inventory if insiders have purchased shares at above present costs, as a result of that means they considered the inventory pretty much as good worth, even at a better value.

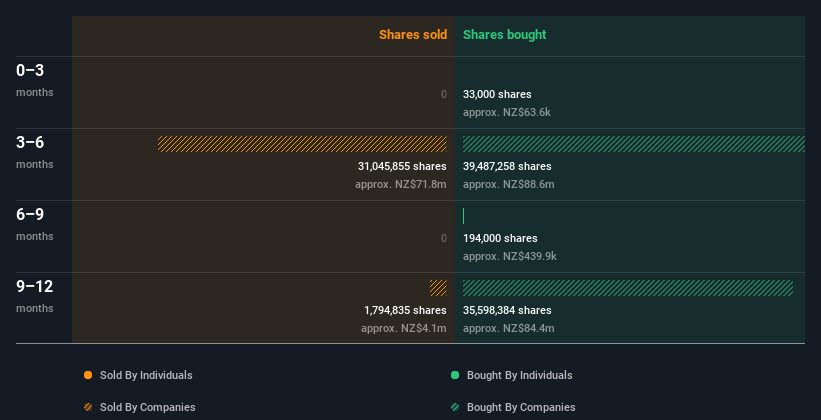

While SkyCity Entertainment Group insiders purchased shares over the last yr, they did not promote. The chart beneath reveals insider transactions (by corporations and people) during the last yr. By clicking on the graph beneath, you possibly can see the exact particulars of every insider transaction!

SkyCity Entertainment Group isn’t the one inventory insiders are shopping for. So take a peek at this free list of growing companies with insider buying.

Insiders At SkyCity Entertainment Group Have Bought Stock Recently

There was some insider shopping for at SkyCity Entertainment Group during the last quarter. Non Executive Director Kate Hughes shelled out NZ$64k for shares in that point. It’s good to see the insider shopping for, in addition to the shortage of latest sellers. However, on this case the quantity invested just lately is kind of small.

Insider Ownership

Many traders prefer to examine how a lot of an organization is owned by insiders. I reckon it is a good signal if insiders personal a big variety of shares within the firm. Based on our knowledge, SkyCity Entertainment Group insiders have about 0.3% of the inventory, value roughly NZ$3.7m. We do notice, nevertheless, it’s attainable insiders have an oblique curiosity via a personal firm or different company construction. We desire to see excessive ranges of insider possession.

What Might The Insider Transactions At SkyCity Entertainment Group Tell Us?

It is nice to see the latest insider buy. We additionally take confidence from the long run image of insider transactions. On this evaluation the one slight destructive we see is the pretty low (general) insider possession; their transactions counsel that they’re fairly optimistic on SkyCity Entertainment Group inventory. In addition to understanding about insider transactions happening, it is helpful to establish the dangers going through SkyCity Entertainment Group. For occasion, we have recognized 3 warning signs for SkyCity Entertainment Group (1 is a bit concerning) you have to be conscious of.

Of course SkyCity Entertainment Group might not be the perfect inventory to purchase. So you might want to see this free collection of high quality companies.

For the needs of this text, insiders are these people who report their transactions to the related regulatory physique. We presently account for open market transactions and personal inclinations of direct pursuits solely, however not by-product transactions or oblique pursuits.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We purpose to carry you long-term centered evaluation pushed by basic knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link